Mileage deduction calculates vehicle expense based on miles driven for business, offering simplicity and consistent rates, while depreciation deduction allows for recovering the vehicle's cost over time by deducting its loss in value. Choosing mileage deduction often benefits businesses with lower vehicle costs or fewer miles driven, as it covers fuel, maintenance, and wear without tracking actual expenses. Depreciation deduction suits higher-cost vehicles or extensive business use, enabling larger write-offs by factoring in purchase price and annual depreciation methods.

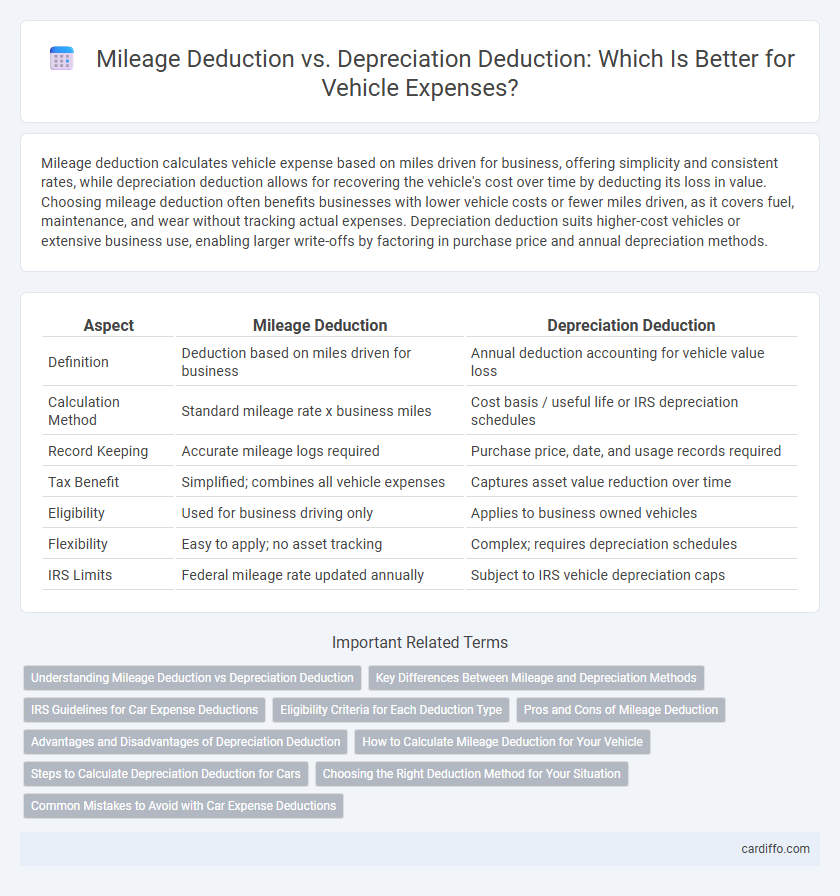

Table of Comparison

| Aspect | Mileage Deduction | Depreciation Deduction |

|---|---|---|

| Definition | Deduction based on miles driven for business | Annual deduction accounting for vehicle value loss |

| Calculation Method | Standard mileage rate x business miles | Cost basis / useful life or IRS depreciation schedules |

| Record Keeping | Accurate mileage logs required | Purchase price, date, and usage records required |

| Tax Benefit | Simplified; combines all vehicle expenses | Captures asset value reduction over time |

| Eligibility | Used for business driving only | Applies to business owned vehicles |

| Flexibility | Easy to apply; no asset tracking | Complex; requires depreciation schedules |

| IRS Limits | Federal mileage rate updated annually | Subject to IRS vehicle depreciation caps |

Understanding Mileage Deduction vs Depreciation Deduction

Mileage deduction allows taxpayers to deduct a fixed rate per mile driven for business purposes, simplifying record-keeping compared to depreciation deduction, which involves allocating the vehicle's cost over its useful life. Depreciation deduction requires tracking the asset's basis, applying IRS-approved depreciation methods, and accounting for factors like salvage value and useful life, leading to potentially larger, yet more complex, tax benefits. Choosing between mileage and depreciation deductions depends on actual vehicle usage, record accuracy, and the taxpayer's preference for simplicity versus maximizing deductions.

Key Differences Between Mileage and Depreciation Methods

Mileage deduction calculates expenses based on a standard rate per mile driven for business purposes, simplifying record-keeping and reflecting variable costs like gas and wear and tear. Depreciation deduction accounts for the vehicle's loss in value over time, spreading the cost of purchase across several years and capturing fixed expenses such as purchase price and long-term asset decline. The key difference lies in mileage deduction offering simplicity and consistency based on distance, while depreciation provides a more precise allocation of vehicle cost over its useful life.

IRS Guidelines for Car Expense Deductions

The IRS allows taxpayers to choose between the mileage deduction and depreciation deduction for car expenses, but not both for the same vehicle in the same year. Mileage deduction offers a standard rate per mile driven for business purposes, while depreciation deduction involves deducting the vehicle's cost over its useful life as per IRS depreciation tables. Careful record-keeping of mileage or vehicle cost and usage is essential to comply with IRS guidelines and maximize allowable deductions.

Eligibility Criteria for Each Deduction Type

Eligibility for mileage deduction requires a vehicle used for business purposes with accurate mileage logs, while depreciation deduction applies to owned business assets subject to depreciation schedules like MACRS. Mileage deduction is available when tracking actual miles driven, regardless of ownership, whereas depreciation requires ownership and capital investment in the vehicle. Businesses must choose based on vehicle ownership status, record-keeping ability, and compliance with IRS guidelines on standard mileage rates or asset depreciation methods.

Pros and Cons of Mileage Deduction

Mileage deduction offers simplicity and ease of tracking vehicle expenses by applying a standard rate per mile, eliminating the need to calculate actual depreciation. Its pros include lower record-keeping burden and consistent deduction amounts regardless of vehicle cost fluctuations. However, it may result in lower total deductions compared to depreciation, especially for high-cost or heavily used vehicles, limiting potential tax benefits.

Advantages and Disadvantages of Depreciation Deduction

Depreciation deduction allows business owners to recover the cost of a vehicle over its useful life, providing a significant tax benefit by spreading the expense across multiple years instead of a one-time deduction. This method offers advantages such as potentially higher total deductions if the vehicle is used extensively for business purposes, but it requires meticulous record-keeping and strict adherence to IRS depreciation schedules and limits. A key disadvantage is the complexity and potential recapture tax if the vehicle's use changes or it is sold for more than its depreciated value, making mileage deduction simpler for some taxpayers.

How to Calculate Mileage Deduction for Your Vehicle

To calculate the mileage deduction for your vehicle, multiply the total business miles driven by the IRS standard mileage rate for the tax year, which is 65.5 cents per mile in 2023. Keep a detailed log of all business-related driving, including dates, mileage, and purpose, to substantiate your deduction. This method simplifies vehicle expense tracking compared to calculating depreciation deduction, which requires tracking the vehicle's cost, useful life, and annual depreciation limits set by the IRS.

Steps to Calculate Depreciation Deduction for Cars

To calculate the depreciation deduction for cars, first determine the vehicle's basis, typically the purchase price plus any sales tax and improvements. Next, apply the IRS depreciation method allowed, such as the Modified Accelerated Cost Recovery System (MACRS), which often uses a 5-year recovery period for passenger vehicles. Finally, adjust the deduction for any business-use percentage, ensuring only the portion related to business mileage is depreciated.

Choosing the Right Deduction Method for Your Situation

Choosing between mileage deduction and depreciation deduction depends on the vehicle's usage and ownership period. Mileage deduction offers a simplified rate per mile driven, ideal for straightforward record-keeping and short-term use, while depreciation deduction accounts for the vehicle's value loss over time, benefiting long-term ownership with higher expenses. Analyzing your annual mileage, maintenance costs, and vehicle value helps maximize tax savings by selecting the most advantageous method.

Common Mistakes to Avoid with Car Expense Deductions

Mileage deduction and depreciation deduction are both valid methods to claim car expenses, but mixing them incorrectly can lead to tax errors. Claiming mileage deduction while also depreciating the vehicle's cost in the same year is a common mistake that results in double-dipping on expenses. Understanding IRS guidelines on when to use standard mileage rates versus actual depreciation is essential to avoid audit risks and maximize legitimate deductions.

Mileage Deduction vs Depreciation Deduction Infographic

cardiffo.com

cardiffo.com