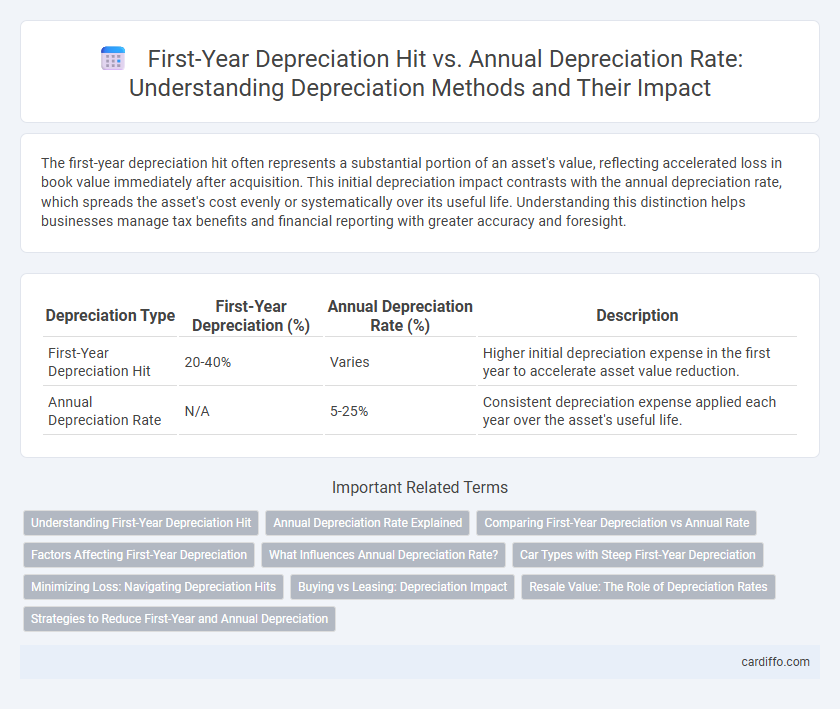

The first-year depreciation hit often represents a substantial portion of an asset's value, reflecting accelerated loss in book value immediately after acquisition. This initial depreciation impact contrasts with the annual depreciation rate, which spreads the asset's cost evenly or systematically over its useful life. Understanding this distinction helps businesses manage tax benefits and financial reporting with greater accuracy and foresight.

Table of Comparison

| Depreciation Type | First-Year Depreciation (%) | Annual Depreciation Rate (%) | Description |

|---|---|---|---|

| First-Year Depreciation Hit | 20-40% | Varies | Higher initial depreciation expense in the first year to accelerate asset value reduction. |

| Annual Depreciation Rate | N/A | 5-25% | Consistent depreciation expense applied each year over the asset's useful life. |

Understanding First-Year Depreciation Hit

First-year depreciation hit represents the initial amount deducted from an asset's value during its first year of service, often higher due to accelerated depreciation methods like MACRS or bonus depreciation. This immediate deduction contrasts with the annual depreciation rate, which spreads the asset's cost evenly or progressively over its useful life. Understanding the first-year depreciation hit is crucial for accurate tax planning and cash flow management, as it significantly impacts the initial year's taxable income.

Annual Depreciation Rate Explained

The annual depreciation rate represents the percentage of an asset's cost allocated as an expense each year, reflecting its gradual decrease in value. Unlike the first-year depreciation hit, which often includes accelerated deductions or bonuses, the annual rate provides a consistent measure for long-term asset valuation. This consistent rate aids financial planning and ensures compliance with accounting standards such as GAAP or IFRS.

Comparing First-Year Depreciation vs Annual Rate

First-year depreciation often reflects an accelerated write-off, resulting in a significantly higher deduction compared to the uniform annual depreciation rate. This initial depreciation hit enables businesses to recover asset costs more quickly, improving cash flow during the acquisition year. In contrast, the annual depreciation rate spreads the asset cost evenly over its useful life, providing consistent but smaller deductions each subsequent year.

Factors Affecting First-Year Depreciation

First-year depreciation hit varies significantly due to factors such as the asset's acquisition cost, applicable tax laws, and chosen depreciation method, including accelerated options like MACRS. The asset's useful life and salvage value directly influence the annual depreciation rate, impacting the initial depreciation expense recognized. Market conditions and regulatory changes also affect the depreciation schedule, emphasizing the importance of strategic planning in asset management.

What Influences Annual Depreciation Rate?

The annual depreciation rate is primarily influenced by the asset's useful life, residual value, and the chosen depreciation method, such as straight-line or declining balance. Economic factors, technological advancements, and usage intensity also impact how quickly an asset depreciates each year. Accurate estimation of these variables ensures realistic depreciation expenses and effective asset management.

Car Types with Steep First-Year Depreciation

Certain car types, such as luxury and electric vehicles, experience a steep first-year depreciation hit, often losing 20-30% of their value immediately after purchase compared to a more consistent annual depreciation rate of 10-15%. Sports cars and high-end SUVs also tend to exhibit accelerated initial depreciation due to rapid market value adjustments and consumer demand shifts. Understanding these depreciation patterns is crucial for buyers aiming to minimize long-term value loss and optimize vehicle investment.

Minimizing Loss: Navigating Depreciation Hits

First-year depreciation hit represents the significant initial value reduction of an asset, often higher than the standard annual depreciation rate applied in subsequent years. Understanding the disparity between the steep first-year loss and consistent annual depreciation rates is crucial for minimizing financial impact and accurately forecasting asset value over time. Strategic planning and accurate asset valuation models help businesses navigate these depreciation hits to optimize tax benefits and preserve capital efficiency.

Buying vs Leasing: Depreciation Impact

The first-year depreciation hit on a purchased vehicle is typically steep, often around 20% to 30%, significantly reducing its resale value compared to the consistent annual depreciation rate of 10% to 15% seen in subsequent years. Leasing transfers this initial depreciation impact to the lessor, making monthly payments more predictable and often lower than financing a purchase. Buyers face a larger upfront loss due to rapid value decline, while lessees benefit from mitigating the first-year depreciation cost by returning the vehicle at lease end.

Resale Value: The Role of Depreciation Rates

First-year depreciation hit significantly reduces an asset's resale value compared to the consistent annual depreciation rate applied in subsequent years. Higher initial depreciation rates accelerate the drop in market value, impacting the asset's trade-in or resale potential immediately after purchase. Understanding these depreciation dynamics is crucial for accurately estimating future resale prices and optimizing asset management strategies.

Strategies to Reduce First-Year and Annual Depreciation

Implementing accelerated depreciation methods like Section 179 or bonus depreciation allows businesses to maximize first-year depreciation benefits while strategically managing tax liabilities. Employing regular asset maintenance and timely upgrades preserves asset value, effectively reducing annual depreciation rates over the asset's useful life. Opting for longer useful life estimates and lower depreciation rates aligns with conservative accounting practices, minimizing both first-year and annual depreciation expenses.

First-Year Depreciation Hit vs Annual Depreciation Rate Infographic

cardiffo.com

cardiffo.com