Lease depreciation reflects the loss in value of a vehicle during the lease term, often factored into monthly payments and typically calculated based on the vehicle's residual value. Purchase depreciation occurs when owning a vehicle outright, representing the decline in asset value over time and impacting resale price or trade-in offers. Understanding the differences helps in deciding between leasing, which spreads depreciation costs, and purchasing, which results in a direct, longer-term asset depreciation.

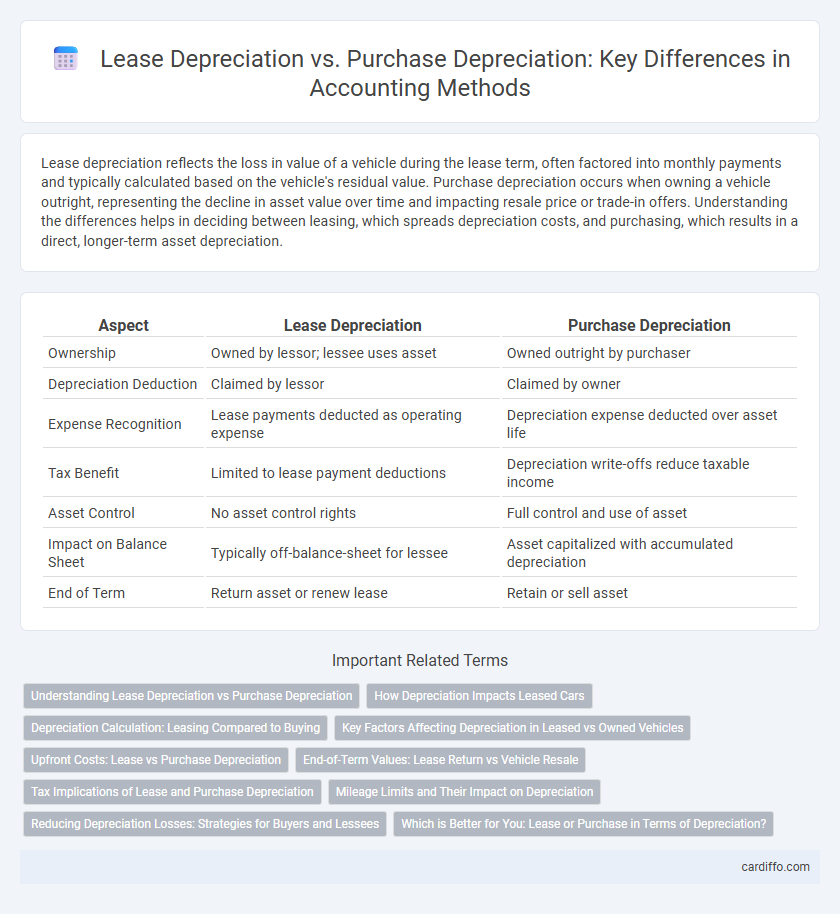

Table of Comparison

| Aspect | Lease Depreciation | Purchase Depreciation |

|---|---|---|

| Ownership | Owned by lessor; lessee uses asset | Owned outright by purchaser |

| Depreciation Deduction | Claimed by lessor | Claimed by owner |

| Expense Recognition | Lease payments deducted as operating expense | Depreciation expense deducted over asset life |

| Tax Benefit | Limited to lease payment deductions | Depreciation write-offs reduce taxable income |

| Asset Control | No asset control rights | Full control and use of asset |

| Impact on Balance Sheet | Typically off-balance-sheet for lessee | Asset capitalized with accumulated depreciation |

| End of Term | Return asset or renew lease | Retain or sell asset |

Understanding Lease Depreciation vs Purchase Depreciation

Lease depreciation reflects the reduction in value of an asset over the lease term, often calculated based on the expected residual value and lease duration, impacting lease payments and financial reporting. Purchase depreciation is the systematic allocation of the cost of owned assets over their useful life, influencing tax deductions and balance sheet valuation. Understanding these differences helps businesses optimize cash flow, tax benefits, and asset management strategies.

How Depreciation Impacts Leased Cars

Depreciation impacts leased cars by influencing the vehicle's residual value, which determines monthly lease payments and the total cost of leasing. Lease depreciation is calculated based on the expected decline in the car's value over the lease term, often leading to lower upfront expenses compared to purchase depreciation, where the owner bears full depreciation costs. Understanding lease depreciation helps lessees anticipate end-of-lease fees and assess whether leasing or buying aligns better with their financial goals.

Depreciation Calculation: Leasing Compared to Buying

Lease depreciation is calculated based on the asset's estimated residual value at lease-end, with the depreciation expense distributed over the lease term, often resulting in lower monthly charges compared to purchasing. Purchase depreciation follows accounting standards such as MACRS or straight-line, allocating the asset's cost minus salvage value over its useful life, impacting tax and financial reporting differently. Understanding these methods is essential for optimizing cash flow and tax benefits in asset management decisions.

Key Factors Affecting Depreciation in Leased vs Owned Vehicles

Lease depreciation primarily depends on the vehicle's residual value and mileage limits set by the lease agreement, influencing monthly payments and total lease cost. Purchase depreciation is affected by factors such as ownership duration, maintenance, vehicle condition, and market demand at resale, which impact the vehicle's book value over time. Both leased and owned vehicles experience accelerated depreciation in the first few years, but leased vehicles emphasize contractual terms while owned vehicles are more influenced by individual usage and upkeep.

Upfront Costs: Lease vs Purchase Depreciation

Lease depreciation involves spreading the asset's cost over the lease term, resulting in lower upfront costs compared to purchase depreciation, where the entire asset value is capitalized immediately. In purchase depreciation, higher initial expenses are recognized as the full asset price is recorded on the balance sheet, leading to significant upfront capital outlay. Leasing reduces initial cash flow impact by allocating depreciation expenses periodically, aiding businesses in managing liquidity and budgeting more effectively.

End-of-Term Values: Lease Return vs Vehicle Resale

Lease depreciation is calculated based on the vehicle's estimated residual value at the end of the lease term, which determines the lease payments and reflects the expected vehicle return condition. Purchase depreciation focuses on the actual market resale value when the owner sells or trades in the vehicle, influenced by factors such as usage, maintenance, and market demand. End-of-term lease returns often require the vehicle to meet specific condition standards, while purchased vehicles offer flexibility but bear the risk of a fluctuating resale price.

Tax Implications of Lease and Purchase Depreciation

Lease depreciation typically does not allow the lessee to claim direct tax deductions on the asset's depreciation since the lessor retains ownership, while lease payments are generally deductible as business expenses. Purchase depreciation enables the owner to claim depreciation deductions over the asset's useful life, reducing taxable income based on IRS depreciation methods such as MACRS. Tax implications favor purchase depreciation when long-term tax benefits outweigh immediate lease payment deductions, especially in capital-intensive industries.

Mileage Limits and Their Impact on Depreciation

Mileage limits in lease depreciation play a critical role in determining the vehicle's residual value, as exceeding these limits accelerates depreciation costs significantly. Purchase depreciation is typically influenced by actual miles driven without strict penalties, making mileage a continuous factor in asset value reduction over time. Understanding the impact of mileage limits helps in optimizing total cost of ownership by aligning usage patterns with depreciation expectations under lease or purchase agreements.

Reducing Depreciation Losses: Strategies for Buyers and Lessees

Lease depreciation typically results in lower upfront depreciation losses for lessees since the asset's residual value risk is transferred to the lessor, allowing better cash flow management. Buyers can reduce depreciation losses by selecting assets with higher residual values and implementing regular maintenance to preserve asset condition and market value. Both lessees and buyers benefit from accurate depreciation schedules and market value assessments to optimize financial planning and minimize total depreciation expenses.

Which is Better for You: Lease or Purchase in Terms of Depreciation?

Lease depreciation typically offers lower upfront costs and predictable expense recognition, as the lease term aligns with the asset's depreciable life. Purchase depreciation provides ownership benefits with the ability to claim full asset depreciation through methods like MACRS, potentially maximizing tax deductions over time. Choosing between lease and purchase depends on cash flow preferences, tax strategy, and long-term asset usage plans.

Lease Depreciation vs Purchase Depreciation Infographic

cardiffo.com

cardiffo.com