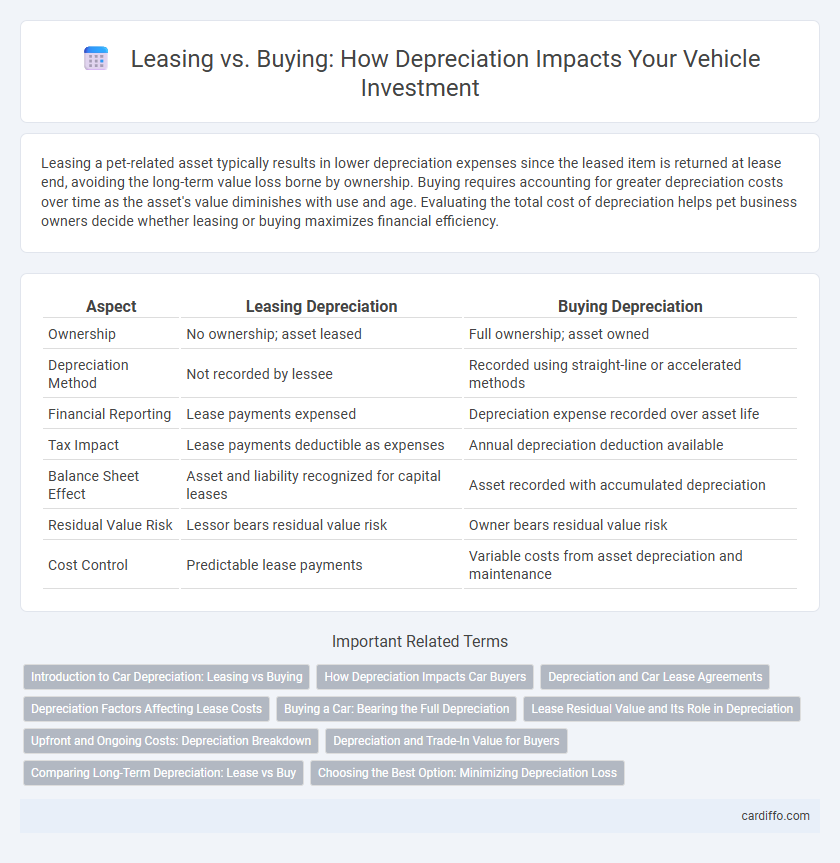

Leasing a pet-related asset typically results in lower depreciation expenses since the leased item is returned at lease end, avoiding the long-term value loss borne by ownership. Buying requires accounting for greater depreciation costs over time as the asset's value diminishes with use and age. Evaluating the total cost of depreciation helps pet business owners decide whether leasing or buying maximizes financial efficiency.

Table of Comparison

| Aspect | Leasing Depreciation | Buying Depreciation |

|---|---|---|

| Ownership | No ownership; asset leased | Full ownership; asset owned |

| Depreciation Method | Not recorded by lessee | Recorded using straight-line or accelerated methods |

| Financial Reporting | Lease payments expensed | Depreciation expense recorded over asset life |

| Tax Impact | Lease payments deductible as expenses | Annual depreciation deduction available |

| Balance Sheet Effect | Asset and liability recognized for capital leases | Asset recorded with accumulated depreciation |

| Residual Value Risk | Lessor bears residual value risk | Owner bears residual value risk |

| Cost Control | Predictable lease payments | Variable costs from asset depreciation and maintenance |

Introduction to Car Depreciation: Leasing vs Buying

Car depreciation significantly affects overall vehicle costs, differing between leasing and buying. When leasing, depreciation is factored into monthly payments, reflecting the vehicle's expected loss in value over the lease term. Buying a car transfers the full depreciation burden to the owner, impacting resale value and long-term equity.

How Depreciation Impacts Car Buyers

Depreciation significantly affects car buyers by reducing the vehicle's resale value over time, making leasing an attractive option for those seeking lower monthly payments and avoiding long-term ownership risks. Buyers who purchase vehicles bear the full brunt of depreciation, which can erode equity and result in greater financial loss if the car is sold within a few years. Leasing transfers the depreciation cost to the lessor, allowing lessees to drive newer models without the concern of significant value decline.

Depreciation and Car Lease Agreements

Car lease agreements typically shift depreciation costs to the leasing company, allowing lessees to pay for only the vehicle's estimated value loss during the lease term. Unlike buying, where owners bear full depreciation impact reducing resale value, leasing incorporates residual value calculations to determine monthly payments. Understanding depreciation's role in leases helps consumers evaluate total costs and avoid unexpected expenses at lease end.

Depreciation Factors Affecting Lease Costs

Lease costs are heavily influenced by the depreciation rate of the leased asset, which depends on factors such as the asset's expected lifespan, residual value, and usage intensity. Higher depreciation rates increase the lessor's risk, leading to higher lease payments to offset potential value loss. Understanding these depreciation variables helps lessees anticipate overall lease expenses and compare them effectively against the costs of purchasing.

Buying a Car: Bearing the Full Depreciation

When buying a car, the owner fully bears the vehicle's depreciation cost, which is typically the largest expense after the purchase price. Depreciation rates can vary significantly depending on the make, model, and age of the car, often exceeding 20% within the first year alone. Owning the vehicle means absorbing these value reductions directly, impacting resale value and overall cost of ownership.

Lease Residual Value and Its Role in Depreciation

Lease residual value significantly impacts depreciation by determining the estimated worth of an asset at the end of the lease term, which influences the monthly lease payments and overall cost. A higher residual value reduces the depreciation expense borne by the lessee, lowering monthly charges compared to buying, where depreciation is calculated on the total asset cost minus salvage value. Understanding residual value trends is crucial for lessees to optimize lease deals and manage depreciation-related expenses effectively.

Upfront and Ongoing Costs: Depreciation Breakdown

Leasing typically involves lower upfront costs since depreciation is spread over the lease term rather than absorbed fully at purchase. Ongoing depreciation expenses in buying accrue as the asset value declines annually, impacting total ownership cost. Understanding the depreciation schedule and residual value is crucial for accurately comparing the financial implications of leasing versus buying.

Depreciation and Trade-In Value for Buyers

Leasing typically reduces concerns about depreciation since the lessee does not own the asset and thus avoids the direct impact of depreciation losses on trade-in value. Buyers who purchase vehicles face depreciation as a significant factor that lowers the trade-in value over time, often losing 20-30% of the vehicle's initial value within the first year. Understanding depreciation schedules and market trends helps buyers make informed decisions to maximize trade-in value and minimize financial loss.

Comparing Long-Term Depreciation: Lease vs Buy

Long-term depreciation differs significantly between leasing and buying assets, with purchasing allowing for tangible asset ownership and depreciation deductions over an extended period, typically following the Modified Accelerated Cost Recovery System (MACRS) for tax purposes. Leasing often results in lower depreciation benefits since lease payments are expensed without capitalizing the asset, limiting depreciation claims to the lessor who owns the asset. Financial analysis of long-term depreciation must consider asset type, lease duration, tax regulations, and residual value to determine the most advantageous approach for asset allocation and tax savings.

Choosing the Best Option: Minimizing Depreciation Loss

Leasing minimizes depreciation loss by transferring the residual value risk to the lessor, making it ideal for assets that rapidly decline in value. Buying offers ownership benefits but exposes the buyer to full depreciation costs, which can be mitigated through strategic asset selection and maintenance. Evaluating total cost of ownership and projected depreciation rates helps determine the most cost-effective option for minimizing financial loss.

Leasing vs Buying Depreciation Infographic

cardiffo.com

cardiffo.com