MACRS depreciation accelerates asset cost recovery by applying predetermined rates over specific recovery periods, favoring tax benefits in early years. Double Declining Balance (DDB) method calculates depreciation based on twice the straight-line rate, resulting in higher expenses initially that gradually decrease. While MACRS is standardized for tax purposes, DDB offers flexibility but may require switching to straight-line to maximize deductions over an asset's useful life.

Table of Comparison

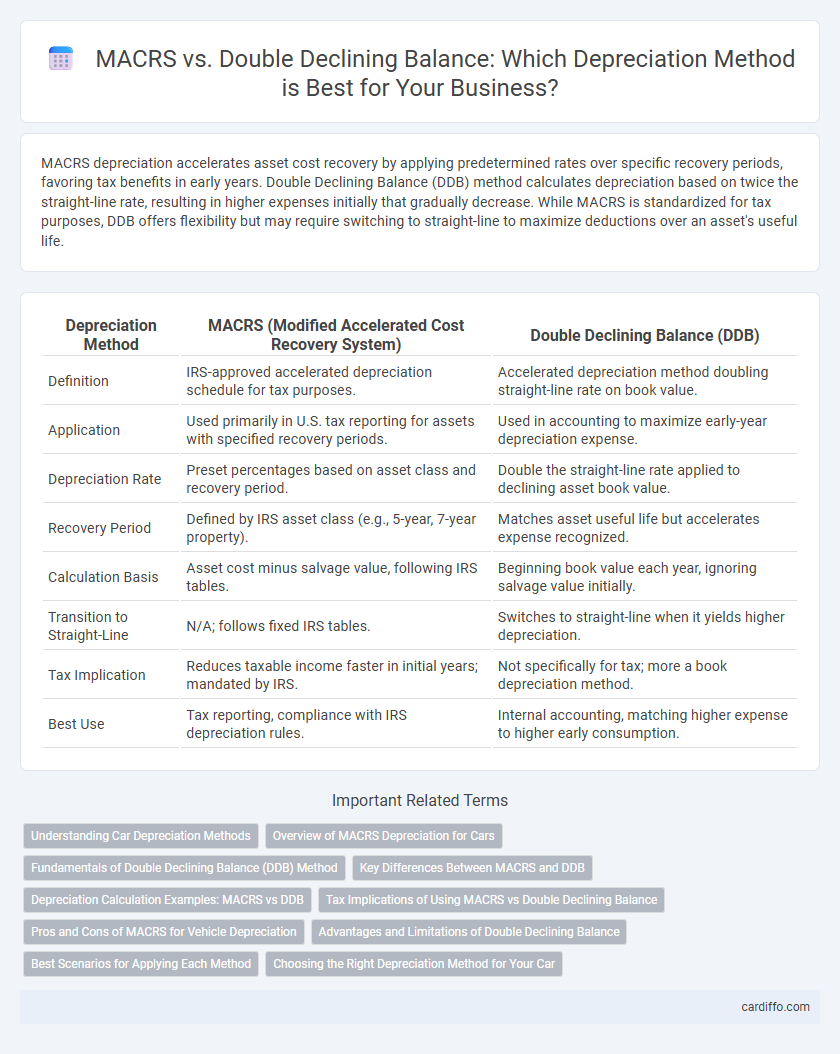

| Depreciation Method | MACRS (Modified Accelerated Cost Recovery System) | Double Declining Balance (DDB) |

|---|---|---|

| Definition | IRS-approved accelerated depreciation schedule for tax purposes. | Accelerated depreciation method doubling straight-line rate on book value. |

| Application | Used primarily in U.S. tax reporting for assets with specified recovery periods. | Used in accounting to maximize early-year depreciation expense. |

| Depreciation Rate | Preset percentages based on asset class and recovery period. | Double the straight-line rate applied to declining asset book value. |

| Recovery Period | Defined by IRS asset class (e.g., 5-year, 7-year property). | Matches asset useful life but accelerates expense recognized. |

| Calculation Basis | Asset cost minus salvage value, following IRS tables. | Beginning book value each year, ignoring salvage value initially. |

| Transition to Straight-Line | N/A; follows fixed IRS tables. | Switches to straight-line when it yields higher depreciation. |

| Tax Implication | Reduces taxable income faster in initial years; mandated by IRS. | Not specifically for tax; more a book depreciation method. |

| Best Use | Tax reporting, compliance with IRS depreciation rules. | Internal accounting, matching higher expense to higher early consumption. |

Understanding Car Depreciation Methods

MACRS (Modified Accelerated Cost Recovery System) offers a structured depreciation schedule set by the IRS, allowing for faster asset write-offs within defined recovery periods, while the Double Declining Balance method accelerates depreciation by applying twice the straight-line rate to the declining book value annually. Understanding car depreciation methods involves recognizing that MACRS typically applies to business vehicles for tax benefits, whereas Double Declining Balance reflects real-time asset value reduction more dynamically. Selecting the appropriate method affects the timing and amount of depreciation expenses recorded, impacting tax liabilities and financial reporting accuracy.

Overview of MACRS Depreciation for Cars

MACRS depreciation for cars allows businesses to recover the vehicle's cost through predetermined recovery periods defined by the IRS, typically five years for passenger vehicles. This method uses accelerated depreciation schedules that allocate higher expense deductions in the earlier years of the asset's life, enhancing tax benefits. Unlike Double Declining Balance, MACRS applies a fixed percentage rate from IRS tables rather than doubling the straight-line rate, simplifying compliance and providing predictable deduction patterns.

Fundamentals of Double Declining Balance (DDB) Method

The Double Declining Balance (DDB) method accelerates depreciation by applying twice the straight-line rate to the asset's declining book value, resulting in higher expenses in the early years. This method ignores salvage value initially, focusing on rapid cost recovery, which benefits tax deductions and cash flow management. Compared to MACRS, DDB offers a straightforward acceleration technique without the standardized IRS tables, providing flexibility in asset depreciation scheduling.

Key Differences Between MACRS and DDB

MACRS (Modified Accelerated Cost Recovery System) provides standardized depreciation rates based on asset classes set by the IRS, ensuring consistent tax reporting, whereas Double Declining Balance (DDB) is a flexible accelerated depreciation method that doubles the straight-line rate to write off asset value faster in early years. MACRS incorporates a predetermined recovery period and switching to straight-line depreciation mid-life, but DDB maintains a constant acceleration factor until book value approaches salvage value. The choice between MACRS and DDB impacts tax deductions timing and financial statement reporting, with MACRS mandatory for tax purposes and DDB preferred for internal financial analysis.

Depreciation Calculation Examples: MACRS vs DDB

MACRS depreciation uses predefined IRS recovery periods and fixed percentage tables to calculate annual depreciation, simplifying tax reporting with consistent expense recognition over the asset's useful life. In contrast, Double Declining Balance (DDB) accelerates depreciation by applying twice the straight-line rate to the asset's declining book value, resulting in higher expenses in the early years and a gradual decrease over time. For example, a $10,000 asset under 5-year MACRS has specific annual rates like 20% in year one, while DDB applies a 40% rate initially, promoting faster write-offs and improved tax deferral benefits.

Tax Implications of Using MACRS vs Double Declining Balance

MACRS (Modified Accelerated Cost Recovery System) typically provides faster depreciation deductions compared to the Double Declining Balance method, resulting in greater tax deferrals and improved current cash flow for businesses. Using MACRS allows for higher tax deductions in the early years of an asset's life, reducing taxable income more aggressively than Double Declining Balance, which switches to straight-line depreciation over time. Tax implications favor MACRS for assets qualifying for accelerated depreciation, maximizing early tax savings and minimizing tax liabilities during initial years of asset ownership.

Pros and Cons of MACRS for Vehicle Depreciation

MACRS depreciation allows faster cost recovery for vehicles, accelerating tax deductions in the early years, which improves cash flow for businesses. However, the accelerated depreciation can result in lower deductions in later years, potentially increasing taxable income when the vehicle's value is lower. MACRS also requires strict adherence to IRS property classifications and recovery periods, which may complicate tax planning compared to the more flexible double declining balance method.

Advantages and Limitations of Double Declining Balance

Double Declining Balance (DDB) depreciation accelerates expense recognition by applying twice the straight-line rate to the asset's declining book value, resulting in higher depreciation in early years which improves cash flow and tax benefits. Its advantage lies in matching depreciation expense with higher asset utility and obsolescence early in the asset's life. Limitations include potential underestimation of depreciation in later years and less simplicity compared to MACRS, which standardizes rates and recovery periods for tax compliance.

Best Scenarios for Applying Each Method

MACRS depreciation is best suited for assets with a clear recovery period defined by tax regulations, optimizing tax deductions over the specified timeframe. The Double Declining Balance method applies effectively to assets that experience higher utility and value loss in the early years, accelerating expense recognition and improving short-term cash flow. Selecting between MACRS and Double Declining Balance depends on balancing tax benefits with the asset's usage pattern and financial strategy.

Choosing the Right Depreciation Method for Your Car

When selecting a depreciation method for your car, MACRS (Modified Accelerated Cost Recovery System) offers tax advantages through accelerated write-offs, especially beneficial for business vehicles. The Double Declining Balance method provides a higher depreciation expense in the early years, maximizing deductions when the car's value declines rapidly. Evaluating your tax situation and cash flow needs helps determine whether MACRS or Double Declining Balance aligns best with your financial strategy.

MACRS vs Double Declining Balance Infographic

cardiffo.com

cardiffo.com