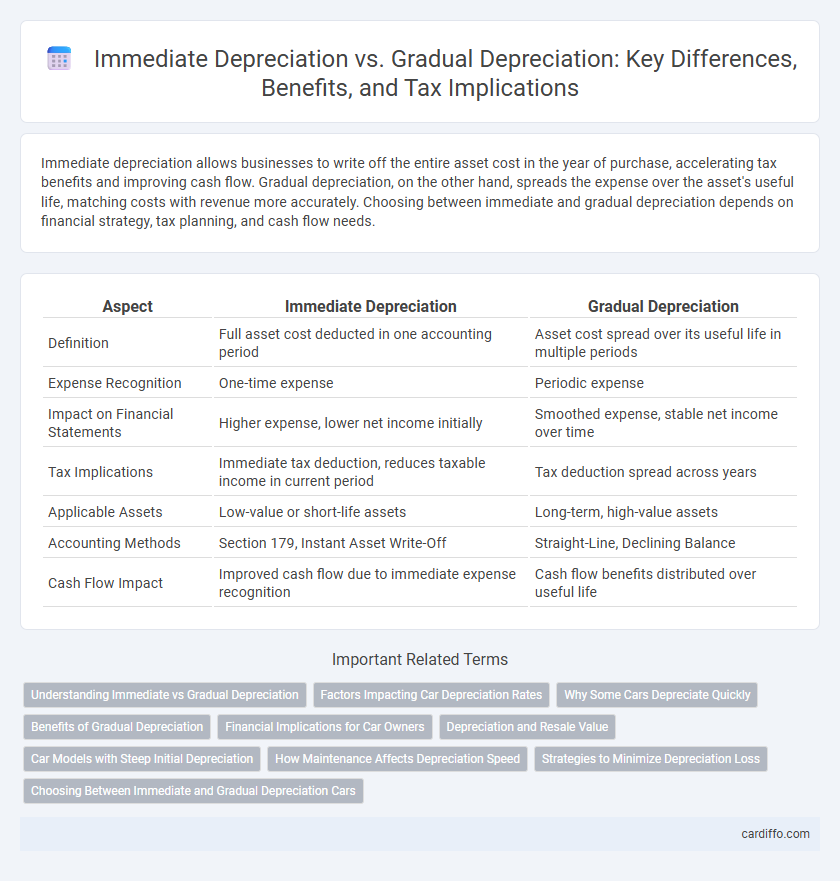

Immediate depreciation allows businesses to write off the entire asset cost in the year of purchase, accelerating tax benefits and improving cash flow. Gradual depreciation, on the other hand, spreads the expense over the asset's useful life, matching costs with revenue more accurately. Choosing between immediate and gradual depreciation depends on financial strategy, tax planning, and cash flow needs.

Table of Comparison

| Aspect | Immediate Depreciation | Gradual Depreciation |

|---|---|---|

| Definition | Full asset cost deducted in one accounting period | Asset cost spread over its useful life in multiple periods |

| Expense Recognition | One-time expense | Periodic expense |

| Impact on Financial Statements | Higher expense, lower net income initially | Smoothed expense, stable net income over time |

| Tax Implications | Immediate tax deduction, reduces taxable income in current period | Tax deduction spread across years |

| Applicable Assets | Low-value or short-life assets | Long-term, high-value assets |

| Accounting Methods | Section 179, Instant Asset Write-Off | Straight-Line, Declining Balance |

| Cash Flow Impact | Improved cash flow due to immediate expense recognition | Cash flow benefits distributed over useful life |

Understanding Immediate vs Gradual Depreciation

Immediate depreciation allows businesses to write off the entire cost of an asset in the year of purchase, maximizing tax deductions and improving short-term cash flow. Gradual depreciation allocates the asset's cost over its useful life, providing consistent expense recognition and matching costs with revenue over time. Understanding the difference helps companies choose a depreciation method that aligns with their financial strategy and tax planning goals.

Factors Impacting Car Depreciation Rates

Car depreciation rates are influenced by factors such as vehicle age, mileage, brand reputation, and market demand, which determine whether immediate or gradual depreciation occurs. Immediate depreciation typically happens with new cars that lose significant value once driven off the lot, while gradual depreciation reflects steady value reduction over time due to wear and tear. Maintenance history, model popularity, and economic conditions also critically impact how quickly a car's value declines.

Why Some Cars Depreciate Quickly

Certain cars depreciate quickly due to factors like high initial cost, rapid technological obsolescence, and poor brand reputation affecting immediate depreciation. Gradual depreciation occurs as wear and tear accumulate over time, but some models lose value sharply within the first few years because of market demand fluctuations and consumer perception. Vehicles with high maintenance costs or limited resale appeal tend to experience steep declines early in their depreciation curve.

Benefits of Gradual Depreciation

Gradual depreciation allows businesses to match the asset's expense with its actual usage and revenue generation over time, improving financial accuracy. This method enhances cash flow management by spreading out tax deductions across multiple periods, leading to more stable profitability reports. It also provides a clearer view of an asset's declining value, aiding in better decision-making for replacements or upgrades.

Financial Implications for Car Owners

Immediate depreciation allows car owners to claim a significant expense deduction in the purchase year, accelerating tax benefits and improving cash flow. Gradual depreciation spreads the expense over the vehicle's useful life, resulting in smaller yearly deductions but consistent tax relief. Choosing between immediate and gradual depreciation impacts overall tax strategy, affecting net cost and financial planning for car ownership.

Depreciation and Resale Value

Immediate depreciation results in a sharp initial decline in an asset's book value, significantly impacting resale value calculations by lowering the recorded worth soon after purchase. Gradual depreciation spreads the asset's cost over its useful life, providing a steadier reduction in value that more closely aligns with market resale values over time. The choice between immediate and gradual depreciation influences financial statements and tax implications, while also affecting the perceived resale value in secondary markets.

Car Models with Steep Initial Depreciation

Car models with steep initial depreciation often lose a significant portion of their value immediately after purchase, making immediate depreciation more pronounced than gradual depreciation. Luxury and electric vehicles typically experience rapid value drops within the first year due to market demand and technological advancements. Gradual depreciation applies to models with stable resale values, where the car's worth declines steadily over time rather than sharply at the outset.

How Maintenance Affects Depreciation Speed

Immediate depreciation accelerates asset value reduction due to rapid wear or obsolescence, often requiring less frequent but more intensive maintenance. Gradual depreciation spreads the value decline over time, with consistent maintenance slowing the depreciation speed by preserving asset condition and extending useful life. Well-maintained assets experience slower depreciation rates, reducing replacement costs and enhancing long-term financial planning.

Strategies to Minimize Depreciation Loss

Immediate depreciation allows businesses to write off asset costs in the first year, accelerating tax benefits but reducing future deductions. Gradual depreciation spreads the expense evenly over the asset's useful life, optimizing long-term financial planning and matching expenses to revenue generation. Implementing asset maintenance programs and selecting appropriate depreciation methods like MACRS or straight-line can further minimize overall depreciation loss.

Choosing Between Immediate and Gradual Depreciation Cars

Choosing between immediate and gradual depreciation for cars depends on usage patterns and financial strategy. Immediate depreciation provides larger tax deductions upfront, benefiting businesses seeking quick write-offs, while gradual depreciation spreads the expense over the vehicle's useful life, matching expenses with actual wear and tear. Evaluating factors like cash flow needs, tax brackets, and vehicle usage helps determine the optimal depreciation method.

Immediate Depreciation vs Gradual Depreciation Infographic

cardiffo.com

cardiffo.com