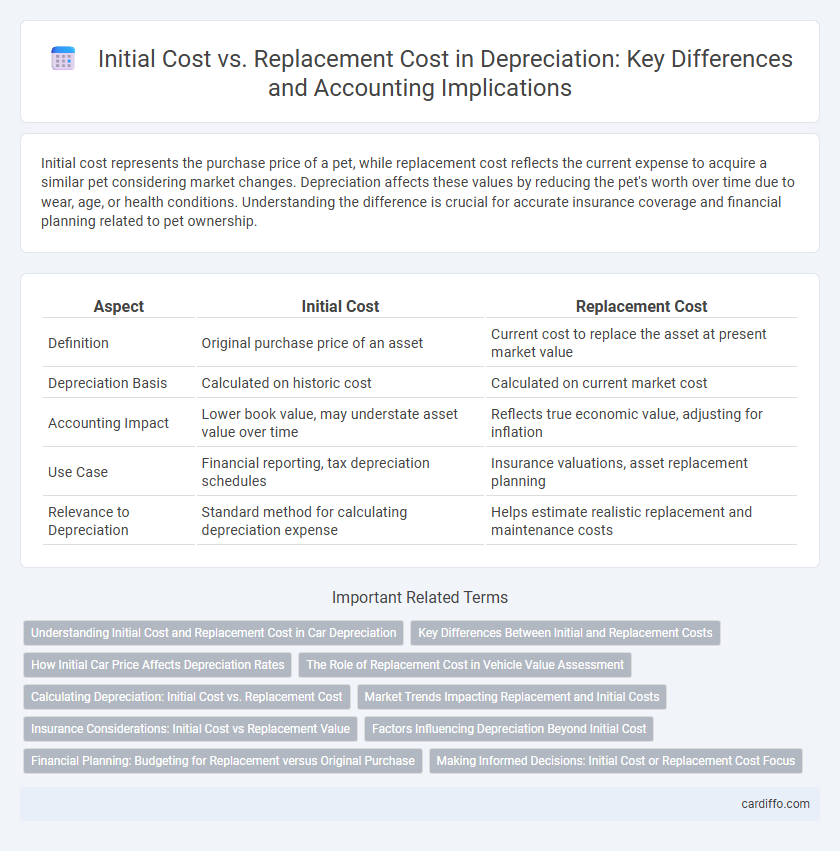

Initial cost represents the purchase price of a pet, while replacement cost reflects the current expense to acquire a similar pet considering market changes. Depreciation affects these values by reducing the pet's worth over time due to wear, age, or health conditions. Understanding the difference is crucial for accurate insurance coverage and financial planning related to pet ownership.

Table of Comparison

| Aspect | Initial Cost | Replacement Cost |

|---|---|---|

| Definition | Original purchase price of an asset | Current cost to replace the asset at present market value |

| Depreciation Basis | Calculated on historic cost | Calculated on current market cost |

| Accounting Impact | Lower book value, may understate asset value over time | Reflects true economic value, adjusting for inflation |

| Use Case | Financial reporting, tax depreciation schedules | Insurance valuations, asset replacement planning |

| Relevance to Depreciation | Standard method for calculating depreciation expense | Helps estimate realistic replacement and maintenance costs |

Understanding Initial Cost and Replacement Cost in Car Depreciation

Initial cost refers to the original purchase price of a vehicle, encompassing the total amount paid at acquisition, including taxes and fees. Replacement cost represents the current market value required to buy a similar new car with comparable features and specifications. In car depreciation analysis, understanding the difference between initial cost and replacement cost is crucial for accurately assessing the loss in value over time and determining insurance claims or resale prices.

Key Differences Between Initial and Replacement Costs

Initial cost refers to the original expense incurred to acquire an asset, including purchase price, installation, and setup fees. Replacement cost represents the current expense to replace the asset with a similar one at present market prices, accounting for inflation and technological advancements. Key differences focus on timing, valuation basis, and impact on financial statements, where initial cost remains fixed while replacement cost fluctuates over time.

How Initial Car Price Affects Depreciation Rates

The initial car price significantly influences depreciation rates, as higher-priced vehicles often experience steeper percentage declines within the first few years due to market demand and luxury tax impacts. Replacement cost, while relevant for insurance and repairs, does not directly affect the rate at which a vehicle depreciates but highlights the financial gap created by depreciation from the initial purchase price. Understanding that vehicles with a high initial cost may lose value faster helps buyers anticipate long-term ownership expenses and residual values.

The Role of Replacement Cost in Vehicle Value Assessment

Replacement cost plays a crucial role in vehicle value assessment by reflecting the current market price required to purchase a similar vehicle, rather than the original purchase price. Unlike initial cost, replacement cost accounts for factors such as inflation, technological advancements, and market demand, providing a more accurate valuation for depreciation calculations and insurance claims. This approach ensures that depreciation reflects the true economic loss and offers a realistic basis for vehicle investment decisions.

Calculating Depreciation: Initial Cost vs. Replacement Cost

Calculating depreciation using initial cost involves allocating the asset's original purchase price over its useful life, reflecting the wear and tear from the moment of acquisition. Replacement cost depreciation, on the other hand, bases the expense on the current cost to replace the asset with a similar one at today's market value, accounting for inflation and technological changes. Accurate financial analysis requires choosing between these methods based on the asset's nature, market conditions, and accounting standards.

Market Trends Impacting Replacement and Initial Costs

Replacement cost often fluctuates in response to market trends such as inflation, technological advancements, and supply chain disruptions, significantly diverging from the initial cost recorded during asset acquisition. Initial cost represents the historical expenditure and does not account for current market conditions, whereas replacement cost reflects the present value required to acquire a similar asset. Businesses must consider these market-driven variations to accurately assess depreciation and make informed financial decisions.

Insurance Considerations: Initial Cost vs Replacement Value

Insurance policies typically base coverage on replacement cost rather than initial cost to ensure full compensation for damaged or lost property. Initial cost reflects the original purchase price, which may be outdated due to inflation or market changes, while replacement cost estimates the current expense to acquire a similar asset. Understanding this distinction helps policyholders secure adequate insurance limits and avoid underinsurance.

Factors Influencing Depreciation Beyond Initial Cost

Depreciation is influenced by factors beyond the initial cost, including the asset's age, usage intensity, and maintenance quality which affect its residual value and useful life. Replacement cost fluctuates with market conditions, technological advancements, and inflation, impacting the asset's economic viability and depreciation calculations. Understanding these variables is essential for accurate financial reporting and asset management strategies.

Financial Planning: Budgeting for Replacement versus Original Purchase

Initial cost represents the original purchase price of an asset, serving as a baseline in financial records, while replacement cost estimates the current expense to acquire a similar asset. Effective budgeting for depreciation requires prioritizing replacement cost to ensure sufficient funds are allocated for future asset renewal at market prices. Ignoring replacement cost can lead to underfunding, compromising asset management and long-term financial stability.

Making Informed Decisions: Initial Cost or Replacement Cost Focus

Evaluating asset depreciation requires balancing initial cost against replacement cost to make informed decisions about long-term value. Prioritizing initial cost may underestimate future expenses, while focusing on replacement cost provides a realistic forecast of asset maintenance and budget needs. Accurate depreciation analysis integrates both metrics to optimize asset management and financial planning.

Initial Cost vs Replacement Cost Infographic

cardiffo.com

cardiffo.com