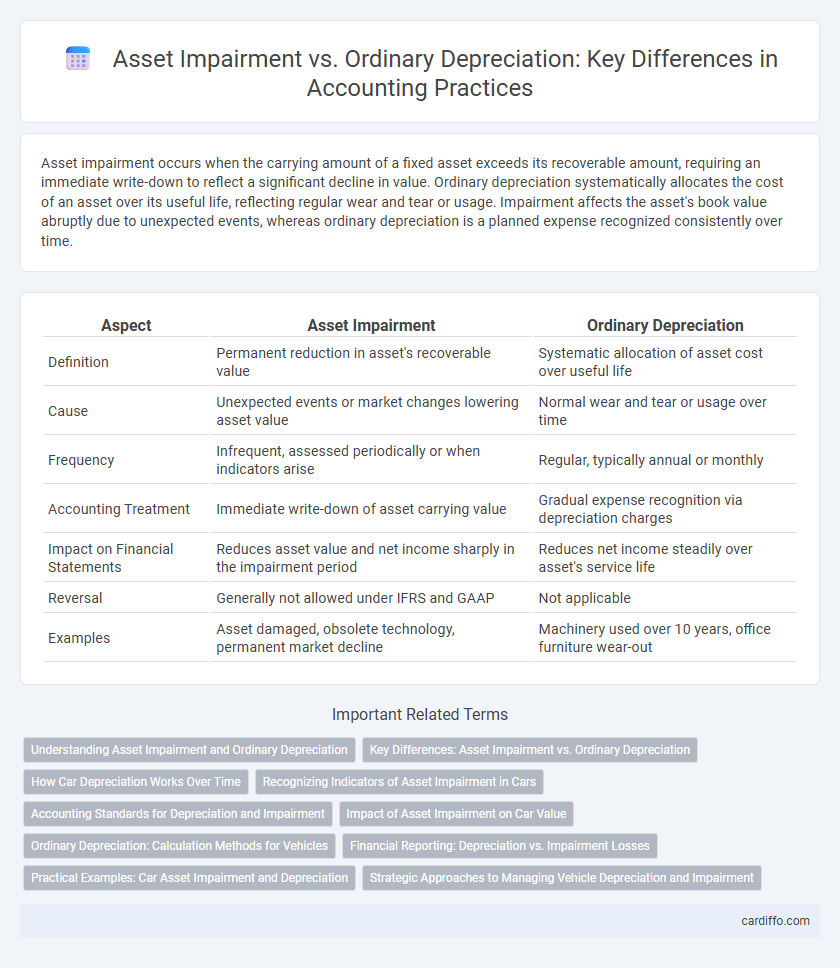

Asset impairment occurs when the carrying amount of a fixed asset exceeds its recoverable amount, requiring an immediate write-down to reflect a significant decline in value. Ordinary depreciation systematically allocates the cost of an asset over its useful life, reflecting regular wear and tear or usage. Impairment affects the asset's book value abruptly due to unexpected events, whereas ordinary depreciation is a planned expense recognized consistently over time.

Table of Comparison

| Aspect | Asset Impairment | Ordinary Depreciation |

|---|---|---|

| Definition | Permanent reduction in asset's recoverable value | Systematic allocation of asset cost over useful life |

| Cause | Unexpected events or market changes lowering asset value | Normal wear and tear or usage over time |

| Frequency | Infrequent, assessed periodically or when indicators arise | Regular, typically annual or monthly |

| Accounting Treatment | Immediate write-down of asset carrying value | Gradual expense recognition via depreciation charges |

| Impact on Financial Statements | Reduces asset value and net income sharply in the impairment period | Reduces net income steadily over asset's service life |

| Reversal | Generally not allowed under IFRS and GAAP | Not applicable |

| Examples | Asset damaged, obsolete technology, permanent market decline | Machinery used over 10 years, office furniture wear-out |

Understanding Asset Impairment and Ordinary Depreciation

Asset impairment occurs when an asset's recoverable amount falls below its carrying amount, requiring an immediate write-down to reflect its reduced value, whereas ordinary depreciation systematically allocates the cost of an asset over its useful life. Understanding asset impairment is crucial for accurate financial reporting as it addresses unexpected declines in asset value, while ordinary depreciation focuses on the gradual consumption of the asset's economic benefits. Recognizing the distinction ensures compliance with accounting standards like IFRS and GAAP, providing transparent asset valuation and financial statements.

Key Differences: Asset Impairment vs. Ordinary Depreciation

Asset impairment involves a sudden, significant decline in the recoverable value of an asset, whereas ordinary depreciation systematically allocates an asset's cost over its useful life. Impairment requires immediate recognition of a loss when the asset's carrying amount exceeds its recoverable amount, while depreciation is a planned, periodic expense reflecting wear and tear. Key differences include timing, measurement basis, and accounting treatment, with impairment impacting financial statements only upon occurrence and depreciation affecting them consistently.

How Car Depreciation Works Over Time

Car depreciation over time differs between ordinary depreciation and asset impairment; ordinary depreciation follows a predictable schedule reflecting gradual loss of value due to wear and age, often calculated using straight-line or declining balance methods. Asset impairment occurs when a car's market value suddenly drops below its book value, typically caused by accidents, significant damage, or drastic market changes, requiring an immediate write-down. Understanding these distinctions helps in accurate financial reporting and estimating the vehicle's true worth during ownership.

Recognizing Indicators of Asset Impairment in Cars

Recognizing indicators of asset impairment in cars involves identifying significant declines in market value, physical damage, or obsolescence that are not accounted for by ordinary depreciation schedules. Unlike ordinary depreciation, which allocates cost systematically over the useful life, asset impairment requires immediate recognition of a loss when the carrying amount exceeds the recoverable amount. Key indicators include accidents causing structural damage, mechanical failures leading to reduced functionality, and rapid technological advancements rendering the vehicle less marketable.

Accounting Standards for Depreciation and Impairment

Asset impairment reflects a permanent reduction in an asset's recoverable amount below its carrying value, requiring immediate write-down under accounting standards such as IAS 36 or ASC 360. Ordinary depreciation systematically allocates the cost of an asset over its useful life based on standard methods outlined in frameworks like IAS 16 or ASC 360. Accounting standards mandate impairment tests periodically or when triggering events occur, ensuring asset values on financial statements represent fair recoverable amounts rather than merely reflecting planned depreciation expense.

Impact of Asset Impairment on Car Value

Asset impairment significantly reduces the car's book value beyond ordinary depreciation by recognizing a sudden decline in market or recoverable value due to damage or obsolescence. Unlike the systematic allocation of depreciation expenses over time, asset impairment requires immediate write-downs, reflecting a more accurate and often substantial impact on the vehicle's accounting value. This adjustment affects financial statements by lowering asset values and potentially increasing expenses, altering depreciation schedules and impairing overall asset valuation.

Ordinary Depreciation: Calculation Methods for Vehicles

Ordinary depreciation for vehicles typically employs the straight-line, declining balance, or units of production methods to systematically allocate the asset's cost over its useful life. The straight-line method divides the vehicle's depreciable base evenly across its estimated lifespan, while the declining balance method accelerates expense recognition in earlier years by applying a fixed depreciation rate to the reducing book value. Units of production depreciation aligns expense with actual usage by calculating depreciation based on miles driven or hours used, providing a more precise allocation linked to the vehicle's operational activity.

Financial Reporting: Depreciation vs. Impairment Losses

Financial reporting requires distinguishing asset impairment from ordinary depreciation, as impairment losses reflect a significant and unexpected decline in asset value, while depreciation allocates cost systematically over an asset's useful life. Impairment losses are recognized when carrying amount exceeds recoverable amount, impacting profit and loss immediately, contrasting with depreciation's periodic expense recognition. Accurate reporting ensures compliance with accounting standards like IFRS IAS 36 and GAAP ASC 360, providing transparent financial statements and aiding stakeholders' decision-making.

Practical Examples: Car Asset Impairment and Depreciation

Car asset impairment occurs when the vehicle's market value significantly drops due to accidents or severe damage, leading to an immediate write-down on the balance sheet. Ordinary depreciation, by contrast, spreads the cost of the car evenly over its useful life, reflecting gradual wear and tear. For example, a car worth $30,000 impaired by a $10,000 accident would show an impairment loss instantly, while ordinary depreciation might allocate $3,000 annually over ten years without sudden value adjustments.

Strategic Approaches to Managing Vehicle Depreciation and Impairment

Strategic management of vehicle depreciation requires differentiating between ordinary depreciation and asset impairment to accurately reflect asset value reduction. Ordinary depreciation applies a systematic allocation of vehicle cost over its useful life, while asset impairment addresses sudden declines in value due to unforeseen events or damages. Effective strategies include regular valuation assessments, timely impairment recognition, and integrating predictive analytics to optimize depreciation schedules, thereby enhancing financial reporting accuracy and fleet management decisions.

Asset Impairment vs Ordinary Depreciation Infographic

cardiffo.com

cardiffo.com