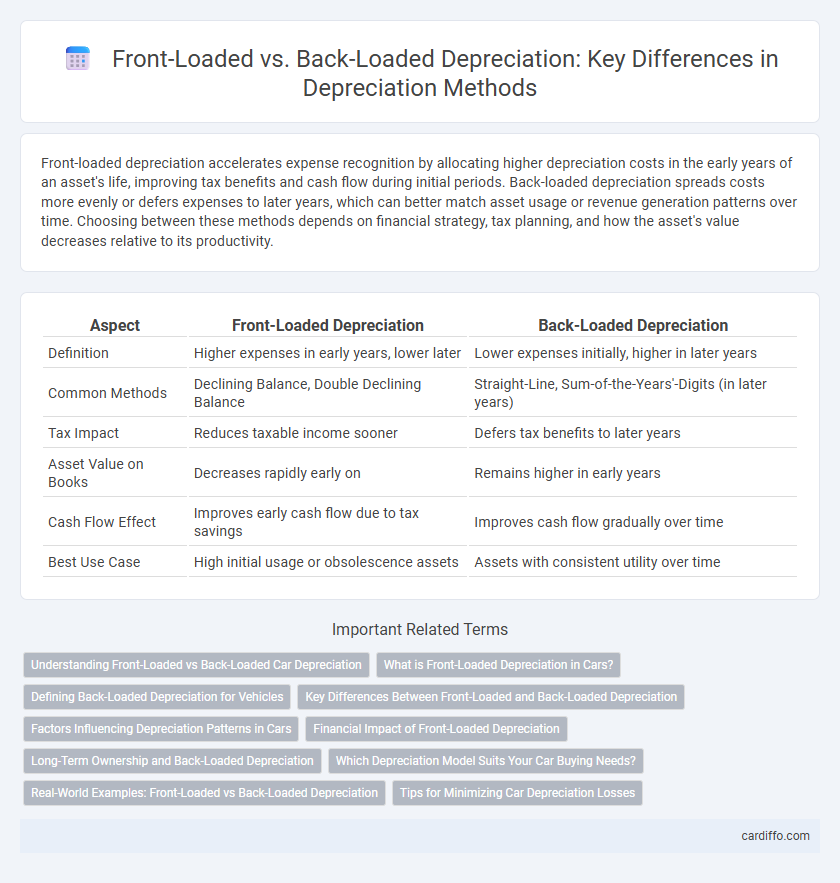

Front-loaded depreciation accelerates expense recognition by allocating higher depreciation costs in the early years of an asset's life, improving tax benefits and cash flow during initial periods. Back-loaded depreciation spreads costs more evenly or defers expenses to later years, which can better match asset usage or revenue generation patterns over time. Choosing between these methods depends on financial strategy, tax planning, and how the asset's value decreases relative to its productivity.

Table of Comparison

| Aspect | Front-Loaded Depreciation | Back-Loaded Depreciation |

|---|---|---|

| Definition | Higher expenses in early years, lower later | Lower expenses initially, higher in later years |

| Common Methods | Declining Balance, Double Declining Balance | Straight-Line, Sum-of-the-Years'-Digits (in later years) |

| Tax Impact | Reduces taxable income sooner | Defers tax benefits to later years |

| Asset Value on Books | Decreases rapidly early on | Remains higher in early years |

| Cash Flow Effect | Improves early cash flow due to tax savings | Improves cash flow gradually over time |

| Best Use Case | High initial usage or obsolescence assets | Assets with consistent utility over time |

Understanding Front-Loaded vs Back-Loaded Car Depreciation

Front-loaded car depreciation occurs when a vehicle loses a significant portion of its value early in its lifespan, often within the first few years of ownership, reducing resale value quickly. Back-loaded depreciation involves a slower initial decrease in value, with more substantial declines occurring later, allowing owners to retain more value upfront. Understanding these patterns helps consumers make informed decisions about vehicle purchase timing and total cost of ownership.

What is Front-Loaded Depreciation in Cars?

Front-loaded depreciation in cars refers to a method where the vehicle loses a significant portion of its value during the initial years of ownership, often due to rapid market value decline and higher depreciation rates. This type of depreciation is typical in new cars, with the most substantial loss occurring within the first two to three years. Understanding front-loaded depreciation helps buyers anticipate resale value and make informed decisions about vehicle purchases and ownership duration.

Defining Back-Loaded Depreciation for Vehicles

Back-loaded depreciation for vehicles allocates higher depreciation expenses in the later years of the asset's useful life, reflecting a slower loss of value initially. This method contrasts with front-loaded depreciation by minimizing early-year deductions and increasing them as the vehicle ages. It benefits businesses that expect lower maintenance costs initially and higher expenses as the vehicle grows older.

Key Differences Between Front-Loaded and Back-Loaded Depreciation

Front-loaded depreciation allocates higher expense amounts in the early years of an asset's life, accelerating tax benefits and matching higher initial usage or obsolescence rates, while back-loaded depreciation spreads costs more evenly or increases expenses in later years. Key differences include cash flow impact, with front-loaded methods improving early cash flow, and accounting precision, as front-loaded better reflects rapid value loss compared to the conservative pattern of back-loaded. Choice between the two depends on tax strategy, asset type, and financial reporting needs, often influenced by regulatory depreciation schedules like MACRS or straight-line methods.

Factors Influencing Depreciation Patterns in Cars

Depreciation patterns in cars are influenced by factors such as the vehicle's make and model, market demand, and expected usage over time, which often determine whether front-loaded or back-loaded depreciation is more applicable. Luxury and high-performance cars tend to experience front-loaded depreciation due to rapid initial value loss within the first few years of ownership. In contrast, economy cars and models with durable reputations may exhibit back-loaded depreciation, retaining value longer before experiencing steeper declines as they age.

Financial Impact of Front-Loaded Depreciation

Front-loaded depreciation results in higher expense recognition during the initial years of an asset's life, significantly reducing taxable income and improving early cash flow for businesses. This approach accelerates tax shield benefits and enhances financial flexibility in the short term, although it lowers reported profits in the early periods. Companies often prefer front-loaded depreciation to optimize tax savings and reinvestment opportunities during critical growth phases.

Long-Term Ownership and Back-Loaded Depreciation

Long-term ownership benefits significantly from back-loaded depreciation, as it allocates lower expenses in the initial years and higher depreciation costs toward the later stages of the asset's useful life. This approach aligns better with assets that appreciate or retain value over time, optimizing tax liabilities across the ownership period. Companies holding assets for extended durations leverage back-loaded depreciation to defer expenses and maximize net income in the early years.

Which Depreciation Model Suits Your Car Buying Needs?

Front-loaded depreciation accelerates expense recognition, offering greater tax benefits in the initial years of a car's ownership, ideal for businesses seeking immediate write-offs. Back-loaded depreciation spreads the cost more evenly over the asset's lifespan, benefiting those who prefer steadier expense allocation and potentially higher resale value. Evaluating your financial goals, tax situation, and vehicle usage will determine whether the aggressive front-loaded or the gradual back-loaded depreciation model best aligns with your car buying needs.

Real-World Examples: Front-Loaded vs Back-Loaded Depreciation

Front-loaded depreciation, exemplified by the double declining balance method often used in technology equipment, accelerates expense recognition, reflecting rapid asset value loss in early years. Back-loaded depreciation, common with real estate or heavy machinery using the straight-line method, spreads costs evenly, matching steady asset use and value retention over time. Companies choose front-loaded schedules for tax advantages and improved cash flow early in asset life, while back-loaded schedules suit assets with consistent utility and lower early maintenance costs.

Tips for Minimizing Car Depreciation Losses

Front-loaded depreciation accelerates the reduction of a car's book value early in its life, maximizing tax deductions but increasing initial losses if resold quickly. Back-loaded depreciation spreads the value loss more evenly, preserving higher resale value in the early years but offering lower immediate tax benefits. To minimize car depreciation losses, maintain regular servicing records, avoid excessive mileage, and consider vehicle makes with historically strong resale values.

Front-Loaded Depreciation vs Back-Loaded Depreciation Infographic

cardiffo.com

cardiffo.com