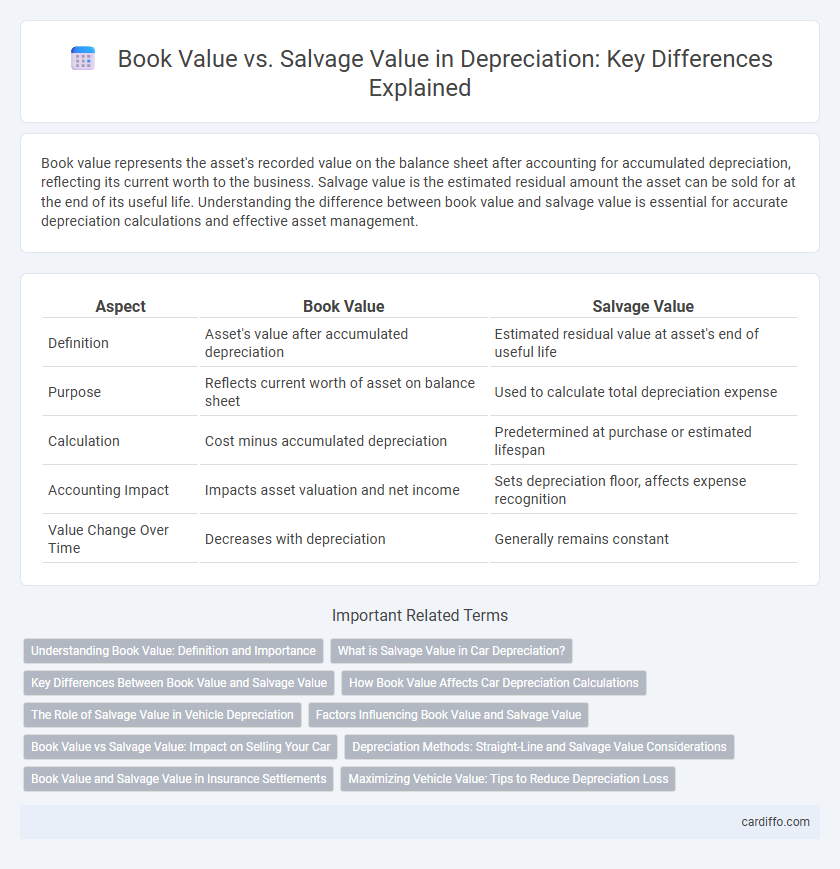

Book value represents the asset's recorded value on the balance sheet after accounting for accumulated depreciation, reflecting its current worth to the business. Salvage value is the estimated residual amount the asset can be sold for at the end of its useful life. Understanding the difference between book value and salvage value is essential for accurate depreciation calculations and effective asset management.

Table of Comparison

| Aspect | Book Value | Salvage Value |

|---|---|---|

| Definition | Asset's value after accumulated depreciation | Estimated residual value at asset's end of useful life |

| Purpose | Reflects current worth of asset on balance sheet | Used to calculate total depreciation expense |

| Calculation | Cost minus accumulated depreciation | Predetermined at purchase or estimated lifespan |

| Accounting Impact | Impacts asset valuation and net income | Sets depreciation floor, affects expense recognition |

| Value Change Over Time | Decreases with depreciation | Generally remains constant |

Understanding Book Value: Definition and Importance

Book value represents the recorded value of an asset on the balance sheet, calculated by subtracting accumulated depreciation from the original cost. It reflects the asset's current worth for accounting purposes and guides decision-making in financial reporting and asset management. Understanding book value is crucial as it impacts depreciation expense calculations and informs the comparison to salvage value, which is the estimated residual value at the end of an asset's useful life.

What is Salvage Value in Car Depreciation?

Salvage value in car depreciation refers to the estimated residual worth of a vehicle at the end of its useful life after accounting for wear and tear. It represents the expected resale or scrap value when the car is no longer economically viable to use. Accurately determining salvage value is essential for calculating depreciation expenses and tax deductions over the vehicle's lifespan.

Key Differences Between Book Value and Salvage Value

Book value represents the asset's recorded value on the balance sheet after accounting for accumulated depreciation, reflecting its current worth to the company. Salvage value, also known as residual value, is the estimated amount an asset can be sold for at the end of its useful life. The key difference lies in book value being a dynamic accounting measure updated over time, while salvage value is a fixed estimate used in depreciation calculations.

How Book Value Affects Car Depreciation Calculations

Book value, representing the asset's recorded cost minus accumulated depreciation, directly impacts car depreciation calculations by determining the depreciable amount over the vehicle's useful life. Salvage value, the estimated residual worth at the end of its useful life, sets the lower limit in depreciation schedules but does not affect daily book value adjustments. Accurate book value assessment ensures precise depreciation expense reporting, which is critical for tax purposes and financial statements in automotive asset management.

The Role of Salvage Value in Vehicle Depreciation

Salvage value represents the estimated residual worth of a vehicle at the end of its useful life, serving as a critical factor in calculating depreciation expense. It helps determine the total depreciable amount by subtracting salvage value from the asset's original cost, directly impacting depreciation schedules such as straight-line or declining balance methods. Accurate estimation of salvage value ensures precise reflection of a vehicle's book value over time, facilitating better financial reporting and asset management decisions.

Factors Influencing Book Value and Salvage Value

Book value decreases over time due to depreciation methods, asset age, usage intensity, and maintenance quality, while salvage value depends on factors such as market demand, residual utility, asset condition, and technological obsolescence. Economic conditions and industry trends also influence both values, as fluctuating market prices and regulatory changes impact the estimated recoverable amount of the asset. Accurate assessment of book and salvage values requires considering purchase cost, accumulated depreciation, and potential resale or scrap value under prevailing market scenarios.

Book Value vs Salvage Value: Impact on Selling Your Car

Book value represents the vehicle's current worth after accounting for accumulated depreciation, while salvage value estimates the residual amount the car can fetch at the end of its useful life. The difference between these values directly affects the selling price; a higher book value relative to salvage value typically results in a better resale value. Understanding both allows sellers to set realistic pricing expectations and negotiate effectively in the used car market.

Depreciation Methods: Straight-Line and Salvage Value Considerations

Depreciation methods like straight-line calculate expense by evenly distributing an asset's cost minus its salvage value over its useful life, ensuring consistent book value reduction. Salvage value plays a critical role in this method as it defines the asset's estimated residual worth after depreciation, preventing overstatement of expense. Understanding the relationship between book value, which decreases over time, and salvage value is essential for accurate financial reporting and asset management.

Book Value and Salvage Value in Insurance Settlements

In insurance settlements, book value represents the asset's depreciated worth at the time of loss, reflecting its actual usage and wear, while salvage value indicates the estimated residual value after depreciation. Accurate distinction between book value and salvage value is critical for determining fair compensation, as insurance typically covers the asset's book value minus the salvage value. Understanding how these values impact settlement calculations ensures precise reimbursement and prevents disputes during claims processing.

Maximizing Vehicle Value: Tips to Reduce Depreciation Loss

Book value represents the vehicle's original cost minus accumulated depreciation, while salvage value is the estimated resale price at the end of its useful life. Maximizing vehicle value involves regular maintenance, timely repairs, and careful driving to minimize wear and tear, thereby slowing depreciation. Maintaining thorough service records and avoiding modifications can also help retain higher resale or salvage value.

Book Value vs Salvage Value Infographic

cardiffo.com

cardiffo.com