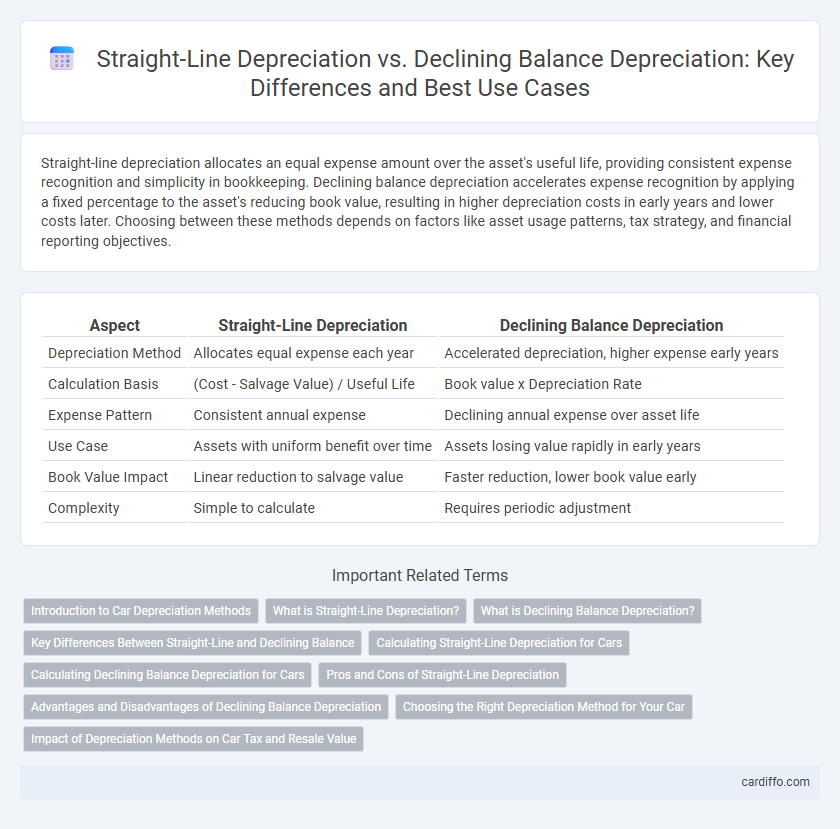

Straight-line depreciation allocates an equal expense amount over the asset's useful life, providing consistent expense recognition and simplicity in bookkeeping. Declining balance depreciation accelerates expense recognition by applying a fixed percentage to the asset's reducing book value, resulting in higher depreciation costs in early years and lower costs later. Choosing between these methods depends on factors like asset usage patterns, tax strategy, and financial reporting objectives.

Table of Comparison

| Aspect | Straight-Line Depreciation | Declining Balance Depreciation |

|---|---|---|

| Depreciation Method | Allocates equal expense each year | Accelerated depreciation, higher expense early years |

| Calculation Basis | (Cost - Salvage Value) / Useful Life | Book value x Depreciation Rate |

| Expense Pattern | Consistent annual expense | Declining annual expense over asset life |

| Use Case | Assets with uniform benefit over time | Assets losing value rapidly in early years |

| Book Value Impact | Linear reduction to salvage value | Faster reduction, lower book value early |

| Complexity | Simple to calculate | Requires periodic adjustment |

Introduction to Car Depreciation Methods

Straight-line depreciation allocates an equal expense amount annually over a car's useful life, providing a consistent reduction in book value. Declining balance depreciation accelerates expense recognition by applying a fixed percentage to the car's decreasing book value, resulting in higher depreciation costs in earlier years. Choosing between these methods impacts tax reporting, financial statements, and the vehicle's asset valuation strategy.

What is Straight-Line Depreciation?

Straight-line depreciation allocates an asset's cost evenly over its useful life, resulting in consistent expense amounts each accounting period. This method simplifies budgeting and financial analysis by spreading the depreciation expense uniformly from acquisition to disposal. It contrasts with accelerated methods like declining balance, which assign higher expenses in early years to reflect asset wear and obsolescence more rapidly.

What is Declining Balance Depreciation?

Declining balance depreciation is an accelerated depreciation method that allocates higher expense amounts in the early years of an asset's useful life, reflecting rapid value loss. It calculates depreciation by applying a fixed rate to the asset's book value at the beginning of each period, resulting in decreasing expense amounts over time. This method contrasts with straight-line depreciation, which spreads the cost evenly across the asset's useful life.

Key Differences Between Straight-Line and Declining Balance

Straight-line depreciation allocates an equal expense amount over the asset's useful life, providing consistent annual expense recognition, while declining balance depreciation applies a fixed percentage to the asset's book value, resulting in higher expenses in earlier years and decreasing amounts over time. Straight-line is simpler and preferred for assets with uniform utility, whereas declining balance better matches depreciation for assets that lose value rapidly. The choice impacts financial reporting and tax deductions, influencing cash flow and profitability analysis.

Calculating Straight-Line Depreciation for Cars

Straight-line depreciation for cars is calculated by subtracting the vehicle's salvage value from its purchase price and then dividing this amount evenly over its useful life. This method provides a consistent annual depreciation expense, making it simpler to forecast and implement in financial statements. Unlike declining balance depreciation, straight-line depreciation does not accelerate expense recognition, ensuring a steady reduction in the car's book value each year.

Calculating Declining Balance Depreciation for Cars

Declining balance depreciation for cars involves applying a fixed depreciation rate to the reducing book value each year, resulting in higher expense in the earlier years and lower expense later. This method accelerates depreciation compared to the straight-line method, which evenly spreads the cost over the asset's useful life. For example, a car purchased for $30,000 with a 20% declining balance rate would depreciate $6,000 in the first year and $4,800 in the second year, based on the decreasing value.

Pros and Cons of Straight-Line Depreciation

Straight-line depreciation offers simplicity and consistency by allocating equal expense amounts over an asset's useful life, enhancing ease of budget forecasting and financial reporting. Its main drawback lies in the inability to reflect actual asset wear and tear or obsolescence, potentially misrepresenting an asset's value in early years. This method benefits companies with stable usage patterns but may not suit assets that lose value rapidly or become outdated quickly.

Advantages and Disadvantages of Declining Balance Depreciation

Declining Balance Depreciation offers accelerated expense recognition, enabling higher depreciation costs in earlier years, which improves tax advantages and cash flow for asset-intensive businesses. However, it results in lower depreciation expenses in later years, potentially distorting profit margins over time and complicating long-term financial forecasting. This method may not align with the actual usage pattern for all assets, making it less suitable for assets with consistent wear and tear.

Choosing the Right Depreciation Method for Your Car

Straight-line depreciation offers a consistent expense allocation over the car's useful life, ideal for vehicles with stable usage and maintenance costs. Declining balance depreciation accelerates expense recognition, suitable for cars that rapidly lose value or incur higher costs early on. Selecting the right method depends on factors like expected vehicle wear, resale value, and tax strategy to maximize financial efficiency.

Impact of Depreciation Methods on Car Tax and Resale Value

Straight-line depreciation spreads the car's cost evenly over its useful life, resulting in consistent annual tax deductions but potentially higher taxable income in early years compared to accelerated methods. Declining balance depreciation front-loads expenses, reducing taxable income more significantly in initial years, which can lower tax liability but also accelerate book value reduction. This accelerated depreciation may lower the car's reported value for resale, influencing market perception and resale negotiation leverage.

Straight-Line Depreciation vs Declining Balance Depreciation Infographic

cardiffo.com

cardiffo.com