Accelerated depreciation allows businesses to write off the asset's cost more quickly in the early years, reducing taxable income sooner compared to standard depreciation. Standard depreciation spreads the expense evenly over the asset's useful life, providing a consistent deduction each year. Choosing between the two methods impacts cash flow timing and tax strategy, with accelerated depreciation benefiting those seeking immediate tax relief.

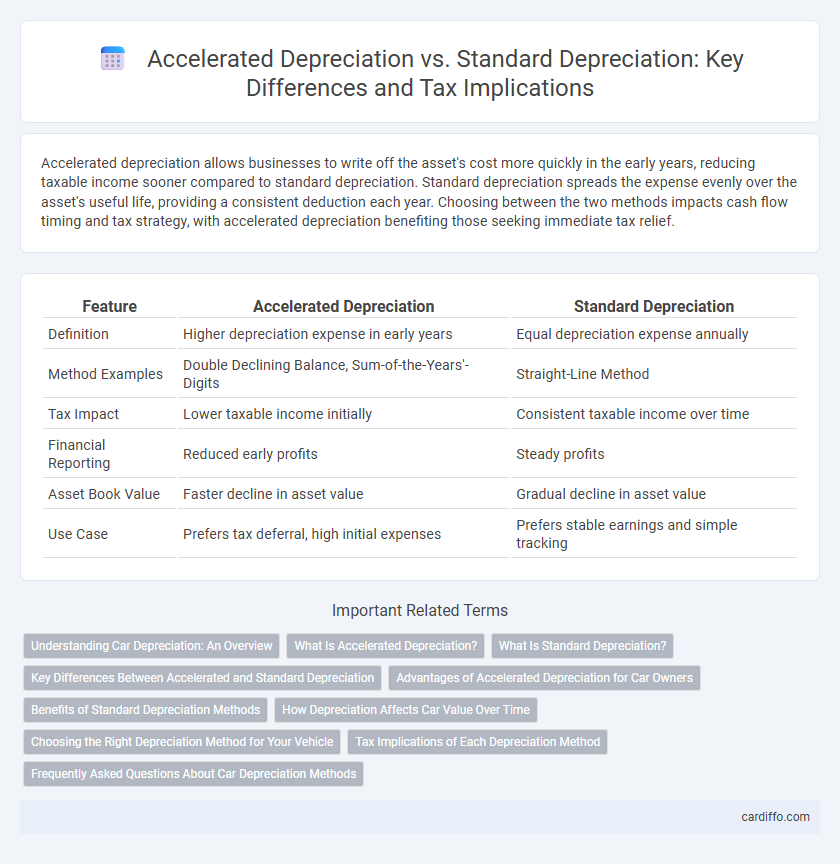

Table of Comparison

| Feature | Accelerated Depreciation | Standard Depreciation |

|---|---|---|

| Definition | Higher depreciation expense in early years | Equal depreciation expense annually |

| Method Examples | Double Declining Balance, Sum-of-the-Years'-Digits | Straight-Line Method |

| Tax Impact | Lower taxable income initially | Consistent taxable income over time |

| Financial Reporting | Reduced early profits | Steady profits |

| Asset Book Value | Faster decline in asset value | Gradual decline in asset value |

| Use Case | Prefers tax deferral, high initial expenses | Prefers stable earnings and simple tracking |

Understanding Car Depreciation: An Overview

Accelerated depreciation methods, such as Double Declining Balance, allow car owners to write off a larger portion of the vehicle's value in the early years, reflecting faster value loss typical in cars. Standard depreciation, often using the straight-line method, spreads the depreciation evenly over the asset's useful life, resulting in consistent annual expense recognition. Understanding these methods helps in accurately assessing the true decline in a car's market value and can influence financial decisions related to resale or tax deductions.

What Is Accelerated Depreciation?

Accelerated depreciation is a method that allows businesses to expense a larger portion of an asset's cost in the earlier years of its useful life, resulting in higher initial depreciation expenses compared to the standard straight-line method. This approach reflects the asset's faster loss of value or usefulness in the initial years, leading to tax advantages by deferring tax liabilities. Common accelerated depreciation methods include the Double Declining Balance and Sum-of-the-Years'-Digits techniques, often used for assets like machinery or vehicles.

What Is Standard Depreciation?

Standard depreciation, also known as straight-line depreciation, allocates the cost of an asset evenly over its useful life, providing a consistent expense amount each accounting period. This method simplifies financial reporting by spreading the asset's value reduction uniformly, reflecting steady usage or wear. It contrasts with accelerated depreciation by offering predictability and ease of calculation in asset expense recognition.

Key Differences Between Accelerated and Standard Depreciation

Accelerated depreciation allocates higher expenses in the early years of an asset's life, resulting in faster tax deductions, while standard depreciation spreads expenses evenly over the asset's useful life. Key differences include accelerated methods like Double Declining Balance and Sum-of-the-Years'-Digits, which front-load depreciation, versus the straight-line method used in standard depreciation that provides consistent expense recognition. Accelerated depreciation improves short-term cash flow and tax benefits, whereas standard depreciation offers simplicity and predictable expense allocation.

Advantages of Accelerated Depreciation for Car Owners

Accelerated depreciation allows car owners to deduct higher expenses in the early years of vehicle ownership, reducing taxable income more quickly than standard depreciation methods. This results in immediate tax savings and improved cash flow, helping owners reinvest in their business or offset other expenses. The method is particularly advantageous for cars used heavily in business, as it reflects the rapid loss in value and higher maintenance costs during initial years.

Benefits of Standard Depreciation Methods

Standard depreciation methods, such as straight-line depreciation, provide consistent expense allocation over an asset's useful life, facilitating straightforward financial forecasting and budgeting. These methods enhance comparability and transparency in financial reporting, aligning with accounting standards and reducing the risk of earnings manipulation. Businesses benefit from stable expense recognition, aiding long-term asset management and investor confidence.

How Depreciation Affects Car Value Over Time

Accelerated depreciation methods, such as Double Declining Balance, reduce a car's book value more rapidly in the early years compared to standard straight-line depreciation, which spreads the expense evenly. This faster depreciation results in a lower reported value on financial statements sooner, impacting tax deductions and resale estimates. Understanding these depreciation schedules helps car owners and accountants evaluate true asset worth and optimize financial planning over the vehicle's lifespan.

Choosing the Right Depreciation Method for Your Vehicle

Accelerated depreciation allows vehicle owners to write off a larger portion of the asset's cost in the early years, maximizing tax benefits upfront and improving cash flow. Standard depreciation spreads the expense evenly over the vehicle's useful life, providing predictable and consistent deductions annually. Choosing the right depreciation method depends on cash flow needs, tax strategy, and the vehicle's usage pattern to optimize financial outcomes.

Tax Implications of Each Depreciation Method

Accelerated depreciation allows businesses to expense a larger portion of an asset's cost in the early years, reducing taxable income and deferring tax liabilities, which can improve short-term cash flow. In contrast, standard depreciation spreads the expense evenly over the asset's useful life, leading to a consistent but potentially higher tax burden each year. Choosing between accelerated and standard depreciation significantly impacts tax planning strategies, cash flow management, and overall financial reporting.

Frequently Asked Questions About Car Depreciation Methods

Accelerated depreciation methods, such as double declining balance, allow faster expense recognition in the early years of a vehicle's life, reducing taxable income more quickly compared to the standard straight-line method. Using accelerated depreciation on cars can lead to significant tax savings initially but results in lower deductions in later years, affecting long-term tax planning. Many taxpayers ask how these methods impact resale value calculations and whether accelerated depreciation aligns with accounting standards for vehicle asset management.

Accelerated Depreciation vs Standard Depreciation Infographic

cardiffo.com

cardiffo.com