Insurance Adjusted Value reflects the current market worth of a depreciated asset after accounting for age, wear, and usage, helping insurers determine accurate claim settlements. Depreciated Value specifically measures the loss in value from the asset's original cost, considering physical and functional depreciation over time. Understanding the distinction ensures policyholders receive fair compensation based on the asset's true value rather than its initial purchase price.

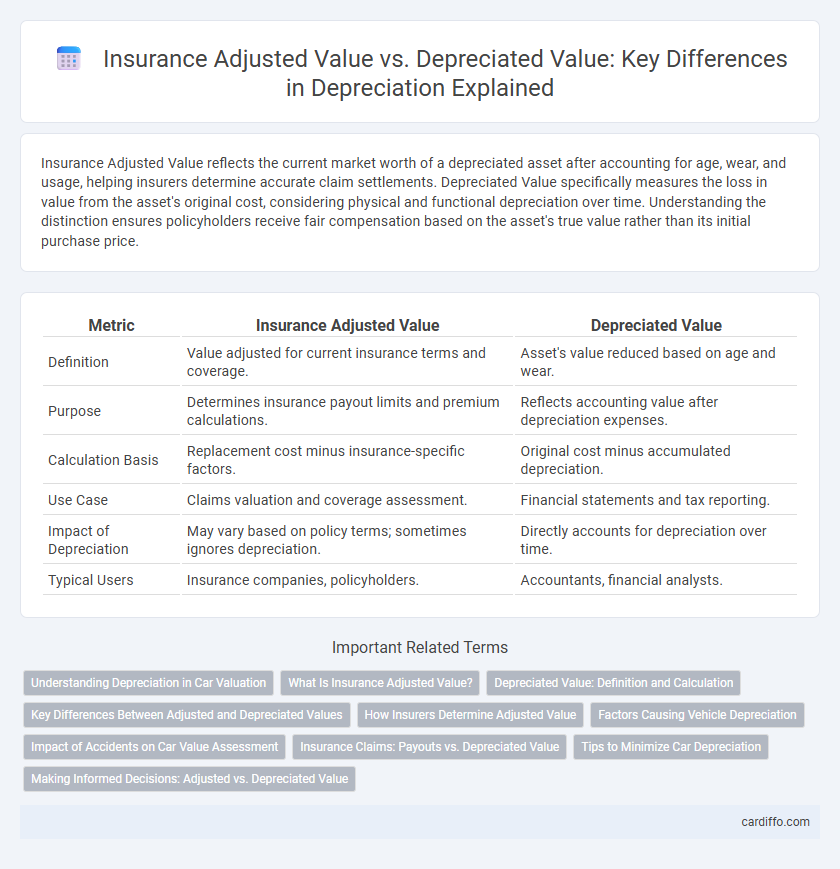

Table of Comparison

| Metric | Insurance Adjusted Value | Depreciated Value |

|---|---|---|

| Definition | Value adjusted for current insurance terms and coverage. | Asset's value reduced based on age and wear. |

| Purpose | Determines insurance payout limits and premium calculations. | Reflects accounting value after depreciation expenses. |

| Calculation Basis | Replacement cost minus insurance-specific factors. | Original cost minus accumulated depreciation. |

| Use Case | Claims valuation and coverage assessment. | Financial statements and tax reporting. |

| Impact of Depreciation | May vary based on policy terms; sometimes ignores depreciation. | Directly accounts for depreciation over time. |

| Typical Users | Insurance companies, policyholders. | Accountants, financial analysts. |

Understanding Depreciation in Car Valuation

Insurance Adjusted Value represents the vehicle's worth determined by insurance companies considering factors like accident history and repair costs, whereas Depreciated Value reflects the natural reduction in the car's market value over time due to use and aging. Understanding depreciation in car valuation is crucial for accurately assessing a car's current market price, insurance claims, and resale value. The depreciation rate varies based on vehicle make, model, mileage, and condition, impacting both insurance settlements and buyer expectations.

What Is Insurance Adjusted Value?

Insurance Adjusted Value refers to the valuation of an asset for insurance purposes after considering depreciation but adjusted for factors such as current replacement costs and market conditions. This value helps insurers determine the appropriate coverage amount to reflect the asset's insurable worth rather than just its diminished accounting value. Unlike the Depreciated Value, which strictly accounts for wear and tear or obsolescence, the Insurance Adjusted Value ensures policyholders receive fair compensation aligned with actual recovery expenses.

Depreciated Value: Definition and Calculation

Depreciated value represents the reduced worth of an asset over time due to factors like wear and tear, age, and obsolescence. It is calculated by subtracting accumulated depreciation from the asset's original purchase price or replacement cost. This value is critical for financial reporting, tax deductions, and insurance claims when determining the current monetary valuation of tangible property.

Key Differences Between Adjusted and Depreciated Values

Insurance Adjusted Value reflects the current replacement cost of an asset after accounting for insurance factors such as risk and coverage limits, whereas Depreciated Value represents the asset's book value after deducting accumulated depreciation based on age and wear. Adjusted Value often includes external adjustments for market conditions or claim settlements, while Depreciated Value strictly follows accounting depreciation methods like straight-line or declining balance. The key difference lies in Adjusted Value emphasizing recovery potential in insurance claims, contrasting with Depreciated Value's focus on asset valuation for financial reporting and tax purposes.

How Insurers Determine Adjusted Value

Insurers determine the Insurance Adjusted Value by calculating the asset's current replacement cost minus depreciation factors considering age, condition, and usage. This value reflects a more accurate payout amount than the straight Depreciated Value, which only accounts for accumulated depreciation over time. Adjusted Value incorporates market conditions and repair costs, ensuring claims settlements align with the true economic loss.

Factors Causing Vehicle Depreciation

Insurance Adjusted Value often differs from Depreciated Value due to factors like vehicle age, mileage, accident history, and market demand influencing depreciation rates. Depreciated Value accounts for wear and tear, mechanical condition, and technological obsolescence reducing the asset's worth over time. Insurance Adjusted Value also considers repair costs and claim settlements, reflecting the vehicle's current replacement cost rather than simple depreciation metrics.

Impact of Accidents on Car Value Assessment

Accidents significantly impact the insurance adjusted value and depreciated value of a car, often leading to a lower valuation despite routine wear and tear deductions. Insurance adjusted value reflects the post-accident condition incorporating repair costs and diminished market appeal, while depreciated value calculates loss based on age and mileage without accounting for damage severity. This distinction becomes crucial in claims processing and resale negotiations, where accident history can drastically reduce a vehicle's overall worth.

Insurance Claims: Payouts vs. Depreciated Value

Insurance Adjusted Value reflects the amount an insurer agrees to pay based on the current market value or replacement cost of an asset, while Depreciated Value accounts for the wear and tear or aging of that asset over time. In insurance claims, payouts are often calculated using the Depreciated Value, which can be significantly lower than the Insurance Adjusted Value, impacting the final reimbursement to policyholders. Understanding the distinction between these values is crucial for accurately assessing claim settlements and ensuring adequate coverage.

Tips to Minimize Car Depreciation

Maintaining regular service records and protecting your car from environmental damage are essential strategies to minimize depreciation and preserve Insurance Adjusted Value. Opt for popular vehicle models with strong resale value and avoid excessive customization that can reduce appeal in the used car market. Keeping the mileage low and parking in secure locations also significantly slows depreciation, ensuring a higher depreciated value when it's time to sell or insure the car.

Making Informed Decisions: Adjusted vs. Depreciated Value

Insurance adjusted value reflects the asset's worth considering insurance claims and market conditions, while depreciated value accounts for the asset's decline in value over time due to wear and tear. Understanding the differences between these values enables accurate assessment of asset replacement costs and financial planning. Making informed decisions requires evaluating both values to optimize insurance coverage and depreciation-related expenses.

Insurance Adjusted Value vs Depreciated Value Infographic

cardiffo.com

cardiffo.com