Open Market Value reflects the price a pet would likely fetch from a private buyer based on current demand and condition, often exceeding the Trade-In Value. Trade-In Value represents the amount a dealer or service provider offers when exchanging a pet, typically lower due to immediate resale risks and associated costs. Understanding both values helps pet owners make informed decisions about selling or upgrading their pet assets.

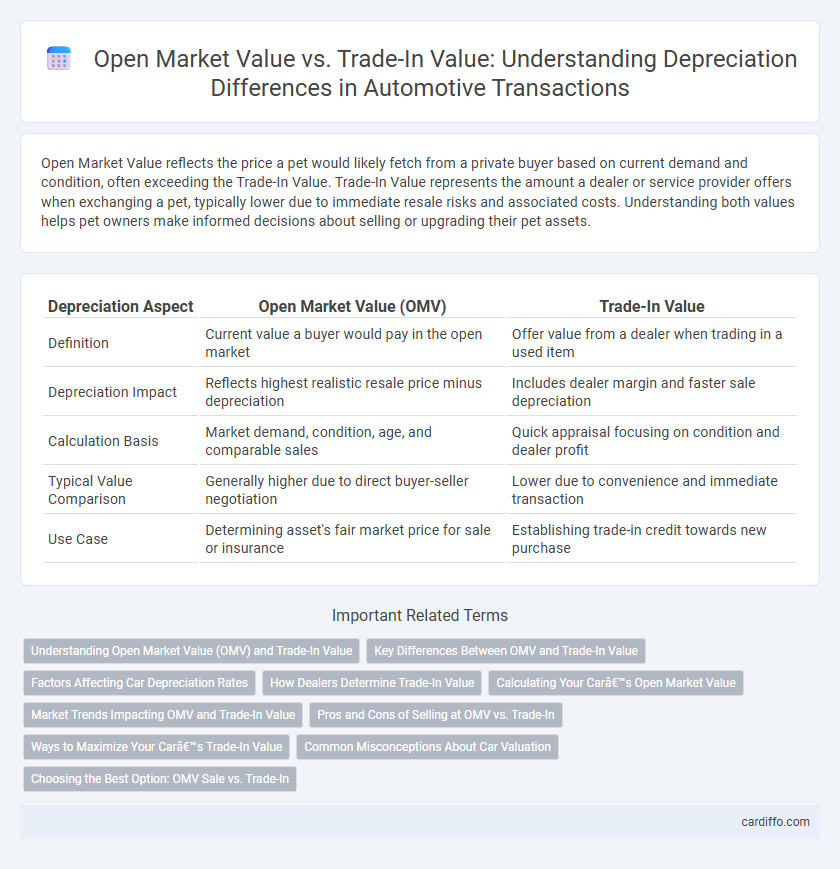

Table of Comparison

| Depreciation Aspect | Open Market Value (OMV) | Trade-In Value |

|---|---|---|

| Definition | Current value a buyer would pay in the open market | Offer value from a dealer when trading in a used item |

| Depreciation Impact | Reflects highest realistic resale price minus depreciation | Includes dealer margin and faster sale depreciation |

| Calculation Basis | Market demand, condition, age, and comparable sales | Quick appraisal focusing on condition and dealer profit |

| Typical Value Comparison | Generally higher due to direct buyer-seller negotiation | Lower due to convenience and immediate transaction |

| Use Case | Determining asset's fair market price for sale or insurance | Establishing trade-in credit towards new purchase |

Understanding Open Market Value (OMV) and Trade-In Value

Open Market Value (OMV) represents the price a vehicle would fetch in an open, competitive market, reflecting current demand, condition, and market trends. Trade-In Value is typically lower than OMV, indicating the amount a dealer is willing to offer for a vehicle when used as part of a purchase transaction. Understanding the distinction between OMV and Trade-In Value helps sellers negotiate better deals and buyers assess true market costs.

Key Differences Between OMV and Trade-In Value

Open Market Value (OMV) represents the highest price a vehicle can command in an open, competitive market, reflecting its current condition, demand, and market trends. Trade-In Value is typically lower, as dealers factor in their costs, expected profit margins, and potential reconditioning expenses when offering a price to the seller. Understanding these distinctions helps sellers set realistic expectations and negotiate effectively during vehicle sales or exchanges.

Factors Affecting Car Depreciation Rates

Open Market Value reflects the price a car can fetch from private buyers, generally higher than the Trade-In Value offered by dealerships, which accounts for immediate resale convenience and dealer profit margins. Factors affecting car depreciation rates include vehicle age, mileage, condition, brand reputation, market demand, and economic conditions, all influencing the gap between these two values. Models with strong resale demand and low depreciation tend to retain higher Open Market Values compared to their Trade-In Values.

How Dealers Determine Trade-In Value

Dealers determine trade-in value by assessing the vehicle's condition, mileage, age, and market demand, often referencing industry guides like Kelley Blue Book and real-time auction prices. Unlike open market value, which reflects the highest price a private seller might achieve, trade-in value factors in the dealer's need to resell the vehicle at a profit after reconditioning costs. This calculated trade-in amount generally results in a lower offer compared to the open market value to account for depreciation and overhead expenses.

Calculating Your Car’s Open Market Value

Calculating your car's open market value involves assessing its current condition, mileage, and age while comparing prices of similar vehicles in your local market. This valuation reflects what a typical buyer would pay when purchasing from a private seller, often higher than the trade-in value offered by dealerships. Using resources like Kelley Blue Book or Edmunds can provide accurate estimates to guide you in setting a competitive price or negotiating trade-in offers.

Market Trends Impacting OMV and Trade-In Value

Open Market Value (OMV) fluctuates significantly with prevailing market trends such as supply-demand dynamics, economic conditions, and consumer preferences, reflecting the price buyers are willing to pay in a competitive environment. Trade-In Value generally lags behind OMV because dealers factor in refurbishment costs, reconditioning expenses, and potential resale margin, causing it to be consistently lower. Market trends impacting OMV like rising fuel prices or technological advancements in vehicles, directly influence trade-in offers as dealers adjust valuations to align with shifting consumer demand and inventory turnover rates.

Pros and Cons of Selling at OMV vs. Trade-In

Selling a vehicle at Open Market Value (OMV) typically yields a higher return as it reflects the current demand and condition-based pricing, offering greater profit compared to trade-in value. Trade-in value provides convenience and faster transactions by allowing direct dealership exchange but often results in lower compensation due to dealer overhead and resale margin. Buyers prioritizing maximum financial return may prefer selling at OMV, while those valuing simplicity and time-efficiency might opt for trade-in despite reduced proceeds.

Ways to Maximize Your Car’s Trade-In Value

Understanding the difference between Open Market Value and Trade-In Value helps maximize your car's trade-in offer by highlighting the higher potential of private sale prices. Maintaining detailed service records and ensuring thorough cleaning and minor repairs can significantly increase the trade-in appraisal. Researching and timing the trade-in when demand is high, such as during tax refund season, also boosts the final negotiated value.

Common Misconceptions About Car Valuation

Many car owners mistakenly believe that the open market value always exceeds the trade-in value, overlooking factors such as vehicle condition, market demand, and dealer incentives that influence these valuations. Open market value reflects the price a private buyer is willing to pay, often higher due to negotiation flexibility and lack of dealer overhead. Trade-in value typically accounts for dealer reconditioning costs and profit margins, resulting in a lower offer than the open market price.

Choosing the Best Option: OMV Sale vs. Trade-In

Open Market Value (OMV) typically yields a higher return compared to Trade-In Value due to direct sale to buyers willing to pay market prices. Assess depreciation impact carefully, as OMV reflects current market demand while trade-in values often factor in dealer margins and faster transaction speeds. Selecting between OMV sale and trade-in hinges on balancing maximum depreciation recovery against convenience and transaction time.

Open Market Value vs Trade-In Value Infographic

cardiffo.com

cardiffo.com