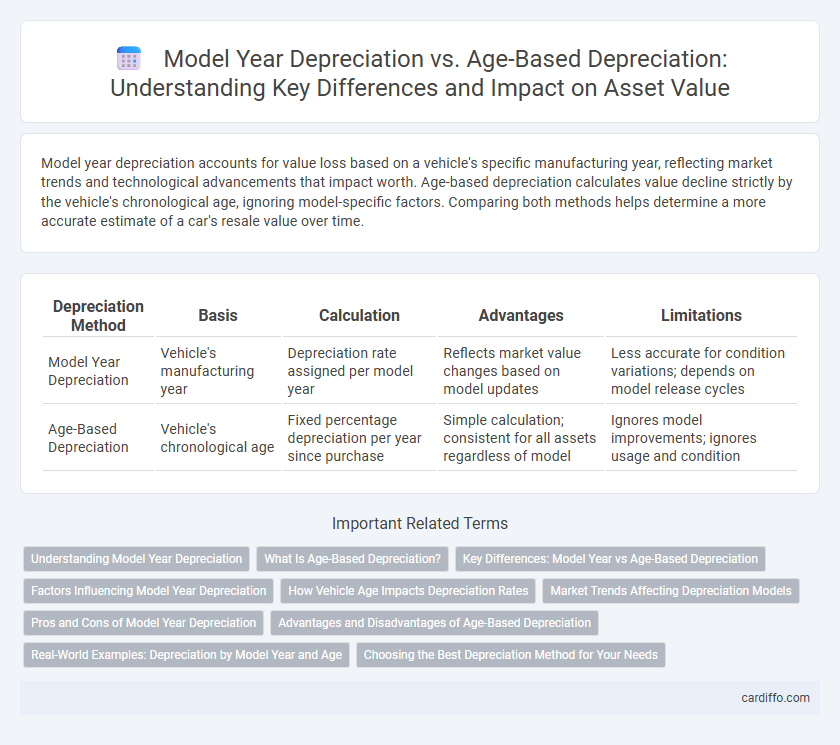

Model year depreciation accounts for value loss based on a vehicle's specific manufacturing year, reflecting market trends and technological advancements that impact worth. Age-based depreciation calculates value decline strictly by the vehicle's chronological age, ignoring model-specific factors. Comparing both methods helps determine a more accurate estimate of a car's resale value over time.

Table of Comparison

| Depreciation Method | Basis | Calculation | Advantages | Limitations |

|---|---|---|---|---|

| Model Year Depreciation | Vehicle's manufacturing year | Depreciation rate assigned per model year | Reflects market value changes based on model updates | Less accurate for condition variations; depends on model release cycles |

| Age-Based Depreciation | Vehicle's chronological age | Fixed percentage depreciation per year since purchase | Simple calculation; consistent for all assets regardless of model | Ignores model improvements; ignores usage and condition |

Understanding Model Year Depreciation

Model Year Depreciation calculates asset value loss based on the specific production year, reflecting market demand and technological advancements from that period. It often results in higher depreciation rates for older model years compared to age-based methods that evenly depreciate assets over time. Understanding this approach helps businesses align depreciation with actual market value fluctuations, improving financial accuracy and asset management.

What Is Age-Based Depreciation?

Age-based depreciation calculates asset value loss strictly according to the time elapsed since acquisition, without considering usage or model-specific factors. This method applies a fixed percentage or amount of depreciation per year, reflecting the asset's aging rather than technological changes or market demand. It is commonly used for accounting simplicity and in sectors where asset wear is primarily due to the passage of time.

Key Differences: Model Year vs Age-Based Depreciation

Model year depreciation calculates asset value reduction based on the specific year a model was manufactured, reflecting market demand and technological advances unique to that year. Age-based depreciation applies a uniform decline rate determined solely by the asset's chronological age, regardless of model or production variations. The key difference lies in model year depreciation capturing market-driven nuances, while age-based depreciation offers a straightforward, time-dependent valuation approach.

Factors Influencing Model Year Depreciation

Model Year Depreciation is influenced by factors such as technological advancements, changes in regulatory standards, and shifts in consumer preferences that differ significantly from traditional Age-Based Depreciation, which solely considers the vehicle's chronological age. Market trends, including new model releases and design improvements, accelerate the depreciation rate for vehicles from older model years even if their physical condition remains strong. Additionally, factors like warranty coverage and historical performance data impact the residual value tied specifically to the model year rather than the vehicle's total years in service.

How Vehicle Age Impacts Depreciation Rates

Vehicle age critically influences depreciation rates, with older vehicles typically experiencing slower value declines compared to newer models subject to model year depreciation. Model year depreciation reflects sharp value drops linked to new model releases and technological upgrades, while age-based depreciation follows a steadier decline tied to wear, mileage, and obsolescence. Understanding these distinctions allows more accurate vehicle valuation and better-informed decisions on buying or selling used cars.

Market Trends Affecting Depreciation Models

Model Year Depreciation reflects decreases in asset value based on the specific year of manufacture, heavily influenced by market demand for that year's features and technological advancements. Age-Based Depreciation depends on the chronological age of the asset, often following a standard percentage reduction irrespective of market fluctuations. Recent market trends show a growing preference for Model Year Depreciation due to rapid innovation cycles and consumer expectations, which challenge traditional Age-Based models by aligning valuation more closely with current market conditions and functionality.

Pros and Cons of Model Year Depreciation

Model Year Depreciation aligns asset value decline with the specific manufacturing year, offering precise tax benefits for businesses with assets from various production cycles. It allows for accelerated depreciation on newer models, potentially reducing taxable income more effectively than age-based methods. However, it can be complex to manage, requiring detailed record-keeping and may not reflect actual wear and tear compared to traditional age-based depreciation.

Advantages and Disadvantages of Age-Based Depreciation

Age-based depreciation offers simplicity and ease of calculation by allocating value loss evenly over an asset's useful life, making it ideal for straightforward accounting. However, it may not accurately reflect the actual wear and tear or market value changes, often leading to discrepancies in asset valuation. This method lacks responsiveness to technological advancements or varying usage patterns, potentially resulting in inefficient financial planning.

Real-World Examples: Depreciation by Model Year and Age

Model year depreciation often causes vehicles to lose significant value immediately after release, with new models typically depreciating 20-30% within the first year, as seen in popular cars like the Toyota Camry and Honda Civic. Age-based depreciation, by contrast, reflects gradual value loss over time due to wear and tear, averaging a 15% decline per year after the initial model year drop. Real-world data shows that while a 2022 Ford F-150 might depreciate sharply after release, its value stabilizes with age, unlike a 2015 Ford F-150, whose depreciation is more influenced by accumulated mileage and condition.

Choosing the Best Depreciation Method for Your Needs

Model Year Depreciation accounts for the vehicle's manufacturing year, resulting in accelerated value loss as newer models emerge, while Age-Based Depreciation calculates value decline strictly based on the asset's chronological age. Selecting the best depreciation method depends on factors such as asset type, usage patterns, and financial reporting needs, with Model Year Depreciation often favored for technology or vehicle assets prone to rapid obsolescence. Evaluating tax implications and asset market trends ensures alignment with business objectives and accurate expense matching.

Model Year Depreciation vs Age-Based Depreciation Infographic

cardiffo.com

cardiffo.com