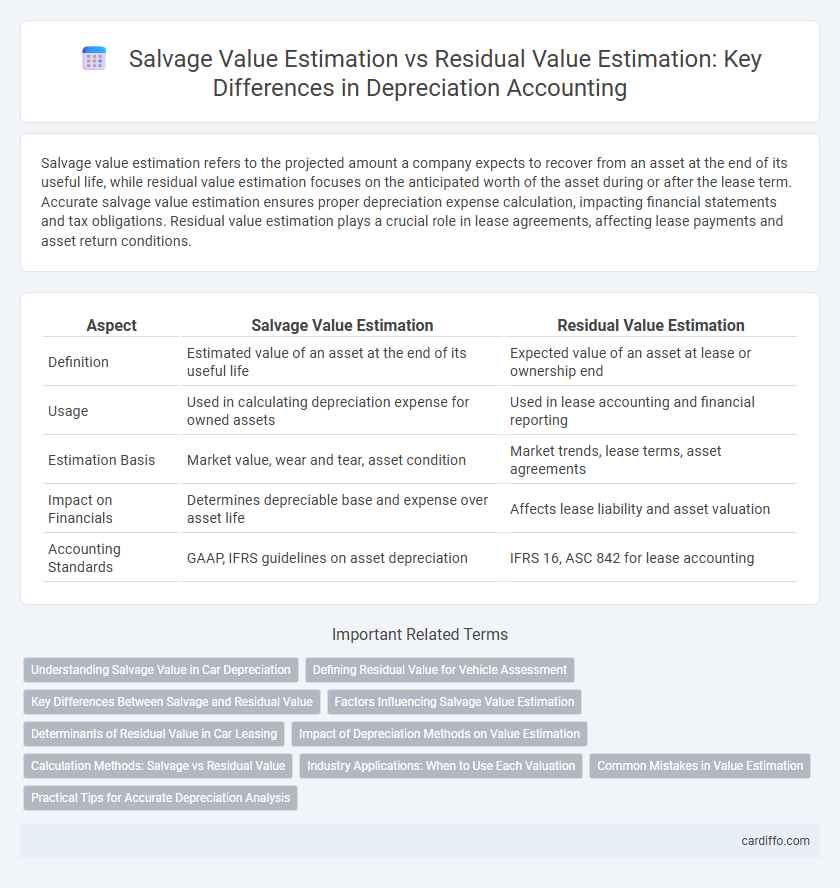

Salvage value estimation refers to the projected amount a company expects to recover from an asset at the end of its useful life, while residual value estimation focuses on the anticipated worth of the asset during or after the lease term. Accurate salvage value estimation ensures proper depreciation expense calculation, impacting financial statements and tax obligations. Residual value estimation plays a crucial role in lease agreements, affecting lease payments and asset return conditions.

Table of Comparison

| Aspect | Salvage Value Estimation | Residual Value Estimation |

|---|---|---|

| Definition | Estimated value of an asset at the end of its useful life | Expected value of an asset at lease or ownership end |

| Usage | Used in calculating depreciation expense for owned assets | Used in lease accounting and financial reporting |

| Estimation Basis | Market value, wear and tear, asset condition | Market trends, lease terms, asset agreements |

| Impact on Financials | Determines depreciable base and expense over asset life | Affects lease liability and asset valuation |

| Accounting Standards | GAAP, IFRS guidelines on asset depreciation | IFRS 16, ASC 842 for lease accounting |

Understanding Salvage Value in Car Depreciation

Salvage value in car depreciation refers to the estimated amount a vehicle will be worth at the end of its useful life after accounting for wear and tear. Accurate salvage value estimation helps determine the total depreciable cost, impacting monthly depreciation expenses and tax deductions. Unlike residual value, which reflects lease-end worth, salvage value focuses on the asset's scrap or resale potential for owners over the depreciation period.

Defining Residual Value for Vehicle Assessment

Residual value for vehicle assessment refers to the estimated amount a vehicle will be worth at the end of its useful life or lease term, after accounting for depreciation. It plays a critical role in determining lease payments, insurance, and total cost of ownership. Accurate residual value estimation requires analyzing market trends, vehicle condition, mileage, and economic factors to predict future resale value.

Key Differences Between Salvage and Residual Value

Salvage value estimation refers to the expected amount an asset can be sold for at the end of its useful life, while residual value estimation focuses on the asset's remaining worth during or after a lease term. Key differences include that salvage value is typically used in ownership contexts for depreciation calculations, whereas residual value is crucial in lease agreements to determine lease payments and end-of-lease obligations. Salvage value is often fixed based on historical data or market trends, while residual value is influenced by market conditions, lease terms, and asset usage.

Factors Influencing Salvage Value Estimation

Factors influencing salvage value estimation include asset age, usage intensity, and market demand for used assets. Economic conditions, technological advancements, and maintenance quality further impact the estimated salvage value. Accurate assessment requires evaluating physical condition and potential resale value in the current market environment.

Determinants of Residual Value in Car Leasing

Residual value estimation in car leasing depends on factors such as the vehicle's make and model, anticipated mileage, and market demand trends at lease-end. Economic conditions, lease duration, and maintenance quality significantly influence depreciation rates and thus impact the residual value. Accurate appraisal requires analyzing past depreciation data, industry forecasts, and vehicle condition to minimize financial risk for both lessor and lessee.

Impact of Depreciation Methods on Value Estimation

Salvage value estimation and residual value estimation are significantly influenced by the choice of depreciation methods such as straight-line, declining balance, or units of production, which determine the asset's value over time. Straight-line depreciation provides a consistent impact on residual value estimation, leading to stable salvage value predictions, while accelerated methods tend to reduce book values more rapidly, affecting the reported salvage value. Accurate estimation of these values is critical for financial reporting and tax purposes, as they directly affect expense recognition and asset valuation accuracy.

Calculation Methods: Salvage vs Residual Value

Salvage value estimation typically employs cost-based methods, assessing the expected resale price of an asset at the end of its useful life, often using historical data and market trends. Residual value estimation focuses on forecasting the remaining worth of an asset after depreciation, incorporating factors such as usage, wear and tear, and market demand through predictive modeling and discounting future cash flows. Both calculation methods are critical in asset management, influencing depreciation schedules and financial reporting accuracy.

Industry Applications: When to Use Each Valuation

Salvage value estimation is crucial in manufacturing industries where equipment is expected to have a tangible end-of-life worth for resale or scrap. Residual value estimation is more applicable in leasing and automotive sectors, reflecting the anticipated market value at lease-end or after usage. Choosing the appropriate valuation depends on asset type, industry standards, and financial reporting requirements to ensure accurate depreciation expense recognition.

Common Mistakes in Value Estimation

Common mistakes in salvage value estimation often involve overestimating the asset's end-of-life worth, leading to understated depreciation expenses and inflated profit margins. Residual value estimation errors frequently stem from neglecting market fluctuations and ignoring asset condition, resulting in inaccurate book value calculations and misguided financial forecasts. Both types of errors can cause significant distortions in financial statements and impair asset management decisions.

Practical Tips for Accurate Depreciation Analysis

Salvage value estimation requires assessing the expected market price of an asset at the end of its useful life, often using historical sales data and industry benchmarks for precision. Residual value estimation focuses on the asset's expected worth after depreciation, typically incorporating factors such as asset condition, technological obsolescence, and economic trends. Accurate depreciation analysis hinges on regularly updating these values through market research and asset inspections to reflect realistic end-of-life valuations.

Salvage Value Estimation vs Residual Value Estimation Infographic

cardiffo.com

cardiffo.com