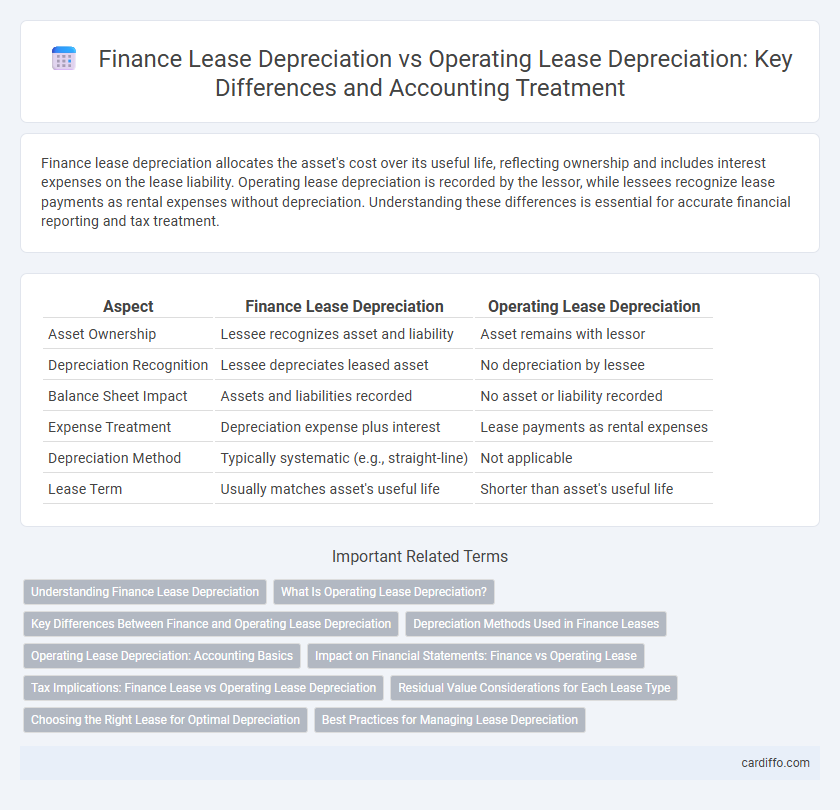

Finance lease depreciation allocates the asset's cost over its useful life, reflecting ownership and includes interest expenses on the lease liability. Operating lease depreciation is recorded by the lessor, while lessees recognize lease payments as rental expenses without depreciation. Understanding these differences is essential for accurate financial reporting and tax treatment.

Table of Comparison

| Aspect | Finance Lease Depreciation | Operating Lease Depreciation |

|---|---|---|

| Asset Ownership | Lessee recognizes asset and liability | Asset remains with lessor |

| Depreciation Recognition | Lessee depreciates leased asset | No depreciation by lessee |

| Balance Sheet Impact | Assets and liabilities recorded | No asset or liability recorded |

| Expense Treatment | Depreciation expense plus interest | Lease payments as rental expenses |

| Depreciation Method | Typically systematic (e.g., straight-line) | Not applicable |

| Lease Term | Usually matches asset's useful life | Shorter than asset's useful life |

Understanding Finance Lease Depreciation

Finance lease depreciation requires the lessee to capitalize the leased asset, depreciating it over its useful life or the lease term, whichever is shorter, reflecting ownership risks and rewards. This approach impacts financial statements by increasing both assets and liabilities, and the depreciation expense systematically allocates the asset's cost. Unlike operating lease depreciation, which is not recorded on the lessee's balance sheet, finance lease depreciation follows accounting standards like IFRS 16 and ASC 842, ensuring transparency and comparability in reporting.

What Is Operating Lease Depreciation?

Operating lease depreciation refers to the expense recognition method where the leased asset remains on the lessor's balance sheet, and the lessee records lease payments as operating expenses without capitalizing the asset. Unlike finance lease depreciation, the lessee does not depreciate the asset but rather expenses the lease payments over the lease term. This treatment aligns with ASC 842 and IFRS 16 accounting standards, ensuring operating leases are treated as service contracts in financial reporting.

Key Differences Between Finance and Operating Lease Depreciation

Finance lease depreciation is recorded on the lessee's balance sheet as the asset is capitalized, reflecting ownership benefits and risks, with depreciation expense recognized over the asset's useful life. Operating lease depreciation does not appear on the lessee's balance sheet because the asset remains owned by the lessor, and lease payments are treated as rental expenses on the income statement. The key difference lies in asset recognition and depreciation treatment: finance leases require asset capitalization and depreciation, whereas operating leases result in expense recognition without asset recording.

Depreciation Methods Used in Finance Leases

Finance lease depreciation typically uses the straight-line method over the asset's useful life or lease term, whichever is shorter, aligning asset consumption with economic benefits. This method reflects the lessee's ownership risks and rewards, contrasting with operating leases where depreciation is not recognized on the lessee's books. Accurate depreciation accounting in finance leases ensures compliance with IFRS 16 and ASC 842 standards, impacting asset value and profit reporting.

Operating Lease Depreciation: Accounting Basics

Operating lease depreciation is not recorded on the lessee's balance sheet since the asset remains owned by the lessor, reflecting a rental expense in financial statements instead. This accounting treatment follows ASC 842/IFRS 16 guidelines, where lease payments are recognized as operating expenses without capitalizing the leased asset. The approach maintains cleaner balance sheet metrics but can obscure the true cost of asset use compared to finance lease depreciation, which involves asset capitalization and systematic depreciation expense recognition.

Impact on Financial Statements: Finance vs Operating Lease

Finance lease depreciation impacts the balance sheet by capitalizing the asset and recognizing both depreciation expense and interest expense, resulting in higher total expenses in the earlier years and reducing net income. Operating lease depreciation treats lease payments as operating expenses recorded on the income statement, with no asset or liability recorded on the balance sheet, leading to a more consistent impact on net income. The distinction affects key financial ratios, such as return on assets and debt-to-equity, influencing investor perception and credit analysis.

Tax Implications: Finance Lease vs Operating Lease Depreciation

Finance lease depreciation is recorded on the lessee's balance sheet, allowing for amortization deductions that directly reduce taxable income over the lease term. Operating lease depreciation is typically not recorded by the lessee, as lease payments are expensed without capitalizing the asset, limiting direct tax depreciation benefits. Tax implications favor finance leases when lessees seek to leverage asset ownership for depreciation tax shields, while operating leases offer simpler expense treatment with potentially less immediate tax advantage.

Residual Value Considerations for Each Lease Type

Finance lease depreciation accounts for the asset's residual value by spreading the depreciable amount over the lease term, reflecting ownership risks and benefits. Operating lease depreciation typically excludes residual value concerns since the lessor retains ownership and assumes residual risk, recording lease payments as expenses. Accurate residual value estimates in finance leases impact depreciation expense and asset valuation, while operating leases focus on lease expense recognition without asset depreciation.

Choosing the Right Lease for Optimal Depreciation

Finance lease depreciation allocates the asset's cost over its useful life, reflecting ownership risks and benefits on the balance sheet, which enhances tax deductions through systematic expense recognition. Operating lease depreciation, treated as a rental expense, does not record asset depreciation on the lessee's books, making it preferable for preserving balance sheet ratios and maintaining off-balance-sheet financing. Selecting the right lease depends on financial strategy goals, with finance leases optimizing tax depreciation benefits, while operating leases offer greater flexibility and less asset-related liability.

Best Practices for Managing Lease Depreciation

Finance lease depreciation requires recognizing the leased asset on the balance sheet and depreciating it over the asset's useful life, adhering to strict accounting standards such as IFRS 16 or ASC 842. Operating lease depreciation, often off-balance-sheet under previous standards, now mandates lease liability recognition but does not involve asset depreciation by the lessee since the lessor retains ownership. Best practices include consistent asset valuation, accurate lease term assessment, and regular review of depreciation schedules to ensure compliance, optimize tax benefits, and maintain transparent financial reporting.

Finance Lease Depreciation vs Operating Lease Depreciation Infographic

cardiffo.com

cardiffo.com