Straight-line depreciation spreads the cost of an asset evenly over its useful life, providing consistent expense recognition and simplicity in accounting. Accelerated depreciation methods, such as double-declining balance, allocate higher expenses in the early years of an asset's life, reflecting faster loss of value and offering potential tax advantages. Choosing between these methods depends on the company's financial strategy, tax planning, and asset usage patterns.

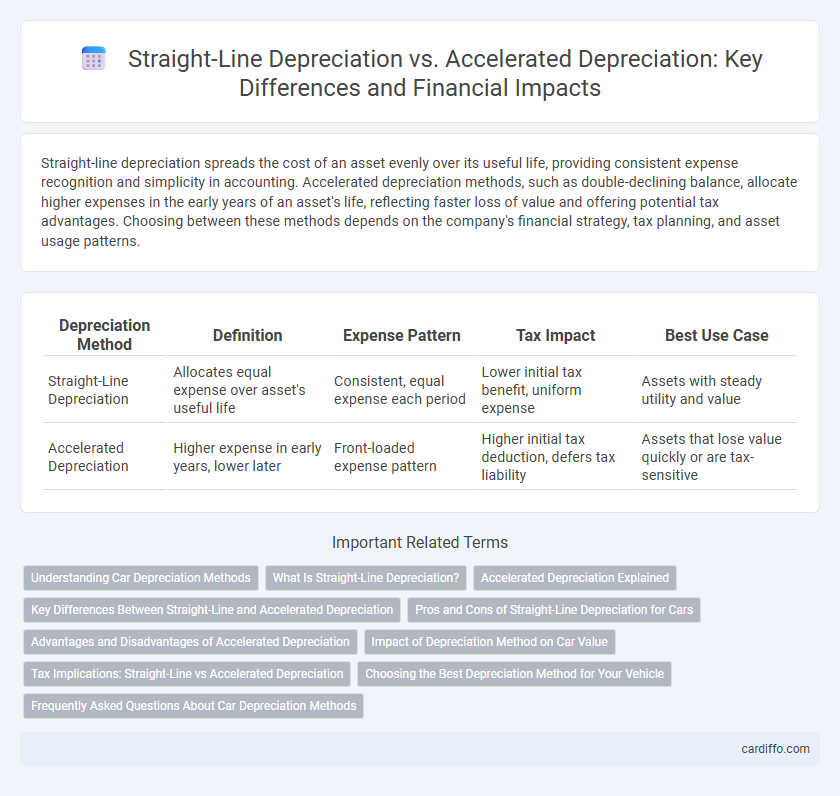

Table of Comparison

| Depreciation Method | Definition | Expense Pattern | Tax Impact | Best Use Case |

|---|---|---|---|---|

| Straight-Line Depreciation | Allocates equal expense over asset's useful life | Consistent, equal expense each period | Lower initial tax benefit, uniform expense | Assets with steady utility and value |

| Accelerated Depreciation | Higher expense in early years, lower later | Front-loaded expense pattern | Higher initial tax deduction, defers tax liability | Assets that lose value quickly or are tax-sensitive |

Understanding Car Depreciation Methods

Straight-line depreciation evenly allocates a car's cost over its useful life, resulting in consistent annual expense recognition and simplified financial planning. Accelerated depreciation methods, such as double-declining balance, front-load higher expenses during the vehicle's early years, reflecting faster value loss typical of cars. Understanding these methods helps optimize tax benefits and accurately represent a car's declining market value on financial statements.

What Is Straight-Line Depreciation?

Straight-line depreciation evenly allocates the cost of an asset over its useful life, resulting in consistent expense amounts each accounting period. This method is calculated by subtracting the asset's salvage value from its initial cost and dividing by the number of years expected in service. It provides a straightforward approach that simplifies financial reporting and budgeting for asset expenses.

Accelerated Depreciation Explained

Accelerated depreciation allows businesses to expense a larger portion of an asset's cost in the earlier years of its useful life, resulting in greater tax deductions upfront. Methods like Double Declining Balance and Sum-of-the-Years'-Digits maximize expense recognition when the asset's productivity or obsolescence is highest. This approach improves cash flow and reflects the actual wear and tear or rapid technological changes affecting assets.

Key Differences Between Straight-Line and Accelerated Depreciation

Straight-line depreciation allocates an equal expense amount for each accounting period over an asset's useful life, providing consistent cost distribution and ease of calculation. Accelerated depreciation methods, such as the double-declining balance, front-load higher expenses in the early years, reflecting faster asset value reduction and offering tax benefit advantages by deferring tax payments. Key differences include expense timing, impact on net income, and cash flow management, with straight-line suiting stable expense recognition and accelerated strategies optimizing tax deductions in initial periods.

Pros and Cons of Straight-Line Depreciation for Cars

Straight-line depreciation offers simplicity and predictability by allocating an equal expense amount over the car's useful life, making financial planning straightforward for both individuals and businesses. However, it may not accurately reflect a car's actual loss in value, as vehicles typically depreciate faster in the initial years due to wear, mileage, and market factors. This method can lead to understated expenses early on and overstated book value, impacting tax benefits and financial reporting accuracy.

Advantages and Disadvantages of Accelerated Depreciation

Accelerated depreciation allows for higher expense recognition in the early years of an asset's life, reducing taxable income and improving cash flow during periods of significant capital investment. However, this method results in lower depreciation expenses in later years, potentially leading to inflated profits and increased tax liabilities over time. Companies must weigh the immediate tax benefits against the complexity of accounting and potential distortions in financial reporting when using accelerated depreciation.

Impact of Depreciation Method on Car Value

Straight-line depreciation allocates car value evenly over the asset's useful life, providing consistent expense recognition and stable book value, which suits financial reporting clarity. Accelerated depreciation allocates higher expenses in the early years, rapidly reducing the car's book value and reflecting faster loss of economic usefulness, beneficial for tax savings and matching expenses to usage intensity. The choice between methods impacts financial statements, tax liabilities, and perceived asset value on the balance sheet.

Tax Implications: Straight-Line vs Accelerated Depreciation

Straight-line depreciation allocates an equal expense over an asset's useful life, resulting in consistent tax deductions annually and potentially higher taxable income in early years. Accelerated depreciation methods, such as double declining balance, front-load expenses, maximizing tax deductions early and reducing taxable income significantly during initial periods. Businesses often choose accelerated depreciation to improve cash flow by deferring tax liabilities to later years, while straight-line provides predictability and simpler accounting.

Choosing the Best Depreciation Method for Your Vehicle

Straight-line depreciation evenly allocates the vehicle's cost over its useful life, providing predictable annual expenses ideal for budgeting and tax planning. Accelerated depreciation methods, such as double declining balance, front-load depreciation expenses, maximizing tax deductions in the earlier years of the vehicle's use. Selecting the best depreciation method depends on cash flow needs, tax strategy, and the anticipated usage pattern of the vehicle over its service life.

Frequently Asked Questions About Car Depreciation Methods

Straight-line depreciation allocates an equal expense amount over a vehicle's useful life, making it simple and predictable for tax and accounting purposes. Accelerated depreciation methods, such as double declining balance, allow higher expenses in the earlier years, reducing taxable income faster but lowering book value more quickly. Car owners and businesses often ask which method maximizes tax benefits and matches the vehicle's actual value loss; straight-line suits steady wear while accelerated depreciation better reflects rapid early depreciation.

Straight-Line Depreciation vs Accelerated Depreciation Infographic

cardiffo.com

cardiffo.com