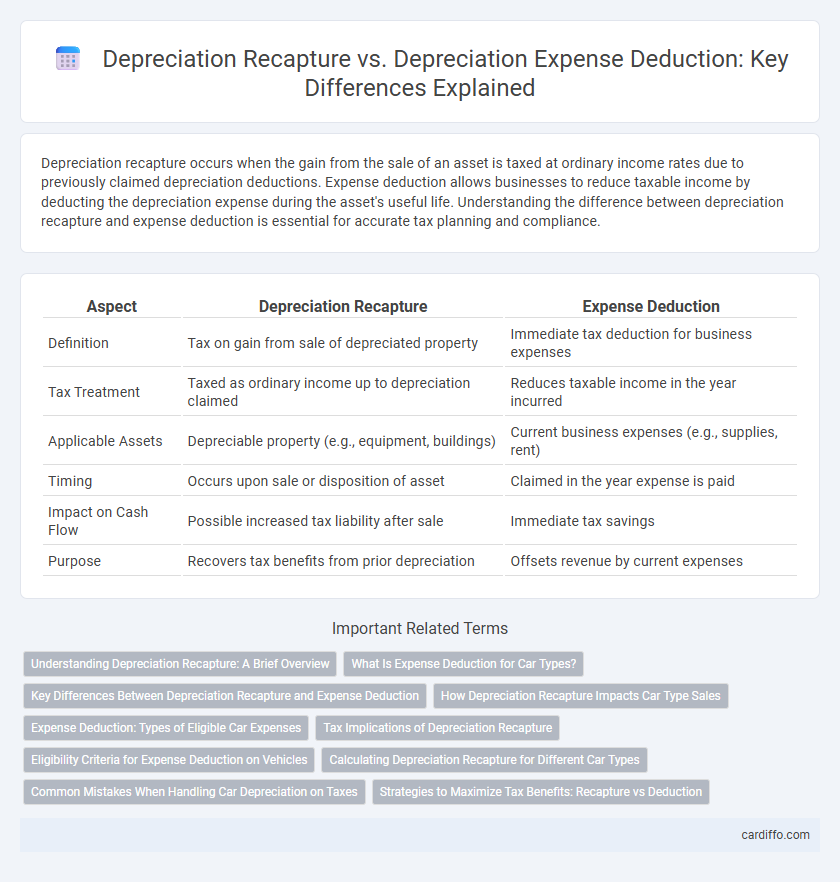

Depreciation recapture occurs when the gain from the sale of an asset is taxed at ordinary income rates due to previously claimed depreciation deductions. Expense deduction allows businesses to reduce taxable income by deducting the depreciation expense during the asset's useful life. Understanding the difference between depreciation recapture and expense deduction is essential for accurate tax planning and compliance.

Table of Comparison

| Aspect | Depreciation Recapture | Expense Deduction |

|---|---|---|

| Definition | Tax on gain from sale of depreciated property | Immediate tax deduction for business expenses |

| Tax Treatment | Taxed as ordinary income up to depreciation claimed | Reduces taxable income in the year incurred |

| Applicable Assets | Depreciable property (e.g., equipment, buildings) | Current business expenses (e.g., supplies, rent) |

| Timing | Occurs upon sale or disposition of asset | Claimed in the year expense is paid |

| Impact on Cash Flow | Possible increased tax liability after sale | Immediate tax savings |

| Purpose | Recovers tax benefits from prior depreciation | Offsets revenue by current expenses |

Understanding Depreciation Recapture: A Brief Overview

Depreciation recapture occurs when the sale of an asset results in taxable income due to the recovery of previously claimed depreciation deductions. This recaptured amount is taxed at ordinary income tax rates, differentiating it from the initial depreciation expense deduction that reduces taxable income over the asset's useful life. Understanding depreciation recapture is essential for accurately assessing the tax implications of selling depreciated property and maximizing tax planning strategies.

What Is Expense Deduction for Car Types?

Expense deduction for car types allows businesses to write off the cost of vehicle expenses such as fuel, maintenance, and depreciation used for business purposes. The IRS offers standard mileage rates or actual expense methods to calculate deductible amounts, with specific limits applied depending on the vehicle type and usage. Unlike depreciation recapture, which applies when a depreciated asset is sold for a gain, expense deductions reduce taxable income based on the operational costs incurred during business use of the car.

Key Differences Between Depreciation Recapture and Expense Deduction

Depreciation recapture occurs when the sale of an asset exceeds its depreciated value, triggering taxable income based on prior depreciation deductions, while expense deduction allows for the gradual reduction of taxable income during the asset's useful life. Depreciation expense lowers taxable income annually by allocating the asset's cost over time, but recapture results in a tax liability upon asset disposition. Key differences include timing, tax treatment, and impact on cash flow, with expense deduction providing ongoing tax benefits and recapture creating a potential tax burden at sale.

How Depreciation Recapture Impacts Car Type Sales

Depreciation recapture significantly affects car type sales by increasing the taxable gain when a vehicle is sold for more than its depreciated value, which applies primarily to business or investment vehicles. Unlike standard expense deductions that reduce taxable income annually, depreciation recapture requires paying taxes on the accumulated depreciation once the vehicle is sold. This tax impact can influence sellers to strategically time sales or choose car types that minimize recapture liabilities, especially in commercial fleets or luxury car markets.

Expense Deduction: Types of Eligible Car Expenses

Eligible car expenses for depreciation deduction include costs such as lease payments, fuel, maintenance, repairs, insurance, registration fees, and parking. The IRS allows taxpayers to deduct either the actual expenses incurred or use the standard mileage rate, which simplifies record-keeping while still providing tax benefits. Proper documentation of business use percentage is essential to accurately calculate deductible car expenses under expense deduction rules.

Tax Implications of Depreciation Recapture

Depreciation recapture triggers a taxable event where previously claimed depreciation deductions are subject to ordinary income tax rates upon asset sale, contrasting with the upfront tax benefits of expense deduction. This recapture can significantly increase the tax liability, often outweighing the initial tax relief gained during asset ownership. Understanding the tax implications of depreciation recapture is crucial for strategic tax planning and minimizing unexpected post-sale tax burdens.

Eligibility Criteria for Expense Deduction on Vehicles

Expense deduction eligibility for vehicles requires the asset to be used more than 50% for business purposes, with strict records proving mileage and use. Depreciation recapture applies when a vehicle is sold for more than its depreciated value, affecting overall tax obligations. Maintaining detailed logs ensures compliance and maximizes allowable expense deductions.

Calculating Depreciation Recapture for Different Car Types

Calculating depreciation recapture for different car types involves identifying the asset's adjusted basis and the total depreciation claimed during ownership. Passenger vehicles typically have distinct depreciation limits under IRS Section 280F, affecting the recapture amount when sold or disposed of. Heavy SUVs and trucks may allow larger depreciation deductions, leading to increased recapture income compared to passenger cars.

Common Mistakes When Handling Car Depreciation on Taxes

Misclassifying depreciation recapture as a routine expense deduction on car taxes leads to incorrect tax liability, resulting in potential audits and penalties. Many taxpayers mistakenly apply standard expense deduction rules to vehicles subject to depreciation recapture, ignoring the requirement to report recapture income upon sale. Proper documentation and understanding IRS guidelines for Section 1245 property are crucial to avoid these costly errors.

Strategies to Maximize Tax Benefits: Recapture vs Deduction

Maximizing tax benefits requires understanding the distinction between depreciation recapture and expense deduction. Strategic expense deduction accelerates tax relief by reducing taxable income annually, while managing potential depreciation recapture during asset sale minimizes unexpected tax liabilities. Employing cost segregation studies and timing asset disposals carefully optimizes deductions and recapture recognition for long-term tax efficiency.

Depreciation Recapture vs Expense Deduction Infographic

cardiffo.com

cardiffo.com