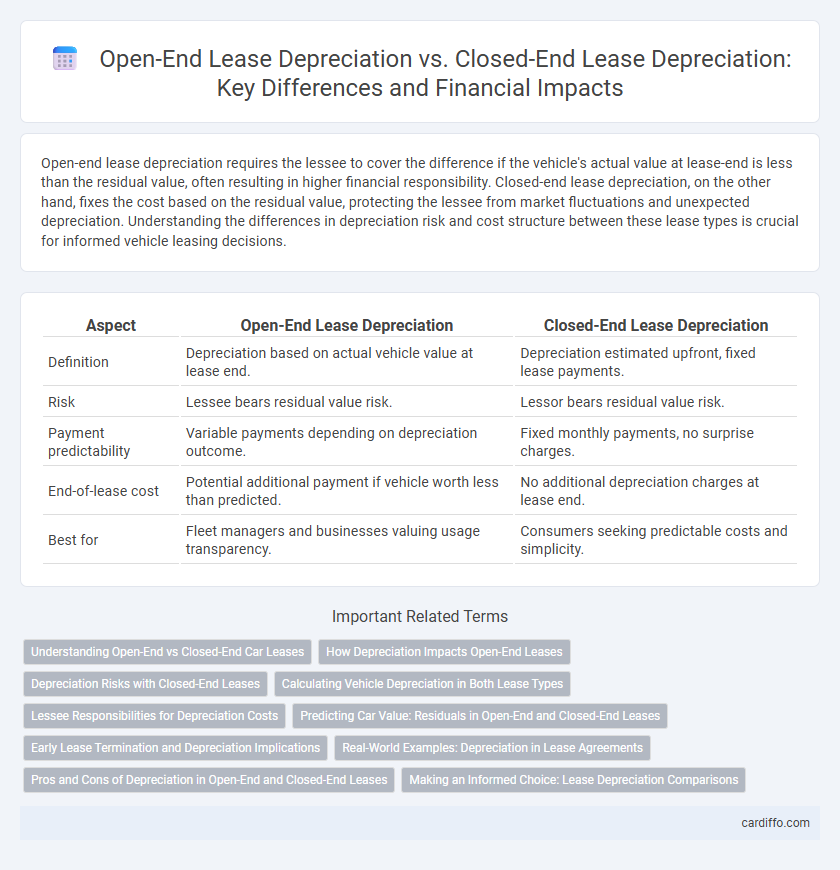

Open-end lease depreciation requires the lessee to cover the difference if the vehicle's actual value at lease-end is less than the residual value, often resulting in higher financial responsibility. Closed-end lease depreciation, on the other hand, fixes the cost based on the residual value, protecting the lessee from market fluctuations and unexpected depreciation. Understanding the differences in depreciation risk and cost structure between these lease types is crucial for informed vehicle leasing decisions.

Table of Comparison

| Aspect | Open-End Lease Depreciation | Closed-End Lease Depreciation |

|---|---|---|

| Definition | Depreciation based on actual vehicle value at lease end. | Depreciation estimated upfront, fixed lease payments. |

| Risk | Lessee bears residual value risk. | Lessor bears residual value risk. |

| Payment predictability | Variable payments depending on depreciation outcome. | Fixed monthly payments, no surprise charges. |

| End-of-lease cost | Potential additional payment if vehicle worth less than predicted. | No additional depreciation charges at lease end. |

| Best for | Fleet managers and businesses valuing usage transparency. | Consumers seeking predictable costs and simplicity. |

Understanding Open-End vs Closed-End Car Leases

Open-end lease depreciation requires the lessee to cover the difference if the vehicle's residual value is less than expected at lease end, reflecting actual market depreciation. Closed-end lease depreciation, in contrast, guarantees a fixed residual value, limiting the lessee's financial exposure and simplifying cost predictability. Understanding these differences helps consumers choose between potential risk and stability when managing vehicle depreciation in leasing agreements.

How Depreciation Impacts Open-End Leases

Open-end lease depreciation directly affects the lessee's financial responsibility since the lessee must cover any difference between the vehicle's residual value and its actual market value at lease-end. Under open-end leases, higher depreciation rates increase potential end-of-lease costs, making careful estimation of residual value critical. This contrasts with closed-end leases, where the lessor assumes depreciation risk, limiting the lessee's exposure to unexpected depreciation losses.

Depreciation Risks with Closed-End Leases

Closed-end lease depreciation transfers the residual value risk to the leasing company, limiting the lessee's financial exposure at lease-end. However, inaccurate depreciation estimates can result in higher lease payments as leasing companies build risk premiums into the contract. Lessees in closed-end leases face depreciation risk indirectly through potentially inflated monthly payments to cover unforeseen vehicle value declines.

Calculating Vehicle Depreciation in Both Lease Types

Open-end lease depreciation is calculated based on the actual depreciation of the vehicle during the lease term, typically the difference between the vehicle's initial value and its residual value at lease end, with the lessee responsible for covering any excess depreciation. Closed-end lease depreciation is estimated upfront by setting a fixed residual value, and the lessee pays rent based on the expected depreciation over the lease period, facing no financial responsibility for the vehicle's actual market value if it is lower than the residual value. Accurate depreciation calculation in both lease types requires assessment of initial vehicle cost, expected mileage, lease term, and projected vehicle market value trends.

Lessee Responsibilities for Depreciation Costs

Open-End Lease depreciation places the responsibility on the lessee to cover any excess depreciation costs exceeding the residual value at lease end, often leading to additional charges based on actual vehicle wear and market value. Closed-End Lease depreciation shifts the risk to the lessor, with fixed residual values agreed upon at lease initiation, resulting in no depreciation cost liability for the lessee beyond agreed payments. Lessees in open-end leases must monitor vehicle condition and mileage carefully to minimize depreciation charges, while closed-end leases offer predictable expenses without unexpected depreciation costs.

Predicting Car Value: Residuals in Open-End and Closed-End Leases

Open-end lease depreciation relies heavily on accurately predicting vehicle residual values because lessees bear the risk of the car's market value at lease-end, potentially owing the difference if the residual is overestimated. In closed-end leases, residual values are pre-determined and fixed, transferring depreciation risk to the leasing company and shielding lessees from market fluctuations. Effective residual value forecasting in open-end leases demands robust market analysis to minimize financial exposure, whereas closed-end leases emphasize conservatively set residuals to balance risk and lease pricing.

Early Lease Termination and Depreciation Implications

Open-End Lease depreciation requires lessees to cover the residual value if the vehicle's market value falls below the estimated depreciation, leading to potential costs at early lease termination. Closed-End Lease depreciation fixes the residual value upfront, limiting lessees' financial exposure regardless of early termination but often involves higher monthly payments. Early lease termination in Open-End Leases can trigger substantial depreciation charges, whereas Closed-End Leases shift depreciation risk to the lessor, reducing lessee liability.

Real-World Examples: Depreciation in Lease Agreements

Open-End Lease Depreciation requires lessees to cover the vehicle's residual value difference, exposing them to increased depreciation risk if the market value falls below the estimated residual. Closed-End Lease Depreciation caps this risk by fixing the residual value at lease inception, making it common in consumer leases where predictable payments are prioritized. For example, commercial fleet operators often choose open-end leases due to fluctuating vehicle values, while individual consumers prefer closed-end leases for budget certainty.

Pros and Cons of Depreciation in Open-End and Closed-End Leases

Open-End Lease depreciation allows lessees to handle the residual value risk, which often results in lower monthly payments but potential financial exposure if the vehicle's market value drops more than expected. Closed-End Lease depreciation offers fixed payments with no risk of owing additional money at lease-end, ideal for budgeting but generally results in higher monthly payments due to the leasing company assuming depreciation risk. Understanding the trade-offs between assuming residual value risk in Open-End Leases and the predictable costs in Closed-End Leases is essential for making informed leasing decisions.

Making an Informed Choice: Lease Depreciation Comparisons

Open-End Lease depreciation requires lessees to cover the difference if the vehicle's residual value is lower than estimated, emphasizing accurate depreciation forecasting in lease agreements. Closed-End Lease depreciation offers fixed payments based on predetermined residual values, reducing financial risk for lessees but potentially limiting benefits from lower-than-expected depreciation. Comparing Open-End and Closed-End Lease depreciation structures helps consumers make informed choices by balancing risk tolerance and potential cost savings in vehicle leasing.

Open-End Lease Depreciation vs Closed-End Lease Depreciation Infographic

cardiffo.com

cardiffo.com