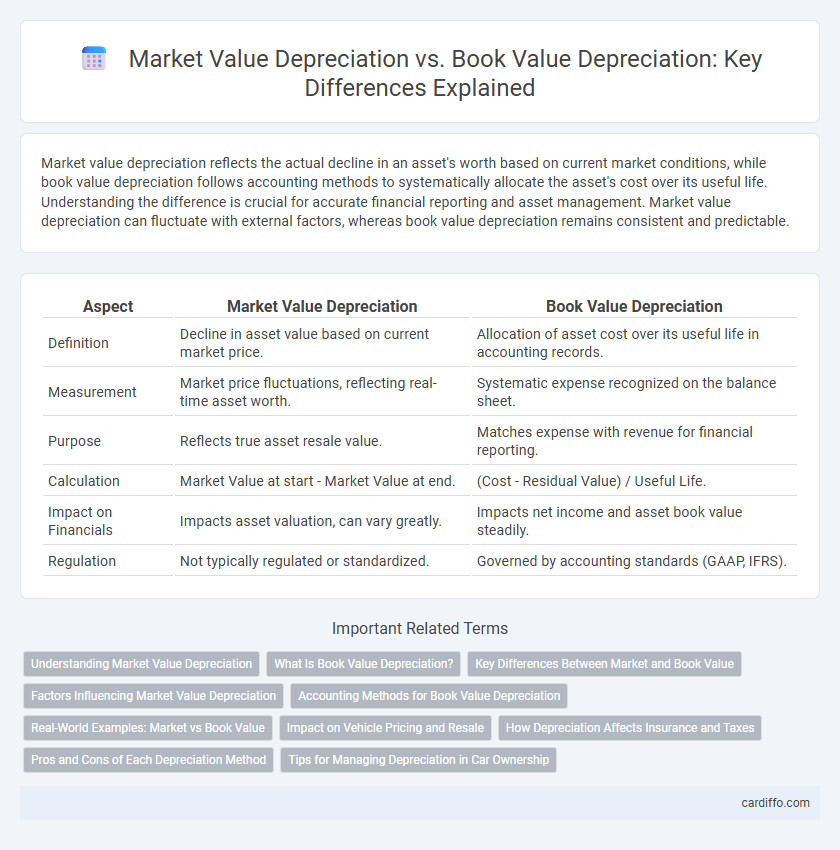

Market value depreciation reflects the actual decline in an asset's worth based on current market conditions, while book value depreciation follows accounting methods to systematically allocate the asset's cost over its useful life. Understanding the difference is crucial for accurate financial reporting and asset management. Market value depreciation can fluctuate with external factors, whereas book value depreciation remains consistent and predictable.

Table of Comparison

| Aspect | Market Value Depreciation | Book Value Depreciation |

|---|---|---|

| Definition | Decline in asset value based on current market price. | Allocation of asset cost over its useful life in accounting records. |

| Measurement | Market price fluctuations, reflecting real-time asset worth. | Systematic expense recognized on the balance sheet. |

| Purpose | Reflects true asset resale value. | Matches expense with revenue for financial reporting. |

| Calculation | Market Value at start - Market Value at end. | (Cost - Residual Value) / Useful Life. |

| Impact on Financials | Impacts asset valuation, can vary greatly. | Impacts net income and asset book value steadily. |

| Regulation | Not typically regulated or standardized. | Governed by accounting standards (GAAP, IFRS). |

Understanding Market Value Depreciation

Market value depreciation reflects the actual decline in an asset's worth based on current market conditions, unlike book value depreciation, which follows a predetermined accounting schedule. Understanding market value depreciation is crucial for investors and asset managers because it provides a realistic estimate of an asset's resale value and economic performance. This form of depreciation captures external factors such as demand fluctuations, technological advancements, and economic changes that book value depreciation may overlook.

What Is Book Value Depreciation?

Book value depreciation represents the reduction of an asset's carrying amount on the balance sheet over its useful life, reflecting the systematic allocation of the asset's cost minus accumulated depreciation. It is calculated based on accounting principles such as straight-line, declining balance, or units of production methods, aiming to match expense recognition with revenue generation. Unlike market value depreciation, which fluctuates with external market conditions, book value depreciation strictly follows historical cost and accounting policies.

Key Differences Between Market and Book Value

Market value depreciation reflects the current price a depreciated asset can fetch in the open market, influenced by supply, demand, and asset condition. Book value depreciation records the asset's cost minus accumulated depreciation based on accounting methods, reflecting the asset's value on financial statements. Key differences lie in market value being dynamic and external, while book value is systematic, historical, and internal to the company's accounting records.

Factors Influencing Market Value Depreciation

Market value depreciation is primarily influenced by external factors such as market demand fluctuations, economic conditions, and technological advancements that can render assets obsolete more quickly. Environmental impacts, regulatory changes, and shifts in consumer preferences also play significant roles in accelerating the decline of an asset's market value. These factors contrast with book value depreciation, which is based on systematic accounting methods rather than real-time market dynamics.

Accounting Methods for Book Value Depreciation

Book value depreciation utilizes systematic accounting methods such as straight-line, declining balance, and units of production to allocate asset costs over their useful lives, ensuring accurate financial reporting. These methods follow Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) to reflect asset value reduction in balance sheets. Market value depreciation, contrastingly, is influenced by external factors like market demand and asset condition, and it is not typically recorded in accounting books but considered for investment decisions.

Real-World Examples: Market vs Book Value

Market value depreciation reflects the actual decline in an asset's resale price, such as a vehicle losing 25% of its value within the first year due to wear and market demand fluctuations. Book value depreciation uses systematic accounting methods like straight-line or declining balance to allocate an asset's cost over its useful life, often not aligning with the real-time market conditions. Real-world examples show cars and electronics frequently exhibit higher market value depreciation compared to book value, impacting decisions in asset replacement and insurance claims.

Impact on Vehicle Pricing and Resale

Market value depreciation reflects the actual decline in a vehicle's worth based on current market conditions, directly influencing resale price and buyer demand. Book value depreciation represents the systematic allocation of the vehicle's cost over time on financial statements, often differing from market realities. The disparity between market and book value depreciation impacts pricing strategies and can lead to significant variations in resale valuation.

How Depreciation Affects Insurance and Taxes

Market value depreciation reflects the asset's current resale value, which influences insurance premiums by adjusting coverage to actual worth, while book value depreciation, based on accounting schedules, impacts tax deductions by reducing taxable income through systematic expense recognition. Insurance claims often consider market value depreciation to determine the payout amount after asset damage or loss, ensuring indemnity aligns with real-time asset worth. Tax authorities rely on book value depreciation methods, such as straight-line or declining balance, to standardize expense reporting and regulate taxable profit margins consistently.

Pros and Cons of Each Depreciation Method

Market value depreciation reflects the asset's current resale price, offering a realistic and dynamic assessment but can lead to fluctuating financial statements and is less predictable for budgeting. Book value depreciation allocates cost evenly over an asset's useful life, providing consistency and simplicity in accounting, yet may not accurately reflect the asset's present market worth or economic condition. Choosing between these methods depends on the need for accurate market representation versus stability and ease of financial planning.

Tips for Managing Depreciation in Car Ownership

Understanding market value depreciation versus book value depreciation helps car owners make informed decisions about vehicle maintenance and resale timing. Market value depreciation reflects the actual resale price decline due to demand and condition, while book value depreciation accounts for the vehicle's recorded cost and usage over time. Regular maintenance, timely repairs, and monitoring market trends can mitigate losses and optimize the car's retained value throughout ownership.

Market Value Depreciation vs Book Value Depreciation Infographic

cardiffo.com

cardiffo.com