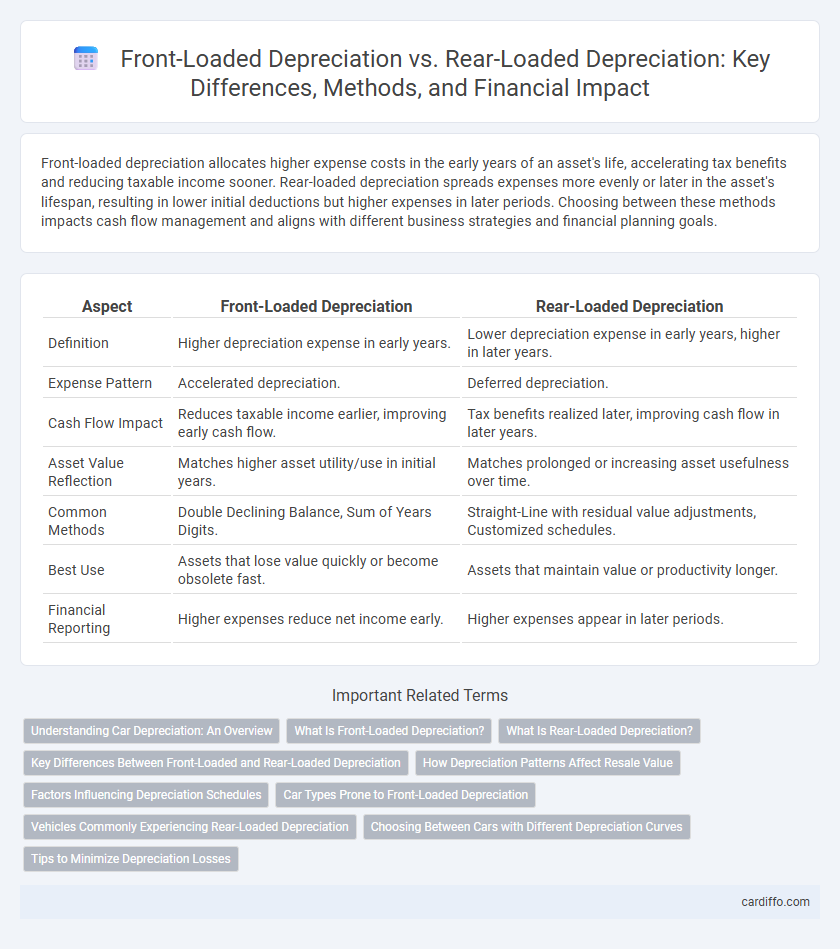

Front-loaded depreciation allocates higher expense costs in the early years of an asset's life, accelerating tax benefits and reducing taxable income sooner. Rear-loaded depreciation spreads expenses more evenly or later in the asset's lifespan, resulting in lower initial deductions but higher expenses in later periods. Choosing between these methods impacts cash flow management and aligns with different business strategies and financial planning goals.

Table of Comparison

| Aspect | Front-Loaded Depreciation | Rear-Loaded Depreciation |

|---|---|---|

| Definition | Higher depreciation expense in early years. | Lower depreciation expense in early years, higher in later years. |

| Expense Pattern | Accelerated depreciation. | Deferred depreciation. |

| Cash Flow Impact | Reduces taxable income earlier, improving early cash flow. | Tax benefits realized later, improving cash flow in later years. |

| Asset Value Reflection | Matches higher asset utility/use in initial years. | Matches prolonged or increasing asset usefulness over time. |

| Common Methods | Double Declining Balance, Sum of Years Digits. | Straight-Line with residual value adjustments, Customized schedules. |

| Best Use | Assets that lose value quickly or become obsolete fast. | Assets that maintain value or productivity longer. |

| Financial Reporting | Higher expenses reduce net income early. | Higher expenses appear in later periods. |

Understanding Car Depreciation: An Overview

Front-loaded depreciation accelerates asset value loss in the initial years, often seen in cars with aggressive resale value drops post-purchase. Rear-loaded depreciation defers higher depreciation expenses to later periods, benefiting vehicles that retain substantial value early on but decline faster later. Understanding these patterns helps buyers and investors anticipate total cost of ownership and resale timing for optimal financial decisions.

What Is Front-Loaded Depreciation?

Front-loaded depreciation is a method where asset value decreases more rapidly in the initial years, reflecting higher expenses early in the asset's life. This approach accelerates tax deductions and reduces taxable income sooner, benefiting cash flow for businesses. It contrasts with rear-loaded depreciation, which allocates more depreciation expense in later years.

What Is Rear-Loaded Depreciation?

Rear-loaded depreciation allocates higher expenses to the later years of an asset's useful life, contrasting front-loaded methods that record higher costs initially. This approach often aligns with assets requiring lower maintenance or where economic benefits increase over time. Businesses use rear-loaded depreciation to match expense recognition with revenue patterns that grow in the asset's maturity phase.

Key Differences Between Front-Loaded and Rear-Loaded Depreciation

Front-loaded depreciation allocates higher expense in the earlier years of an asset's life, reflecting rapid value loss or higher utility, while rear-loaded depreciation spreads higher costs toward the end of the asset's useful life, often capturing maintenance or obsolescence costs later. Key differences include timing of expense recognition, impact on financial statements, and cash flow management, with front-loaded depreciation accelerating tax benefits and rear-loaded depreciation aligning expenses with end-of-life costs. Selecting between methods depends on matching expense patterns with asset usage and financial strategy for optimal tax advantages and profitability reporting.

How Depreciation Patterns Affect Resale Value

Front-loaded depreciation results in higher expense recognition early in an asset's life, reducing book value swiftly and potentially signaling greater initial wear to buyers, which can lower resale value. Rear-loaded depreciation defers expense recognition, maintaining higher book value longer, often suggesting better preserved asset condition and possibly enhancing resale price. Understanding these depreciation patterns helps predict how perceived asset longevity influences market valuations and buyer perceptions.

Factors Influencing Depreciation Schedules

Front-loaded depreciation schedules allocate higher expenses in the early years due to factors such as rapid technological obsolescence or initial usage intensity, resulting in accelerated expense recognition. Rear-loaded depreciation tends to be applied when asset utility or maintenance costs increase over time, reflecting lower early-year expenses and higher costs in later periods. Asset type, industry standards, regulatory requirements, and expected asset lifecycle all critically influence whether front-loaded or rear-loaded depreciation is appropriate for accurate financial reporting.

Car Types Prone to Front-Loaded Depreciation

Luxury cars, sports cars, and high-end electric vehicles are prone to front-loaded depreciation due to rapid initial value loss influenced by technological advancements and market demand shifts. These vehicles often experience sharp declines in market value within the first few years, reflecting front-loaded depreciation patterns. Understanding this trend is crucial for buyers aiming to minimize total cost of ownership on fast-depreciating car types.

Vehicles Commonly Experiencing Rear-Loaded Depreciation

Vehicles commonly experiencing rear-loaded depreciation include classic cars, luxury vehicles with sustained market demand, and certain electric vehicles with improving battery technology. These vehicles maintain higher residual values in later years due to factors like rarity, brand prestige, and technological advancements. Rear-loaded depreciation patterns contrast sharply with rapid initial value drops seen in mainstream vehicles.

Choosing Between Cars with Different Depreciation Curves

Choosing between cars with different depreciation curves requires understanding front-loaded depreciation, where a vehicle loses value rapidly in the initial years, versus rear-loaded depreciation, which features slower early depreciation with value dropping more significantly later. Cars with front-loaded depreciation often offer higher trade-in value shortly after purchase, beneficial for owners planning to sell within a few years. Rear-loaded depreciation vehicles may provide lower monthly costs and longer-term ownership value but can result in larger losses when selling after extended use.

Tips to Minimize Depreciation Losses

Front-loaded depreciation accelerates expense recognition early in an asset's life, reducing taxable income sooner, while rear-loaded depreciation defers expenses, impacting cash flow differently; businesses can minimize depreciation losses by selecting the method aligning with their financial goals and tax strategy. Regular asset revaluation and timely maintenance extend an asset's useful life, enhancing depreciation efficiency. Employing tax incentives and understanding industry-specific depreciation rules also optimize asset cost recovery and minimize overall depreciation impact.

Front-Loaded Depreciation vs Rear-Loaded Depreciation Infographic

cardiffo.com

cardiffo.com