Tax depreciation allows businesses to deduct the cost of assets over a set period based on tax regulations, often using accelerated methods to reduce taxable income sooner. Economic depreciation reflects the actual decline in an asset's market value due to wear and tear, obsolescence, or usage, providing a more precise measure of asset value over time. Understanding the distinction helps businesses manage cash flow effectively while aligning financial reporting with real asset performance.

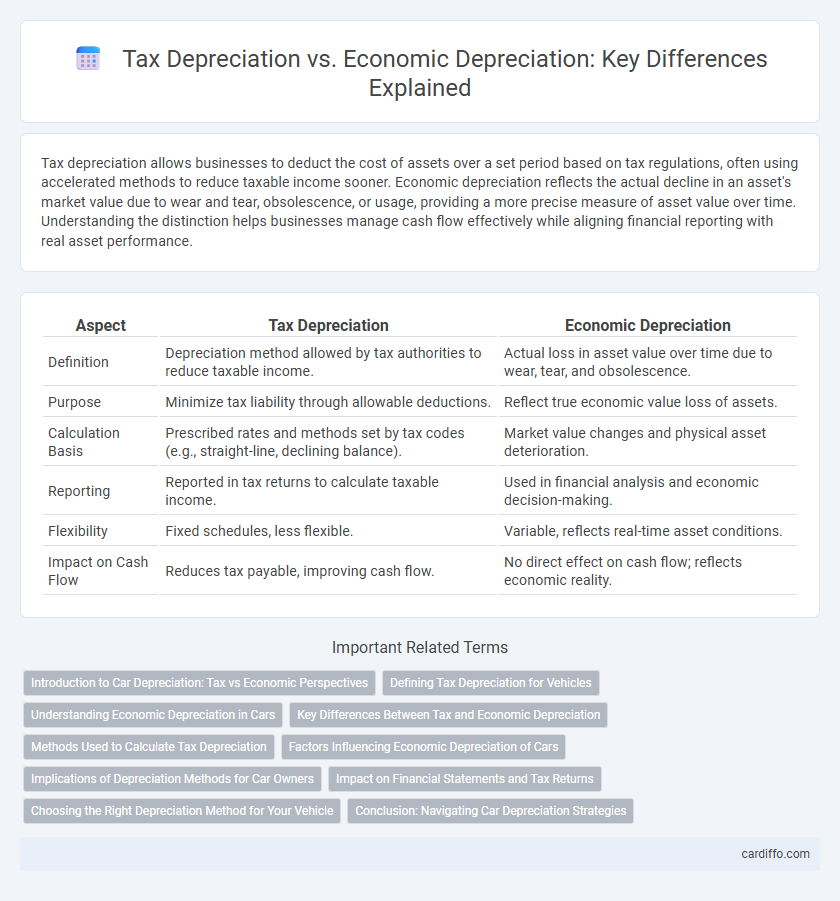

Table of Comparison

| Aspect | Tax Depreciation | Economic Depreciation |

|---|---|---|

| Definition | Depreciation method allowed by tax authorities to reduce taxable income. | Actual loss in asset value over time due to wear, tear, and obsolescence. |

| Purpose | Minimize tax liability through allowable deductions. | Reflect true economic value loss of assets. |

| Calculation Basis | Prescribed rates and methods set by tax codes (e.g., straight-line, declining balance). | Market value changes and physical asset deterioration. |

| Reporting | Reported in tax returns to calculate taxable income. | Used in financial analysis and economic decision-making. |

| Flexibility | Fixed schedules, less flexible. | Variable, reflects real-time asset conditions. |

| Impact on Cash Flow | Reduces tax payable, improving cash flow. | No direct effect on cash flow; reflects economic reality. |

Introduction to Car Depreciation: Tax vs Economic Perspectives

Tax depreciation calculates a vehicle's deductible expense based on government-approved schedules, often accelerating write-offs for tax benefits and reducing taxable income. Economic depreciation reflects the actual decline in a car's market value over time due to wear, obsolescence, and usage, providing a realistic measure of asset loss. Understanding both perspectives helps businesses optimize tax strategies while accurately assessing the asset's economic worth.

Defining Tax Depreciation for Vehicles

Tax depreciation for vehicles represents the allowable deduction in accounting for the decline in value of a vehicle asset as specified by tax regulations, often using methods like the Modified Accelerated Cost Recovery System (MACRS) in the United States. This form of depreciation determines the taxable income by spreading the vehicle's purchase cost over a designated recovery period dictated by the IRS, which differs from the vehicle's actual market value decline. Understanding tax depreciation rules is crucial for vehicle owners and businesses to optimize tax liabilities while complying with legal standards.

Understanding Economic Depreciation in Cars

Economic depreciation in cars refers to the actual decline in a vehicle's market value over time due to factors like wear and tear, mileage, and technological obsolescence. Unlike tax depreciation, which follows predetermined schedules set by tax authorities for accounting and tax deduction purposes, economic depreciation reflects real-world changes in value, influencing resale price and insurance costs. Understanding economic depreciation helps car owners and buyers make informed decisions about pricing, maintenance, and timing for selling or trading vehicles.

Key Differences Between Tax and Economic Depreciation

Tax depreciation follows government-established schedules and rules to allocate asset costs for tax reporting, often resulting in accelerated deductions to incentivize investment. Economic depreciation measures the actual decline in an asset's market value or productive capacity over time, reflecting real wear and tear or obsolescence. The key differences lie in their purposes--tax depreciation reduces taxable income based on regulatory methods, while economic depreciation captures true asset value loss to guide better financial decision-making.

Methods Used to Calculate Tax Depreciation

Tax depreciation methods primarily include the Modified Accelerated Cost Recovery System (MACRS) and the Straight-Line method, both designed to allocate asset costs over predetermined periods defined by tax regulations. MACRS accelerates depreciation expenses through predefined recovery periods and class lives, enabling businesses to maximize early tax deductions, whereas the Straight-Line method spreads depreciation evenly across the asset's useful life for simplicity. The choice of method directly impacts taxable income and cash flow, emphasizing compliance with IRS guidelines to optimize tax liabilities.

Factors Influencing Economic Depreciation of Cars

Economic depreciation of cars is influenced by factors such as mileage, condition, market demand, technological advancements, and model obsolescence. Unlike tax depreciation, which follows predetermined schedules, economic depreciation reflects real-world value loss based on usage and external market conditions. Resale value fluctuations, fuel efficiency improvements, and changing consumer preferences significantly impact the economic depreciation rate of vehicles.

Implications of Depreciation Methods for Car Owners

Tax depreciation allows car owners to reduce taxable income by deducting a standardized portion of the vehicle's cost over its useful life, often following accelerated schedules mandated by tax authorities. Economic depreciation reflects the actual decline in the vehicle's market value due to wear and tear, mileage, and obsolescence, providing a more accurate measure of the car's true loss in value over time. Understanding the differences between these methods helps car owners optimize tax benefits while aligning maintenance and replacement decisions with the real economic impact of car depreciation.

Impact on Financial Statements and Tax Returns

Tax depreciation follows IRS guidelines, creating accelerated expense recognition that reduces taxable income and tax liability, directly impacting tax returns by lowering tax payments. Economic depreciation reflects the actual decline in an asset's market value or usefulness, providing a more accurate measure of asset wear and tear for financial statements, affecting reported earnings and asset valuations. Differences between tax and economic depreciation can lead to timing discrepancies in expense recognition, influencing both book income and taxable income, thus affecting deferred tax assets or liabilities on the balance sheet.

Choosing the Right Depreciation Method for Your Vehicle

Selecting the appropriate depreciation method for your vehicle requires understanding the differences between tax depreciation and economic depreciation. Tax depreciation follows IRS guidelines to maximize deductions within legal limits, often using accelerated methods like MACRS, while economic depreciation reflects the actual loss in the vehicle's market value over time. Prioritizing economic depreciation offers a realistic assessment of your vehicle's worth, but incorporating tax depreciation strategies can optimize tax benefits and improve cash flow.

Conclusion: Navigating Car Depreciation Strategies

Effectively managing car depreciation requires understanding the distinction between tax depreciation and economic depreciation, as tax rules often accelerate write-offs that differ from actual market value loss. Prioritizing economic depreciation provides a realistic assessment of a vehicle's declining worth, while tax depreciation offers strategic benefits for financial reporting and tax planning. Balancing these approaches enables optimized financial decisions, minimizing tax liabilities and accurately reflecting asset value over time.

Tax Depreciation vs Economic Depreciation Infographic

cardiffo.com

cardiffo.com