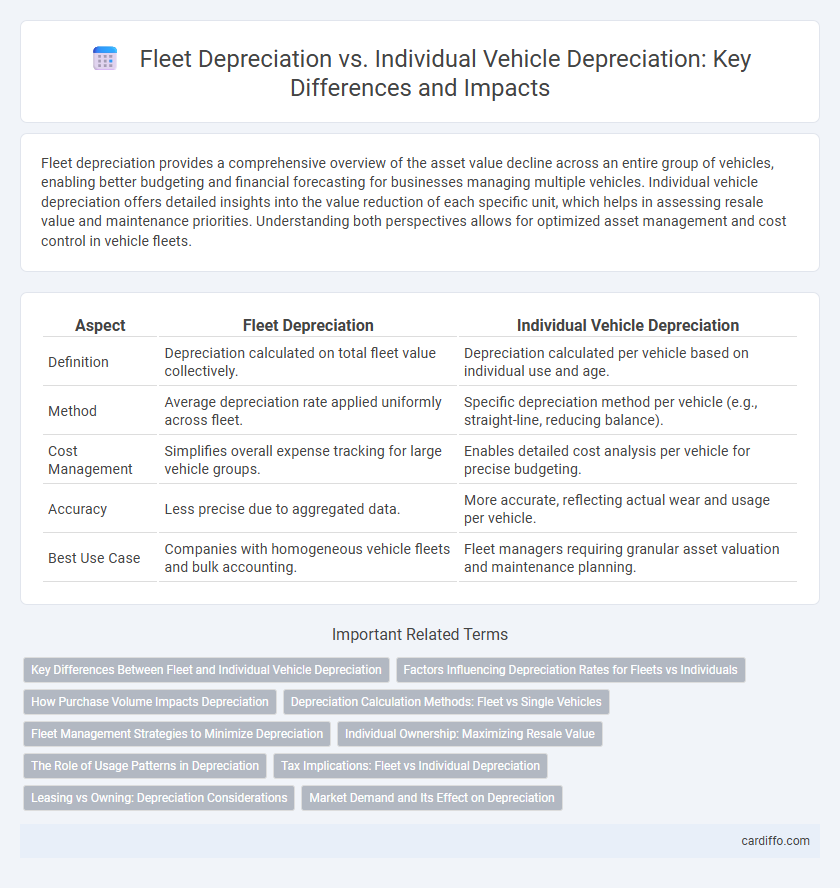

Fleet depreciation provides a comprehensive overview of the asset value decline across an entire group of vehicles, enabling better budgeting and financial forecasting for businesses managing multiple vehicles. Individual vehicle depreciation offers detailed insights into the value reduction of each specific unit, which helps in assessing resale value and maintenance priorities. Understanding both perspectives allows for optimized asset management and cost control in vehicle fleets.

Table of Comparison

| Aspect | Fleet Depreciation | Individual Vehicle Depreciation |

|---|---|---|

| Definition | Depreciation calculated on total fleet value collectively. | Depreciation calculated per vehicle based on individual use and age. |

| Method | Average depreciation rate applied uniformly across fleet. | Specific depreciation method per vehicle (e.g., straight-line, reducing balance). |

| Cost Management | Simplifies overall expense tracking for large vehicle groups. | Enables detailed cost analysis per vehicle for precise budgeting. |

| Accuracy | Less precise due to aggregated data. | More accurate, reflecting actual wear and usage per vehicle. |

| Best Use Case | Companies with homogeneous vehicle fleets and bulk accounting. | Fleet managers requiring granular asset valuation and maintenance planning. |

Key Differences Between Fleet and Individual Vehicle Depreciation

Fleet depreciation aggregates the loss in value of multiple vehicles over time, offering a comprehensive overview that smooths out individual variances and simplifies accounting for businesses managing numerous assets. Individual vehicle depreciation tracks the value decline of a single vehicle, providing precise data tailored to its unique usage, condition, and maintenance history. The key differences lie in scale, reporting granularity, and the ability to leverage bulk purchasing or maintenance efficiencies in fleet management versus the detailed, specific asset management required for individual vehicles.

Factors Influencing Depreciation Rates for Fleets vs Individuals

Fleet depreciation rates are influenced by factors such as bulk purchase discounts, standardized maintenance schedules, and uniform usage patterns, which often lead to more predictable value loss compared to individual vehicles. Individual vehicle depreciation varies widely based on factors like personalized maintenance, usage intensity, and market demand for specific models or conditions. Economic considerations, mileage accumulation, and vehicle age impact both fleet and individual depreciation but manifest differently due to scale and operational consistency.

How Purchase Volume Impacts Depreciation

Purchase volume directly influences fleet depreciation by enabling bulk acquisition discounts and uniform maintenance schedules, which reduce overall depreciation rates. Individual vehicle depreciation varies more significantly due to factors such as model, usage, and condition, lacking the economies of scale seen in fleet purchases. Higher purchase volumes leverage negotiating power with suppliers and service providers, lowering per-unit depreciation costs compared to isolated vehicle acquisitions.

Depreciation Calculation Methods: Fleet vs Single Vehicles

Fleet depreciation calculation leverages collective metrics such as average usage, total mileage, and aggregate operational hours, enabling streamlined and consistent valuation across multiple vehicles. Individual vehicle depreciation focuses on specific factors like unique usage patterns, maintenance history, and condition, resulting in a more precise but time-intensive valuation. Utilizing fleet methods reduces administrative overhead, whereas single vehicle calculations provide granular accuracy essential for high-value or specialized assets.

Fleet Management Strategies to Minimize Depreciation

Fleet depreciation management leverages collective data analytics to optimize replacement cycles, reducing overall asset value loss compared to individual vehicle depreciation tracking. Employing standardized maintenance schedules and bulk procurement strategies enhances fleet-wide residual values while minimizing downtime costs. Integrating telematics and predictive analytics empowers proactive decisions, ensuring maximum return on investment across all fleet assets.

Individual Ownership: Maximizing Resale Value

Individual vehicle depreciation can be managed more effectively by tailoring maintenance and usage patterns to each vehicle's specific condition and market demand, maximizing resale value. Tracking depreciation at the individual vehicle level allows owners to identify optimal selling times based on mileage, age, and market trends. Personalized care strategies and timely upgrades or repairs help preserve asset value, unlike fleet depreciation that averages costs across multiple vehicles.

The Role of Usage Patterns in Depreciation

Fleet depreciation reflects aggregate wear and tear, often averaging usage patterns across multiple vehicles to determine overall value loss. Individual vehicle depreciation accounts for specific usage behaviors, such as mileage, driving conditions, and maintenance, which directly influence its residual value. Analyzing detailed usage data enables more accurate depreciation models, optimizing asset management and cost forecasting.

Tax Implications: Fleet vs Individual Depreciation

Fleet depreciation allows businesses to aggregate vehicle costs for tax purposes, enabling simplified accounting and potentially higher overall deductions in a fiscal year. Individual vehicle depreciation requires tracking each asset separately, which can limit immediate tax benefits but provides precise expense matching for each vehicle's use and wear. Tax regulations often favor fleet depreciation for commercial operators seeking streamlined compliance and optimized cash flow management.

Leasing vs Owning: Depreciation Considerations

Fleet depreciation allows businesses to spread the cost of asset value decline across multiple vehicles, optimizing tax benefits and cash flow management compared to individual vehicle depreciation. Leasing typically shifts depreciation risk to the lessor, making it a cost-effective solution for companies prioritizing predictable expenses, while owning requires direct handling of depreciation expenses and potential resale value fluctuations. Understanding whether to lease or own hinges on analyzing total depreciation impact, operational flexibility, and financial strategies related to asset management.

Market Demand and Its Effect on Depreciation

Market demand significantly influences fleet depreciation, where a high demand for specific vehicle types can slow overall fleet value decline. Individual vehicle depreciation is more sensitive to localized market trends and consumer preferences, impacting resale value distinctly from broader fleet averages. Understanding these demand dynamics enables more accurate forecasting of depreciation rates for both fleets and single vehicles.

Fleet Depreciation vs Individual Vehicle Depreciation Infographic

cardiffo.com

cardiffo.com