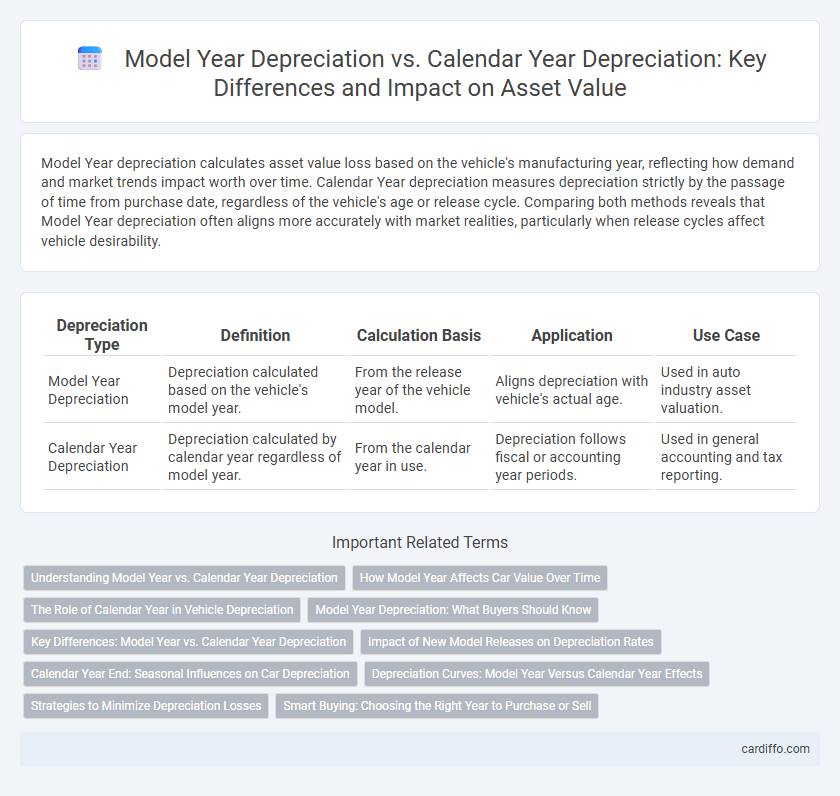

Model Year depreciation calculates asset value loss based on the vehicle's manufacturing year, reflecting how demand and market trends impact worth over time. Calendar Year depreciation measures depreciation strictly by the passage of time from purchase date, regardless of the vehicle's age or release cycle. Comparing both methods reveals that Model Year depreciation often aligns more accurately with market realities, particularly when release cycles affect vehicle desirability.

Table of Comparison

| Depreciation Type | Definition | Calculation Basis | Application | Use Case |

|---|---|---|---|---|

| Model Year Depreciation | Depreciation calculated based on the vehicle's model year. | From the release year of the vehicle model. | Aligns depreciation with vehicle's actual age. | Used in auto industry asset valuation. |

| Calendar Year Depreciation | Depreciation calculated by calendar year regardless of model year. | From the calendar year in use. | Depreciation follows fiscal or accounting year periods. | Used in general accounting and tax reporting. |

Understanding Model Year vs. Calendar Year Depreciation

Model Year Depreciation calculates asset value decline based on the official production year, impacting vehicle insurance and resale pricing through standardized depreciation schedules. Calendar Year Depreciation, however, applies depreciation by actual calendar years since purchase, reflecting usage and wear in accounting records more accurately. Understanding these distinctions is crucial for accurate financial reporting and asset management in industries like automotive and equipment leasing.

How Model Year Affects Car Value Over Time

Model year depreciation significantly influences a car's value depreciation rate, with newer model years typically experiencing faster initial value drops due to rapid advancements in technology and design. Unlike calendar year depreciation, which measures age from the car's manufacture or registration date, model year depreciation aligns value declines with industry release cycles, often causing greater perceived obsolescence as newer models arrive. Understanding model year impact helps buyers and sellers anticipate market value fluctuations more accurately throughout the vehicle's lifecycle.

The Role of Calendar Year in Vehicle Depreciation

Calendar year depreciation calculates a vehicle's value loss based on the passage of time, regardless of usage or model year, reflecting market trends and economic factors affecting resale value annually. This method captures the impact of aging and external conditions on depreciation, offering a straightforward approach for tax and accounting purposes. By contrast, model year depreciation aligns value loss with the specific vehicle release date, emphasizing technology obsolescence and design updates relative to its production cycle.

Model Year Depreciation: What Buyers Should Know

Model year depreciation directly impacts the resale value of vehicles, as buyers often associate newer model years with improved technology and design, regardless of the actual age or mileage. Vehicles from the latest model year typically command higher prices due to perceived advances and updated features that enhance performance, safety, and fuel efficiency. Understanding model year depreciation helps buyers make informed decisions by prioritizing vehicles that balance age, condition, and model updates to maximize value retention.

Key Differences: Model Year vs. Calendar Year Depreciation

Model Year Depreciation calculates asset value loss based on the year the asset was manufactured, influencing tax and resale value schedules aligned with the model release date. Calendar Year Depreciation applies depreciation on a fixed annual basis regardless of the asset's manufacture date, spreading the expense uniformly across the fiscal years of ownership. The key difference lies in timing and alignment: Model Year Depreciation ties deductions to asset age, while Calendar Year Depreciation standardizes expense recognition.

Impact of New Model Releases on Depreciation Rates

New model releases accelerate depreciation rates for previous model years by increasing their relative age and reducing market demand. Model year depreciation directly reflects the vehicle's manufacturing date, causing sharper value drops with each new iteration. Calendar year depreciation provides a broader time-based perspective but is often less sensitive to sudden market shifts triggered by new model introductions.

Calendar Year End: Seasonal Influences on Car Depreciation

Calendar year end depreciation reflects the impact of seasonal trends on vehicle value, often causing sharper drops due to tax incentives and new model releases. Cars typically depreciate more steeply in late autumn and early winter as demand decreases and dealers clear inventory. Understanding these seasonal patterns helps buyers and sellers time transactions for optimal value retention.

Depreciation Curves: Model Year Versus Calendar Year Effects

Depreciation curves show distinct patterns when comparing model year depreciation to calendar year depreciation, as model year depreciation accounts for the vehicle's manufacturing age while calendar year depreciation reflects the actual passage of time regardless of model release. Model year depreciation typically results in sharper value declines during the initial years as newer models enter the market, whereas calendar year depreciation offers a smoother, more linear decline aligned with the asset's usage and aging. Understanding these differences is crucial for accurate asset valuation and financial reporting, especially in automotive fleet management and tax calculations.

Strategies to Minimize Depreciation Losses

Model Year Depreciation accelerates asset value decline as new models enter the market, while Calendar Year Depreciation spreads loss evenly over time regardless of market changes. Implementing timed resale strategies before the release of newer models and maintaining regular maintenance records can significantly minimize depreciation losses. Leveraging hybrid assessment methods that combine both model year and calendar year approaches provides a more accurate reflection of an asset's market value.

Smart Buying: Choosing the Right Year to Purchase or Sell

Model year depreciation often causes a vehicle to lose a significant portion of its value as soon as a new model is released, making purchasing just before the new model year an optimal smart buying strategy. Calendar year depreciation reflects gradual loss based on time, which tends to be more predictable and manageable for sellers aiming to time the market effectively. Understanding the distinctions between model year and calendar year depreciation helps buyers and sellers maximize value by selecting the most advantageous year for purchase or sale.

Model Year Depreciation vs Calendar Year Depreciation Infographic

cardiffo.com

cardiffo.com