Mileage-based depreciation calculates a vehicle's value loss primarily on the number of miles driven, reflecting wear and tear directly related to usage. Time-based depreciation, however, reduces value based on the vehicle's age regardless of how much it has been driven, accounting for factors like aging components and technological obsolescence. Choosing between these methods depends on whether usage intensity or ownership duration more accurately represents the car's decline in value.

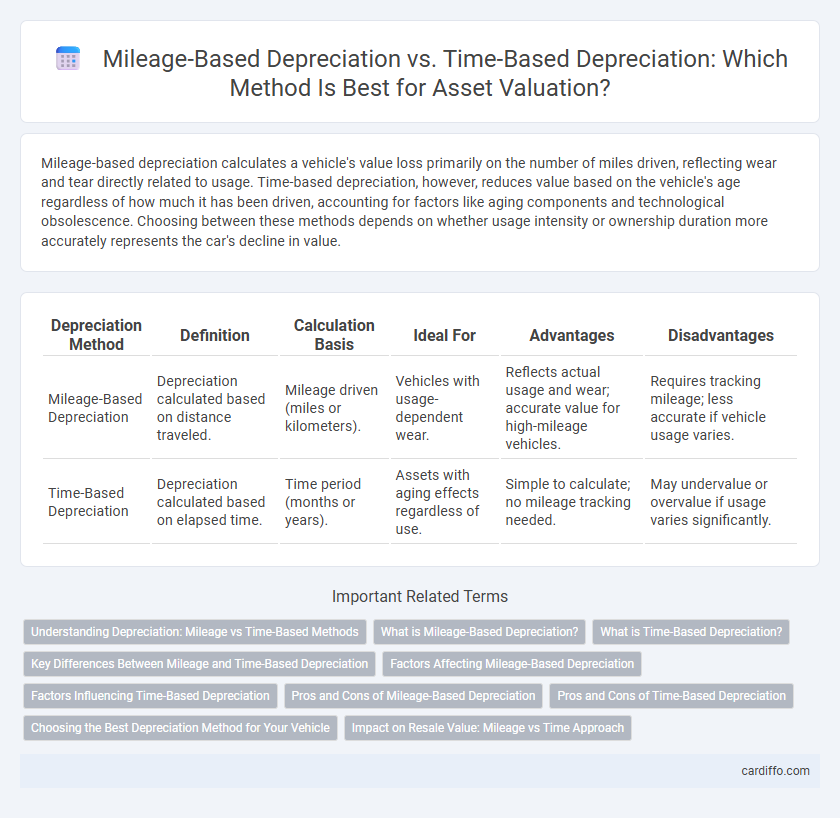

Table of Comparison

| Depreciation Method | Definition | Calculation Basis | Ideal For | Advantages | Disadvantages |

|---|---|---|---|---|---|

| Mileage-Based Depreciation | Depreciation calculated based on distance traveled. | Mileage driven (miles or kilometers). | Vehicles with usage-dependent wear. | Reflects actual usage and wear; accurate value for high-mileage vehicles. | Requires tracking mileage; less accurate if vehicle usage varies. |

| Time-Based Depreciation | Depreciation calculated based on elapsed time. | Time period (months or years). | Assets with aging effects regardless of use. | Simple to calculate; no mileage tracking needed. | May undervalue or overvalue if usage varies significantly. |

Understanding Depreciation: Mileage vs Time-Based Methods

Mileage-based depreciation calculates an asset's value reduction based on the actual distance traveled, providing a precise reflection of wear and tear, especially for vehicles. Time-based depreciation reduces value uniformly over a specified period, regardless of usage intensity, often used for accounting simplicity. Choosing between these methods depends on accurate asset usage tracking and the intended financial reporting purpose.

What is Mileage-Based Depreciation?

Mileage-based depreciation calculates a vehicle's loss in value based on the number of miles driven, reflecting wear and tear more accurately than simple chronological age. This method adjusts depreciation expenses according to actual usage, making it especially useful for fleet management and insurance assessments. By correlating depreciation with mileage, it provides a precise indicator of a car's market value over time.

What is Time-Based Depreciation?

Time-based depreciation calculates the reduction in an asset's value over a fixed period, regardless of usage. This method spreads the cost evenly across the asset's useful life, often using straight-line depreciation for simplicity. It is commonly applied to vehicles, machinery, and equipment where wear and tear correlates more directly with the passage of time than with mileage or usage.

Key Differences Between Mileage and Time-Based Depreciation

Mileage-based depreciation calculates asset value loss primarily on the distance traveled, making it ideal for vehicles or equipment with usage directly tied to mileage. Time-based depreciation allocates value reduction evenly over a predetermined period, suitable for assets whose wear and tear relate more to age than usage. The key difference lies in mileage depreciation reflecting actual wear dependent on usage, while time-based depreciation assumes consistent value decline regardless of activity.

Factors Affecting Mileage-Based Depreciation

Mileage-based depreciation is primarily influenced by factors such as annual mileage, vehicle usage patterns, and driving conditions, which directly accelerate the wear and tear of the car's components. Higher mileage typically leads to increased mechanical degradation, reducing resale value more rapidly compared to time-based depreciation. Environmental conditions like urban stop-and-go traffic or highway driving also significantly impact the rate of mileage-based depreciation by affecting engine and transmission longevity.

Factors Influencing Time-Based Depreciation

Factors influencing time-based depreciation include the vehicle's age, wear and tear from environmental exposure, and advancements in automotive technology that reduce a car's value over time. Regular maintenance and storage conditions also significantly impact the rate at which depreciation occurs. Unlike mileage-based depreciation, time-based depreciation primarily reflects the passage of time regardless of the car's actual usage.

Pros and Cons of Mileage-Based Depreciation

Mileage-based depreciation offers a precise reflection of vehicle wear and tear by accounting for actual usage, making it highly accurate for determining resale value. It can incentivize lower mileage, preserving vehicle condition, but requires diligent tracking, potentially leading to administrative burdens. This method may undervalue vehicles used less frequently but over longer periods, neglecting factors like age-related deterioration.

Pros and Cons of Time-Based Depreciation

Time-based depreciation offers straightforward and predictable expense allocation over an asset's useful life, simplifying accounting and budgeting processes. However, it may not accurately reflect the actual wear and tear if asset usage varies significantly, potentially leading to under- or over-depreciation in a given period. This method is less effective for assets with fluctuating activity, where mileage-based depreciation can better match depreciation expense with asset usage.

Choosing the Best Depreciation Method for Your Vehicle

Mileage-based depreciation aligns closely with actual vehicle usage, allowing owners to account for wear and tear based on miles driven, which often results in a more accurate reflection of a car's value. Time-based depreciation calculates value loss over a fixed period regardless of mileage, offering simplicity but potentially mismatching the vehicle's true condition if driven more or less than average. Selecting the ideal depreciation method depends on individual driving habits and how precisely one wants to match depreciation to the vehicle's actual usage and aging factors.

Impact on Resale Value: Mileage vs Time Approach

Mileage-based depreciation directly correlates with a vehicle's usage, typically reducing resale value more significantly when high mileage accumulates, as wear-and-tear increases. Time-based depreciation decreases value steadily over the vehicle's age, regardless of usage, impacting resale value through perceived obsolescence and aging components. Resale value tends to be higher for low-mileage vehicles under mileage-based methods, whereas time-based depreciation can undervalue gently used vehicles with minimal miles.

Mileage-Based Depreciation vs Time-Based Depreciation Infographic

cardiffo.com

cardiffo.com