The Straight-Line Method allocates an equal amount of depreciation expense each year, making it simple to apply and ideal for assets that wear out evenly over time. The Declining Balance Method accelerates depreciation, charging higher expenses in the early years and decreasing amounts later, which better reflects assets that lose value quickly. Choosing between these methods depends on the asset's usage pattern and the company's financial strategy for reporting expenses.

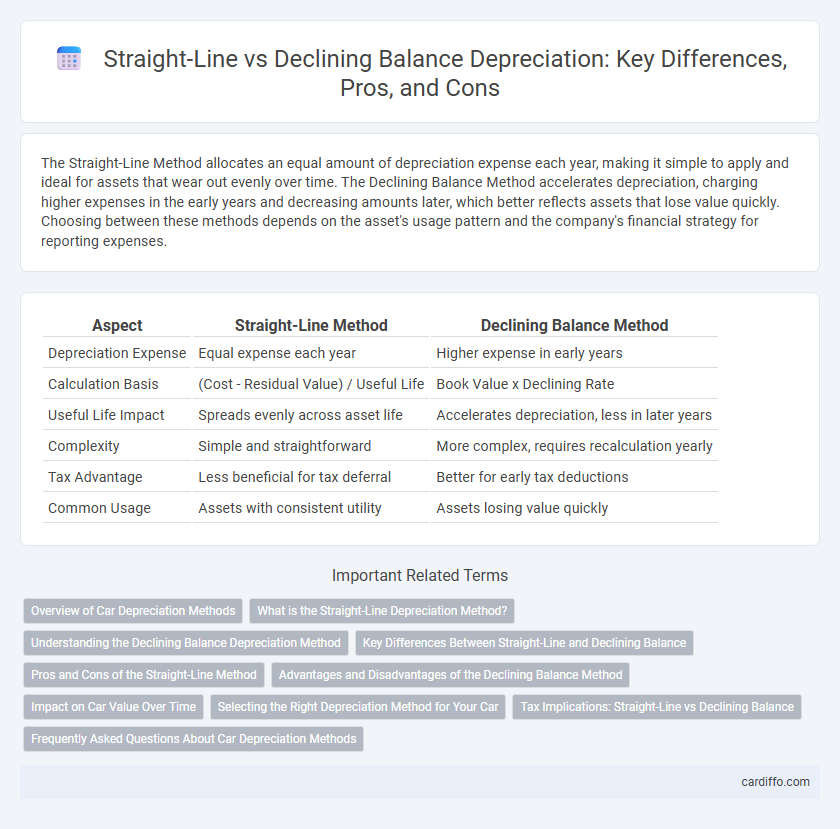

Table of Comparison

| Aspect | Straight-Line Method | Declining Balance Method |

|---|---|---|

| Depreciation Expense | Equal expense each year | Higher expense in early years |

| Calculation Basis | (Cost - Residual Value) / Useful Life | Book Value x Declining Rate |

| Useful Life Impact | Spreads evenly across asset life | Accelerates depreciation, less in later years |

| Complexity | Simple and straightforward | More complex, requires recalculation yearly |

| Tax Advantage | Less beneficial for tax deferral | Better for early tax deductions |

| Common Usage | Assets with consistent utility | Assets losing value quickly |

Overview of Car Depreciation Methods

The Straight-Line Method of car depreciation allocates an equal expense amount over the vehicle's useful life, providing consistent and predictable depreciation charges annually. In contrast, the Declining Balance Method accelerates depreciation, recognizing higher expenses in the early years of the vehicle's use, which better reflects the rapid loss of value in the initial period. Both methods comply with accounting standards but differ in impact on financial statements, tax calculations, and asset book value during the vehicle's ownership.

What is the Straight-Line Depreciation Method?

The Straight-Line Depreciation Method allocates an equal amount of depreciation expense each year over the asset's useful life, simplifying financial planning and reporting. This method calculates depreciation by subtracting the asset's salvage value from its initial cost and dividing the result by the total number of years expected for usage. Commonly used for assets with consistent utility, the straight-line method contrasts with accelerated approaches by providing steady expense recognition across periods.

Understanding the Declining Balance Depreciation Method

The Declining Balance Depreciation Method accelerates expense recognition by applying a fixed depreciation rate to the asset's reducing book value each year, resulting in higher charges in early periods and lower ones later. This method better matches expenses with revenue for assets that lose value more quickly initially, such as machinery and vehicles. Compared to the Straight-Line Method, which spreads cost evenly over the asset's useful life, the declining balance approach provides a more realistic reflection of declining asset utility and market value.

Key Differences Between Straight-Line and Declining Balance

The Straight-Line Method allocates an equal depreciation expense each year over an asset's useful life, resulting in consistent expense recognition. In contrast, the Declining Balance Method applies a fixed depreciation rate to the asset's decreasing book value, producing higher expenses in early years and lower in later periods. Key differences include expense timing, impact on net income, and suitability based on asset usage patterns or tax strategies.

Pros and Cons of the Straight-Line Method

The Straight-Line Method offers simplicity and consistent expense allocation, making it ideal for assets with uniform usage over their lifespan. However, it may not accurately reflect the asset's decreasing productivity or market value compared to the Declining Balance Method, which accelerates depreciation. This uniform approach can lead to less tax savings in early years and may not match actual revenue generation patterns.

Advantages and Disadvantages of the Declining Balance Method

The Declining Balance Method accelerates depreciation, allowing higher expense recognition in the early years and better matching of expenses with revenues for rapidly depreciating assets. This method provides tax advantages due to increased initial deductions but may result in lower book values that complicate asset valuation over time. However, the accelerated depreciation can lead to reduced reported profits initially and may not align well with the actual usage pattern of all asset types.

Impact on Car Value Over Time

The Straight-Line Method reduces a car's book value evenly over its useful life, resulting in consistent expense recognition and a steady decline in asset value. The Declining Balance Method accelerates depreciation, causing a sharper drop in car value during the initial years, which reflects higher expense recognition early on. This accelerated approach better matches depreciation with the car's diminishing market value and usage intensity over time.

Selecting the Right Depreciation Method for Your Car

Choosing the right depreciation method for your car depends on your financial goals and usage patterns. The straight-line method spreads the vehicle's cost evenly over its useful life, providing consistent expense recognition ideal for steady value decline. In contrast, the declining balance method accelerates depreciation, reflecting higher expenses in the early years and better matching the rapid loss in value typical of new cars.

Tax Implications: Straight-Line vs Declining Balance

The Straight-Line Method results in consistent annual depreciation expenses, leading to a steady reduction in taxable income over an asset's useful life. In contrast, the Declining Balance Method accelerates depreciation, yielding higher expenses and lower taxable income in earlier years, which can defer tax liabilities and improve immediate cash flow. Choosing between these methods depends on a company's tax strategy, with the Declining Balance Method often preferred for tax deferral benefits under accelerated depreciation regulations.

Frequently Asked Questions About Car Depreciation Methods

The Straight-Line Method allocates an equal depreciation expense each year, making it easier to predict car value decline over time, ideal for vehicles with consistent use. The Declining Balance Method applies a higher depreciation rate in the earlier years, reflecting faster loss of value typically seen in new cars. Car owners often ask which method provides better tax benefits, with the Declining Balance Method usually offering greater initial deductions.

Straight-Line Method vs Declining Balance Method Infographic

cardiffo.com

cardiffo.com