Tax depreciation allows businesses to reduce taxable income by allocating the cost of an asset over its useful life according to tax regulations, which may differ from the asset's actual wear and tear. Actual depreciation reflects the real decline in the asset's value based on usage and market conditions, providing a more accurate measure of its current worth. Understanding the difference between tax depreciation and actual depreciation is essential for accurate financial reporting and tax planning.

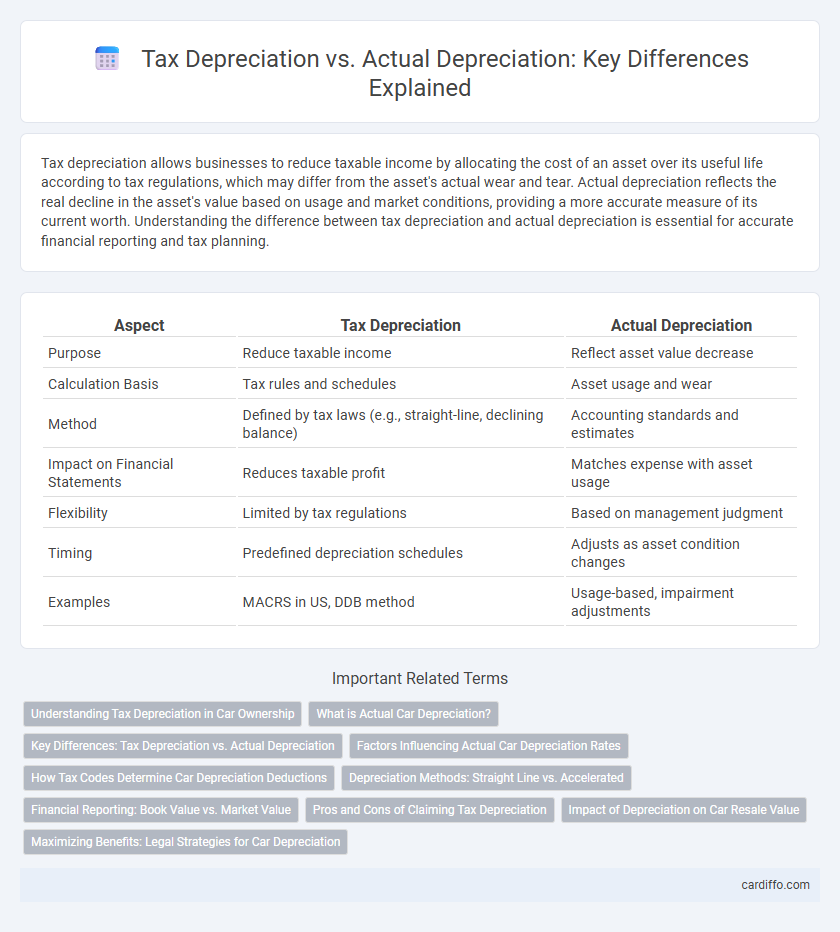

Table of Comparison

| Aspect | Tax Depreciation | Actual Depreciation |

|---|---|---|

| Purpose | Reduce taxable income | Reflect asset value decrease |

| Calculation Basis | Tax rules and schedules | Asset usage and wear |

| Method | Defined by tax laws (e.g., straight-line, declining balance) | Accounting standards and estimates |

| Impact on Financial Statements | Reduces taxable profit | Matches expense with asset usage |

| Flexibility | Limited by tax regulations | Based on management judgment |

| Timing | Predefined depreciation schedules | Adjusts as asset condition changes |

| Examples | MACRS in US, DDB method | Usage-based, impairment adjustments |

Understanding Tax Depreciation in Car Ownership

Tax depreciation on cars allows owners to deduct the vehicle's cost over a specified period according to government schedules, which often differ from actual depreciation based on market value and wear. Understanding tax depreciation helps car owners optimize their tax benefits by applying allowable rates and methods such as the Modified Accelerated Cost Recovery System (MACRS) used in the United States. This tax deduction reduces taxable income but may not accurately reflect the vehicle's real decrease in value over time.

What is Actual Car Depreciation?

Actual car depreciation refers to the real-world decrease in a vehicle's market value over time due to factors like age, mileage, wear and tear, and market demand. Unlike tax depreciation, which follows specific government rules and schedules for accounting purposes, actual depreciation reflects the true loss in resale value experienced by the car owner. Understanding actual car depreciation helps buyers and sellers estimate a vehicle's current worth and make informed financial decisions.

Key Differences: Tax Depreciation vs. Actual Depreciation

Tax depreciation is a method prescribed by tax authorities that allows businesses to deduct the depreciation expense of assets over a specified period for tax benefit purposes, often following accelerated schedules or specific rules. Actual depreciation reflects the true wear and tear or usage-based loss in value of an asset over its useful life, based on accounting principles and asset conditions. The key difference lies in tax depreciation optimizing tax liabilities, while actual depreciation represents the economic reality of asset value decline.

Factors Influencing Actual Car Depreciation Rates

Actual car depreciation rates are influenced by factors such as mileage, vehicle condition, market demand, and model popularity, which often differ from tax depreciation schedules set by governments. Tax depreciation follows standardized methods like the Modified Accelerated Cost Recovery System (MACRS) for tax reporting, whereas actual depreciation reflects real-world wear and tear and consumer preferences. Economic conditions and technological advancements also impact actual depreciation, causing discrepancies between tax and actual values.

How Tax Codes Determine Car Depreciation Deductions

Tax codes determine car depreciation deductions by specifying the allowable methods and recovery periods for assets, often using the Modified Accelerated Cost Recovery System (MACRS) to calculate tax depreciation. These rules differ from actual depreciation, which reflects the vehicle's real market value decline over time based on usage and wear. Tax depreciation enables businesses to reduce taxable income through standardized schedules, often accelerating deductions compared to the vehicle's true economic loss.

Depreciation Methods: Straight Line vs. Accelerated

Tax depreciation often utilizes accelerated methods like the Modified Accelerated Cost Recovery System (MACRS) to maximize early-year deductions, reducing taxable income more quickly compared to actual depreciation methods. Actual depreciation, typically recorded using the straight-line method, spreads the asset's cost evenly over its useful life, reflecting a consistent expense for financial reporting. Straight-line provides stable expense recognition, while accelerated methods front-load depreciation expenses, impacting cash flow and tax liabilities differently.

Financial Reporting: Book Value vs. Market Value

Tax depreciation follows government regulations to reduce taxable income, often differing from actual depreciation based on asset usage or wear. Financial reporting relies on book value, reflecting accumulated depreciation according to accounting standards, whereas market value represents the current asset worth, influenced by factors beyond recorded depreciation. Variances between book value and market value impact investment decisions and financial analysis.

Pros and Cons of Claiming Tax Depreciation

Claiming tax depreciation allows property investors to reduce their taxable income by accounting for the wear and tear of assets, generating significant tax savings and improving cash flow. However, tax depreciation schedules can be complex and require professional assessment, and the claimed depreciation does not reflect the actual market value reduction, potentially misleading financial reporting. Balancing the tax benefits against the administrative costs and discrepancies with actual asset depreciation is essential for accurate investment decision-making.

Impact of Depreciation on Car Resale Value

Tax depreciation reduces a vehicle's book value for tax purposes, often faster than actual wear and tear, leading to a lower reported asset value. Actual depreciation reflects the real market decline in a car's value based on condition, mileage, and demand, which directly impacts resale price. Understanding the divergence between tax and actual depreciation helps car owners optimize financial planning and maximize resale value.

Maximizing Benefits: Legal Strategies for Car Depreciation

Maximizing benefits from car depreciation requires understanding the differences between tax depreciation and actual depreciation methods. Tax depreciation often follows accelerated schedules like MACRS, enabling higher upfront deductions that reduce taxable income, while actual depreciation reflects the car's true market value decline over time. Implementing legal strategies such as Section 179 expensing or bonus depreciation allows businesses to optimize cash flow by aligning tax deductions with financial planning goals.

Tax Depreciation vs Actual Depreciation Infographic

cardiffo.com

cardiffo.com