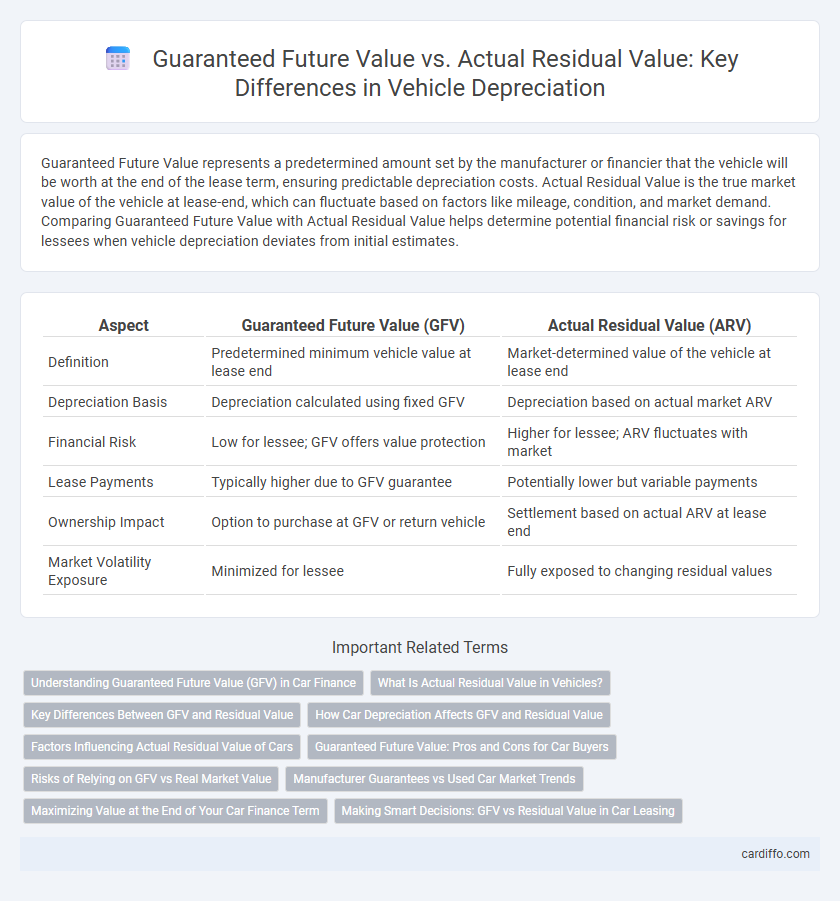

Guaranteed Future Value represents a predetermined amount set by the manufacturer or financier that the vehicle will be worth at the end of the lease term, ensuring predictable depreciation costs. Actual Residual Value is the true market value of the vehicle at lease-end, which can fluctuate based on factors like mileage, condition, and market demand. Comparing Guaranteed Future Value with Actual Residual Value helps determine potential financial risk or savings for lessees when vehicle depreciation deviates from initial estimates.

Table of Comparison

| Aspect | Guaranteed Future Value (GFV) | Actual Residual Value (ARV) |

|---|---|---|

| Definition | Predetermined minimum vehicle value at lease end | Market-determined value of the vehicle at lease end |

| Depreciation Basis | Depreciation calculated using fixed GFV | Depreciation based on actual market ARV |

| Financial Risk | Low for lessee; GFV offers value protection | Higher for lessee; ARV fluctuates with market |

| Lease Payments | Typically higher due to GFV guarantee | Potentially lower but variable payments |

| Ownership Impact | Option to purchase at GFV or return vehicle | Settlement based on actual ARV at lease end |

| Market Volatility Exposure | Minimized for lessee | Fully exposed to changing residual values |

Understanding Guaranteed Future Value (GFV) in Car Finance

Guaranteed Future Value (GFV) in car finance represents the minimum value a vehicle is assured to hold at the end of a lease or contract, providing financial predictability for lessees. Unlike the Actual Residual Value, which fluctuates based on market conditions, GFV is a pre-agreed amount set by the finance provider to protect against depreciation risks. This value is essential in calculating monthly payments and deciding whether to purchase, return, or trade the vehicle at the contract's conclusion.

What Is Actual Residual Value in Vehicles?

Actual Residual Value in vehicles represents the true market worth of a car at the end of a lease or ownership period, reflecting factors such as condition, mileage, and market demand. It often differs from the Guaranteed Future Value (GFV), which is a pre-agreed price set by the leasing company for vehicle buyout options. Understanding the Actual Residual Value is crucial for accurately estimating depreciation and potential resale price.

Key Differences Between GFV and Residual Value

Guaranteed Future Value (GFV) ensures a predetermined minimum value of an asset at the end of a contract, providing financial security to the lessee or buyer. Actual Residual Value represents the real market value of the asset after depreciation, which can fluctuate based on market conditions and asset usage. The key difference lies in GFV offering a fixed, contractual assurance, while Residual Value is an estimated, variable amount determined by current market realities.

How Car Depreciation Affects GFV and Residual Value

Guaranteed Future Value (GFV) is a pre-agreed amount a car's value will be at the end of a finance or lease term, serving as a safety net against depreciation fluctuations. Actual Residual Value reflects the car's market worth at the contract's conclusion, often lower due to accelerated depreciation, mileage, and condition. Car depreciation directly influences both GFV and Actual Residual Value, where rapid depreciation can cause the market value to fall below the guaranteed figure, potentially impacting buyout options or equity in the vehicle.

Factors Influencing Actual Residual Value of Cars

Actual residual value of cars is influenced by mileage, maintenance history, market demand, brand reputation, and economic conditions. Fluctuations in fuel prices, technological advances, and changes in consumer preferences also affect the vehicle's depreciation rate. Environmental regulations and geographic location play crucial roles in determining a car's end-of-lease value compared to the guaranteed future value.

Guaranteed Future Value: Pros and Cons for Car Buyers

Guaranteed Future Value (GFV) offers car buyers the advantage of financial predictability by assuring a set resale price at the end of the finance term, reducing the risk of depreciation fluctuations. This provides peace of mind and simplifies budgeting for future vehicle replacement. However, GFV often comes with higher monthly payments and restrictions on mileage and vehicle condition, potentially limiting flexibility for some buyers.

Risks of Relying on GFV vs Real Market Value

Guaranteed Future Value (GFV) provides a fixed buyback price at the end of a contract, but it may not reflect actual market conditions, exposing users to the risk of overpaying or losing potential equity. Real Residual Value fluctuates with market demand, making it a more accurate indicator of an asset's true worth and reducing the likelihood of unexpected depreciation losses. Relying solely on GFV can lead to discrepancies between expected and actual asset value, affecting financial planning and asset management outcomes.

Manufacturer Guarantees vs Used Car Market Trends

Guaranteed Future Value (GFV) represents the manufacturer's promise to repurchase a vehicle at a predetermined price, offering financial predictability and protection against market volatility. Actual Residual Value, however, is influenced by fluctuating used car market trends, including demand shifts, vehicle condition, and economic factors, which often result in discrepancies from the GFV. Manufacturer guarantees help mitigate depreciation risks, but relying solely on GFV may overlook potential gains or losses from real-world resale outcomes.

Maximizing Value at the End of Your Car Finance Term

Guaranteed Future Value (GFV) ensures a predetermined car value at the end of your finance term, providing financial predictability and reducing depreciation risk. Actual Residual Value (ARV) depends on the car's market performance, which may fluctuate due to mileage, condition, and market demand, potentially lowering returns. Maximizing value involves maintaining the vehicle's condition, adhering to mileage limits, and selecting finance options like GFV that offer security against depreciation uncertainty.

Making Smart Decisions: GFV vs Residual Value in Car Leasing

Guaranteed Future Value (GFV) in car leasing ensures a predetermined buyback price at lease end, providing financial predictability and protection against depreciation fluctuations. Actual Residual Value reflects the vehicle's market worth after lease term, which can vary based on usage, condition, and market trends, impacting potential costs or gains. Comparing GFV to Actual Residual Value helps lessees make smart decisions by balancing risk tolerance and financial certainty in lease agreements.

Guaranteed Future Value vs Actual Residual Value Infographic

cardiffo.com

cardiffo.com