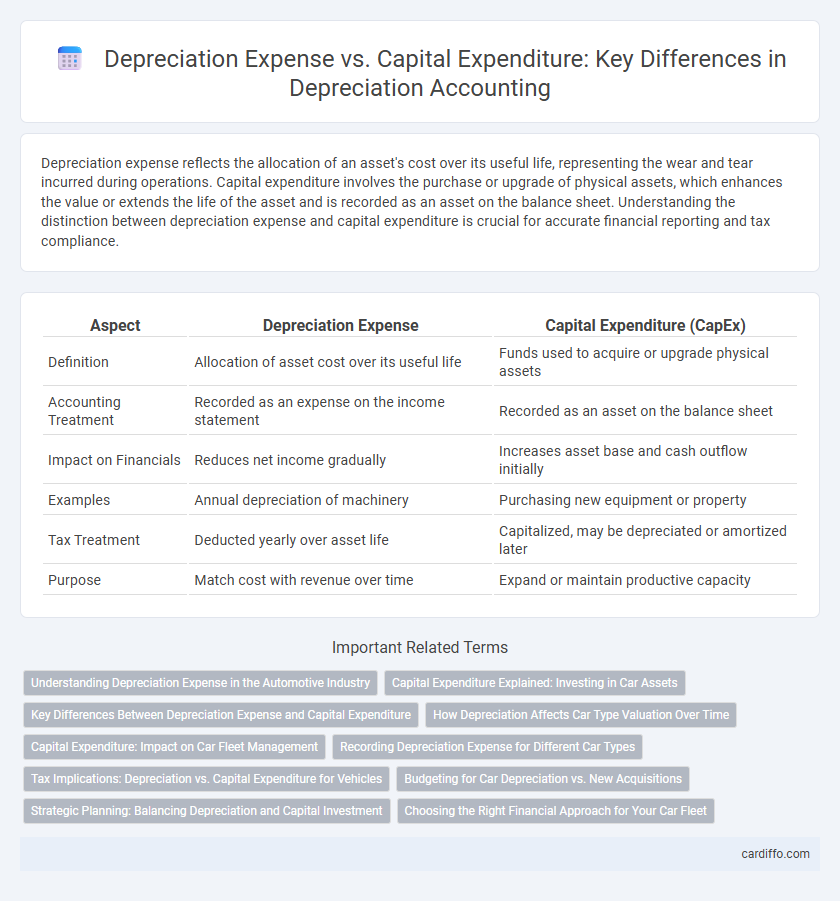

Depreciation expense reflects the allocation of an asset's cost over its useful life, representing the wear and tear incurred during operations. Capital expenditure involves the purchase or upgrade of physical assets, which enhances the value or extends the life of the asset and is recorded as an asset on the balance sheet. Understanding the distinction between depreciation expense and capital expenditure is crucial for accurate financial reporting and tax compliance.

Table of Comparison

| Aspect | Depreciation Expense | Capital Expenditure (CapEx) |

|---|---|---|

| Definition | Allocation of asset cost over its useful life | Funds used to acquire or upgrade physical assets |

| Accounting Treatment | Recorded as an expense on the income statement | Recorded as an asset on the balance sheet |

| Impact on Financials | Reduces net income gradually | Increases asset base and cash outflow initially |

| Examples | Annual depreciation of machinery | Purchasing new equipment or property |

| Tax Treatment | Deducted yearly over asset life | Capitalized, may be depreciated or amortized later |

| Purpose | Match cost with revenue over time | Expand or maintain productive capacity |

Understanding Depreciation Expense in the Automotive Industry

Depreciation expense in the automotive industry reflects the systematic allocation of a vehicle's cost over its useful life, impacting both financial statements and tax calculations. Unlike capital expenditure, which involves the initial purchase or significant improvement of an asset, depreciation expense spreads this cost as an operational expense, reducing taxable income annually. Understanding depreciation methods, such as straight-line or declining balance, is crucial for accurately capturing asset value and optimizing financial performance in automotive businesses.

Capital Expenditure Explained: Investing in Car Assets

Capital expenditure (CapEx) involves investing in long-term car assets such as vehicles or fleet upgrades, which enhance operational capacity and are not expensed immediately. Unlike depreciation expense that systematically allocates the cost of these assets over their useful life, CapEx directly impacts the balance sheet by increasing asset value. Proper classification of CapEx ensures accurate financial reporting and supports strategic investment decisions in vehicle assets.

Key Differences Between Depreciation Expense and Capital Expenditure

Depreciation expense reflects the gradual allocation of a tangible asset's cost over its useful life, impacting the income statement by reducing taxable income each accounting period. Capital expenditure (CapEx) involves the initial purchase or improvement of long-term assets, recorded on the balance sheet and not immediately expensed, as it provides future economic benefits. Key differences include timing of expense recognition, impact on financial statements, and the accounting treatment, with depreciation spreading the cost over time, while capital expenditure represents upfront investment in fixed assets.

How Depreciation Affects Car Type Valuation Over Time

Depreciation expense systematically reduces the book value of a car over its useful life, reflecting wear and tear, which directly impacts its valuation for accounting and resale purposes. Unlike capital expenditure, which increases the asset's value by adding or improving features, depreciation expense allocates the initial cost over time, decreasing the car's net worth on balance sheets. This ongoing reduction in value affects loan collateral assessments and insurance premiums, making accurate depreciation tracking crucial for financial decision-making in vehicle ownership.

Capital Expenditure: Impact on Car Fleet Management

Capital expenditure in car fleet management involves investing in acquiring or upgrading vehicles to enhance operational efficiency and reduce long-term costs. Unlike depreciation expense, which reflects the allocation of the vehicle's cost over its useful life, capital expenditures directly influence the fleet's value and capacity. Effective management of capital expenditures ensures sustained fleet performance, minimizes downtime, and supports strategic growth by maintaining up-to-date and reliable vehicles.

Recording Depreciation Expense for Different Car Types

Recording depreciation expense varies by car types due to differences in asset value, useful life, and usage patterns, affecting the expense recognized each accounting period. Capital expenditure involves the initial cost of acquiring and improving the vehicle, while depreciation expense systematically allocates that cost over its estimated useful life, reflecting the car's wear and tear. Fleet vehicles often use straight-line depreciation for simplicity, whereas luxury or specialized cars may require accelerated methods to capture higher value loss in early years.

Tax Implications: Depreciation vs. Capital Expenditure for Vehicles

Depreciation expense for vehicles allows businesses to deduct a portion of the asset's cost over its useful life, reducing taxable income gradually. In contrast, capital expenditure on vehicles is typically capitalized and depreciated, meaning the tax benefit is spread across several years rather than claimed immediately. Understanding IRS Section 179 and bonus depreciation rules is crucial, as they enable accelerated deductions for vehicle purchases, significantly impacting tax liability and cash flow planning.

Budgeting for Car Depreciation vs. New Acquisitions

Depreciation expense impacts budgeting by allocating the cost of an asset, such as a car, over its useful life, reflecting wear and value reduction without immediate cash outflow. Capital expenditure involves large, upfront investments like purchasing new vehicles, requiring significant budget allocation and approval for acquisition. Effective financial planning balances ongoing depreciation costs against the timing and scale of new acquisitions to maintain operational efficiency and cash flow stability.

Strategic Planning: Balancing Depreciation and Capital Investment

Strategic planning requires balancing depreciation expense with capital expenditure to optimize asset management and maintain financial health. Depreciation expense reflects the systematic allocation of an asset's cost over its useful life, influencing net income and tax planning. Capital expenditure involves significant investments in acquiring or upgrading assets, directly impacting long-term growth and competitive advantage.

Choosing the Right Financial Approach for Your Car Fleet

Depreciation expense reflects the allocation of a vehicle's cost over its useful life, directly impacting your car fleet's operational expenses and tax deductions. Capital expenditure involves significant investments in purchasing or upgrading fleet vehicles, which are capitalized and depreciated over time rather than expensed immediately. Selecting the appropriate financial approach requires balancing immediate tax benefits from depreciation expense against long-term asset value management through capital expenditures to optimize fleet budgeting and cash flow.

Depreciation Expense vs Capital Expenditure Infographic

cardiffo.com

cardiffo.com