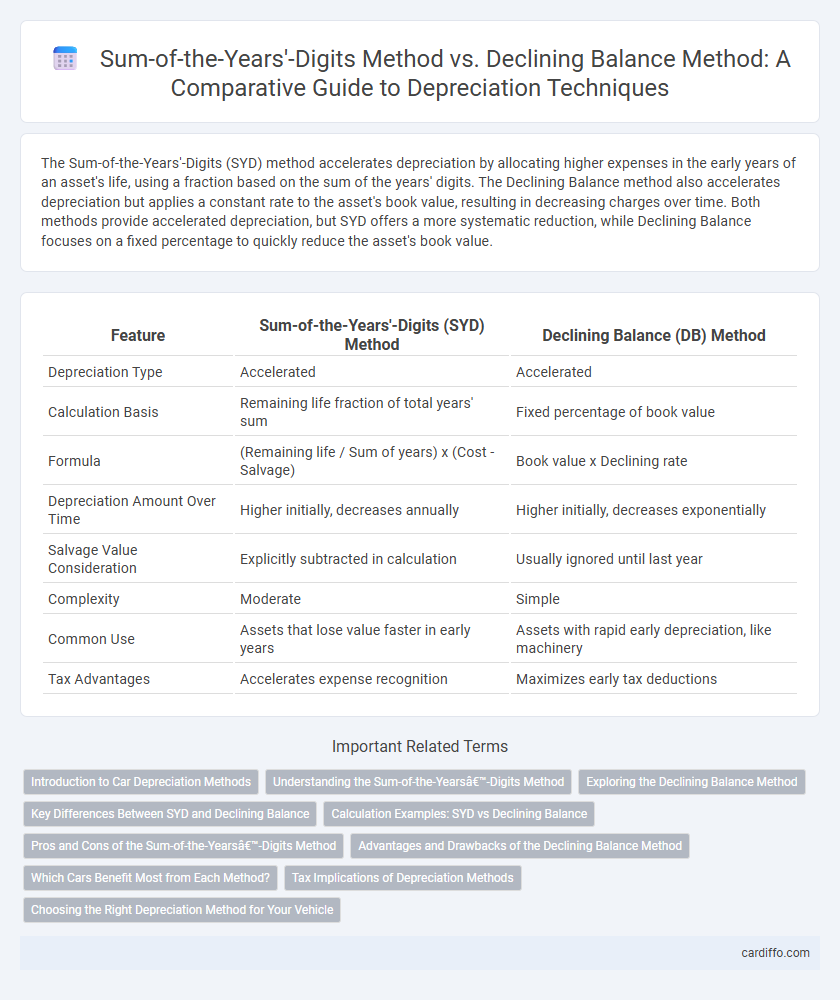

The Sum-of-the-Years'-Digits (SYD) method accelerates depreciation by allocating higher expenses in the early years of an asset's life, using a fraction based on the sum of the years' digits. The Declining Balance method also accelerates depreciation but applies a constant rate to the asset's book value, resulting in decreasing charges over time. Both methods provide accelerated depreciation, but SYD offers a more systematic reduction, while Declining Balance focuses on a fixed percentage to quickly reduce the asset's book value.

Table of Comparison

| Feature | Sum-of-the-Years'-Digits (SYD) Method | Declining Balance (DB) Method |

|---|---|---|

| Depreciation Type | Accelerated | Accelerated |

| Calculation Basis | Remaining life fraction of total years' sum | Fixed percentage of book value |

| Formula | (Remaining life / Sum of years) x (Cost - Salvage) | Book value x Declining rate |

| Depreciation Amount Over Time | Higher initially, decreases annually | Higher initially, decreases exponentially |

| Salvage Value Consideration | Explicitly subtracted in calculation | Usually ignored until last year |

| Complexity | Moderate | Simple |

| Common Use | Assets that lose value faster in early years | Assets with rapid early depreciation, like machinery |

| Tax Advantages | Accelerates expense recognition | Maximizes early tax deductions |

Introduction to Car Depreciation Methods

The Sum-of-the-Years'-Digits (SYD) method accelerates depreciation by allocating higher expenses in the early years of a car's life, reflecting rapid value loss shortly after purchase. The Declining Balance method applies a fixed depreciation rate to the car's reducing book value, resulting in a decreasing expense over time yet maintaining a consistent percentage. Both methods offer strategic approaches to match depreciation expense with the vehicle's actual usage and decline in market value.

Understanding the Sum-of-the-Years’-Digits Method

The Sum-of-the-Years'-Digits (SYD) method accelerates depreciation by allocating higher expense amounts to the early years of an asset's life, based on the sum of the asset's useful life digits. This approach results in a rapidly decreasing depreciation expense, reflecting greater usage or obsolescence in the initial periods. SYD provides a systematic and rational way to depreciate assets faster than straight-line but less aggressively than the Declining Balance method.

Exploring the Declining Balance Method

The Declining Balance Method accelerates depreciation by applying a fixed rate to the book value of the asset, resulting in higher expense in the early years and lower expense as the asset ages. This method is particularly advantageous for assets that lose value quickly or become obsolete rapidly, such as technology equipment and vehicles. Compared to the Sum-of-the-Years'-Digits Method, the Declining Balance Method provides a more aggressive depreciation schedule, enhancing tax benefits and better matching expenses with revenue generation.

Key Differences Between SYD and Declining Balance

The Sum-of-the-Years'-Digits (SYD) method allocates depreciation based on a decreasing fraction of the asset's useful life, resulting in higher expenses in earlier years and lower expenses later. In contrast, the Declining Balance method calculates depreciation as a constant percentage of the asset's book value, producing accelerated depreciation without considering the asset's age directly. SYD emphasizes time-based allocation, while Declining Balance focuses on book value reduction, affecting financial reporting and tax strategies differently.

Calculation Examples: SYD vs Declining Balance

The Sum-of-the-Years'-Digits (SYD) method calculates depreciation by applying a decreasing fraction of the asset's depreciable base, summing the years' digits for the asset's useful life and multiplying each year's fraction by the base cost minus salvage value. For example, an asset with a 5-year life and $10,000 depreciable base has SYD fractions of 5/15, 4/15, 3/15, 2/15, and 1/15 applied annually, yielding higher depreciation early on that tapers off. The Declining Balance method calculates depreciation by applying a fixed percentage rate to the book value at the beginning of each year, such as 40% double declining balance on an initial cost of $10,000 results in $4,000 depreciation in the first year, then depreciation declines as book value decreases, offering accelerated expense recognition compared to straight-line.

Pros and Cons of the Sum-of-the-Years’-Digits Method

The Sum-of-the-Years'-Digits (SYD) Method accelerates depreciation by allocating higher expenses in earlier years, improving tax benefits and matching asset usage more accurately than straight-line methods. However, its complexity in calculation and less intuitive expense patterns can challenge accounting consistency and financial forecasting. The SYD method is less flexible compared to the Declining Balance Method, which allows depreciation to be recalculated based on reducing book value, offering potential tax advantages over time.

Advantages and Drawbacks of the Declining Balance Method

The Declining Balance Method accelerates depreciation, allowing higher expense recognition in the early years of an asset's life, which better matches expenses with revenues for rapidly obsolete assets. It provides tax benefits by reducing taxable income sooner but results in lower depreciation expenses in later years, potentially distorting profit comparisons over time. However, the method is less intuitive and harder to apply to assets with irregular usage patterns compared to straight-line methods.

Which Cars Benefit Most from Each Method?

Luxury vehicles with high initial costs often benefit from the Sum-of-the-Years'-Digits method due to its accelerated depreciation that aligns with the rapid value decline in the early years. Economy cars and fleet vehicles typically gain more from the Declining Balance method, which provides higher depreciation expenses initially but reduces over time, matching their usage patterns and maintenance costs. Choosing the optimal depreciation method depends on the vehicle's purchase price, expected lifespan, and usage intensity.

Tax Implications of Depreciation Methods

The Sum-of-the-Years'-Digits (SYD) method accelerates depreciation expenses more than the straight-line method but less aggressively than the Declining Balance method, resulting in moderate early tax deductions and reduced taxable income during initial years. The Declining Balance method, often double declining, maximizes depreciation charges early in an asset's life, leading to significant tax deferrals by lowering taxable income upfront and improving cash flow. Tax authorities generally accept both methods, but businesses must carefully consider how accelerated depreciation impacts long-term tax liabilities and financial reporting outcomes.

Choosing the Right Depreciation Method for Your Vehicle

Selecting the right depreciation method for your vehicle hinges on usage patterns and financial goals. The Sum-of-the-Years'-Digits method accelerates depreciation early, ideal for vehicles that lose value quickly within the first years. The Declining Balance method also front-loads expenses but emphasizes a consistent percentage, benefiting businesses aiming to maximize tax deductions during high-usage periods.

Sum-of-the-Years’-Digits Method vs Declining Balance Method Infographic

cardiffo.com

cardiffo.com