Tax depreciation and accounting depreciation differ primarily in their purpose and methods; tax depreciation is designed to reduce taxable income by spreading the cost of an asset over its useful life according to tax laws, often using accelerated methods. In contrast, accounting depreciation aims to match the expense with the asset's actual usage and wear for accurate financial reporting, typically following straight-line or other systematic approaches. Understanding these differences is crucial for businesses to optimize tax benefits while maintaining transparent financial statements.

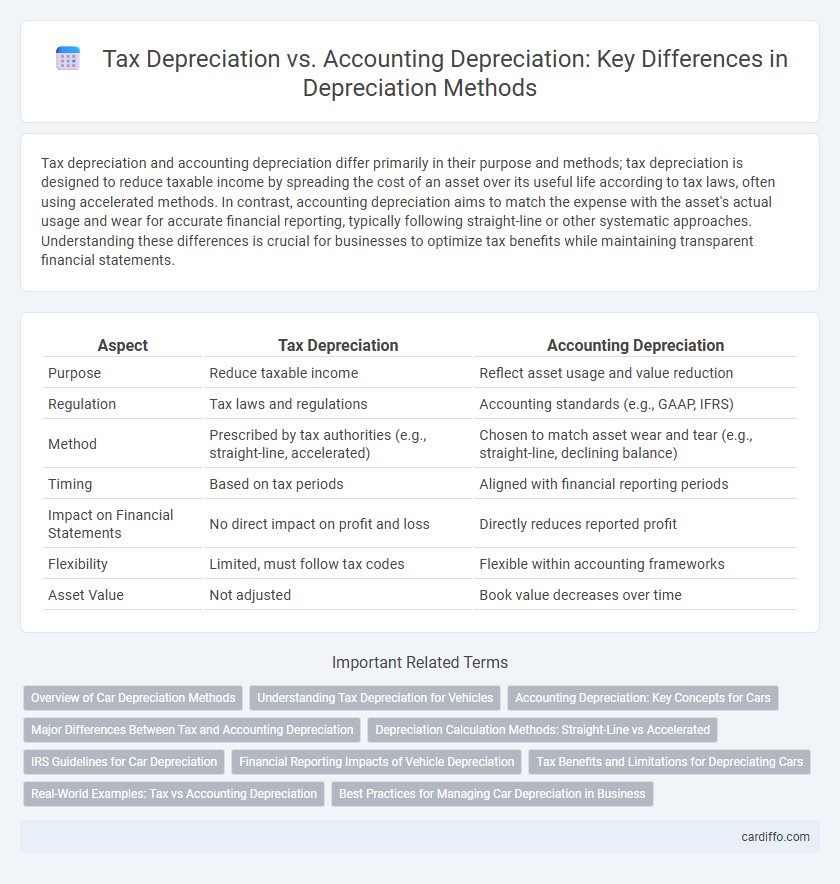

Table of Comparison

| Aspect | Tax Depreciation | Accounting Depreciation |

|---|---|---|

| Purpose | Reduce taxable income | Reflect asset usage and value reduction |

| Regulation | Tax laws and regulations | Accounting standards (e.g., GAAP, IFRS) |

| Method | Prescribed by tax authorities (e.g., straight-line, accelerated) | Chosen to match asset wear and tear (e.g., straight-line, declining balance) |

| Timing | Based on tax periods | Aligned with financial reporting periods |

| Impact on Financial Statements | No direct impact on profit and loss | Directly reduces reported profit |

| Flexibility | Limited, must follow tax codes | Flexible within accounting frameworks |

| Asset Value | Not adjusted | Book value decreases over time |

Overview of Car Depreciation Methods

Tax depreciation and accounting depreciation for vehicles use different methods reflecting regulatory and financial reporting goals. Tax depreciation often follows the Modified Accelerated Cost Recovery System (MACRS), allowing accelerated write-offs to reduce taxable income, whereas accounting depreciation typically employs the straight-line method for consistent expense recognition. Understanding these differences is crucial for accurate financial planning and compliance in car asset management.

Understanding Tax Depreciation for Vehicles

Tax depreciation for vehicles allows businesses to deduct the cost of a vehicle over its useful life according to specific IRS guidelines, often using methods like the Modified Accelerated Cost Recovery System (MACRS). This method differs from accounting depreciation, which follows Generally Accepted Accounting Principles (GAAP) and aims to match expenses with revenues for financial reporting. Understanding tax depreciation ensures accurate deduction claims, reduces taxable income, and complies with the IRS rules on vehicle usage and classification.

Accounting Depreciation: Key Concepts for Cars

Accounting depreciation for cars involves systematically allocating the vehicle's cost over its useful life to reflect wear and tear, usage, and obsolescence. Common methods include straight-line depreciation, where expense is evenly spread, and diminishing balance, which accelerates depreciation in earlier years. Accurate accounting depreciation enhances financial reporting by matching expenses to revenue periods and providing realistic asset values on balance sheets.

Major Differences Between Tax and Accounting Depreciation

Tax depreciation and accounting depreciation differ primarily in purpose and method; tax depreciation is designed to reduce taxable income based on government-approved schedules, often accelerating deductions to provide tax benefits. Accounting depreciation aims to allocate the cost of an asset over its useful life for accurate financial reporting, following standards like GAAP or IFRS. The major differences include varying asset lifespans, depreciation methods allowed, and timing of expense recognition, impacting both tax liabilities and financial statements.

Depreciation Calculation Methods: Straight-Line vs Accelerated

Tax depreciation methods primarily include accelerated depreciation techniques such as MACRS, which allow higher expense deductions in the early years of an asset's life, reducing taxable income more rapidly. Accounting depreciation often uses the straight-line method, spreading the cost evenly over the asset's useful life for consistent expense recognition. The choice between straight-line and accelerated methods impacts financial statements differently, with tax depreciation focusing on tax benefits and accounting depreciation emphasizing accurate profit measurement.

IRS Guidelines for Car Depreciation

Tax depreciation for vehicles follows IRS guidelines closely, allowing businesses to deduct the cost of a car used for business purposes through methods such as the Modified Accelerated Cost Recovery System (MACRS). Accounting depreciation, by contrast, is based on estimated useful life and matching expenses to revenue, often utilizing straight-line or accelerated methods for financial reporting. The IRS limits depreciation deductions on passenger vehicles under the luxury auto limits, which can affect the total amount deductible annually for tax purposes.

Financial Reporting Impacts of Vehicle Depreciation

Tax depreciation and accounting depreciation methods for vehicles differ significantly, impacting financial reporting by altering net income and asset values. Tax depreciation often uses accelerated methods like the Modified Accelerated Cost Recovery System (MACRS), reducing taxable income quicker, while accounting depreciation typically employs straight-line methods to evenly allocate vehicle costs over useful life. These variations affect key financial metrics, influencing investor perceptions, tax liabilities, and compliance with accounting standards such as GAAP or IFRS.

Tax Benefits and Limitations for Depreciating Cars

Tax depreciation allows businesses to reduce taxable income by writing off the cost of cars, following specific IRS guidelines such as Section 179 and bonus depreciation, which can accelerate deductions. Accounting depreciation, based on GAAP, spreads the cost of a vehicle evenly over its useful life to match expenses with revenue, offering less immediate tax relief. Limitations on tax depreciation for cars include luxury auto limits and strict mileage or usage documentation requirements, restricting the total deductible amount and ensuring compliance with tax laws.

Real-World Examples: Tax vs Accounting Depreciation

Tax depreciation follows government regulations such as the Modified Accelerated Cost Recovery System (MACRS) in the United States, allowing businesses to deduct asset costs faster for tax benefits. Accounting depreciation, on the other hand, uses methods like straight-line or declining balance based on the asset's useful life and matching expenses to revenues. For example, a company might use MACRS to reduce taxable income quickly while reporting straight-line depreciation on financial statements for investor transparency.

Best Practices for Managing Car Depreciation in Business

Tax depreciation follows specific IRS guidelines to maximize allowable deductions over a vehicle's useful life, while accounting depreciation uses standard methods like straight-line or declining balance to reflect true asset value on financial statements. Best practices for managing car depreciation in business include maintaining detailed mileage and usage records to justify expense claims, selecting the appropriate depreciation method aligned with tax benefits and financial reporting needs, and regularly reviewing asset valuations to optimize tax savings and reporting accuracy. Tracking maintenance costs alongside depreciation ensures comprehensive cost management and improves decision-making regarding fleet replacement timing.

Tax Depreciation vs Accounting Depreciation Infographic

cardiffo.com

cardiffo.com