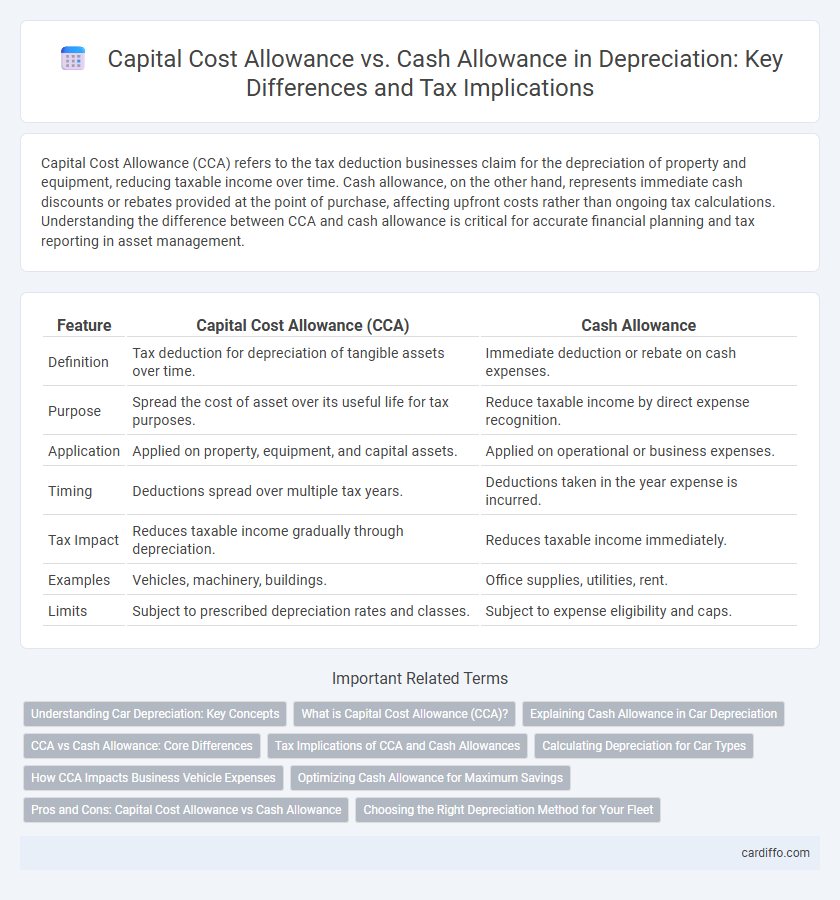

Capital Cost Allowance (CCA) refers to the tax deduction businesses claim for the depreciation of property and equipment, reducing taxable income over time. Cash allowance, on the other hand, represents immediate cash discounts or rebates provided at the point of purchase, affecting upfront costs rather than ongoing tax calculations. Understanding the difference between CCA and cash allowance is critical for accurate financial planning and tax reporting in asset management.

Table of Comparison

| Feature | Capital Cost Allowance (CCA) | Cash Allowance |

|---|---|---|

| Definition | Tax deduction for depreciation of tangible assets over time. | Immediate deduction or rebate on cash expenses. |

| Purpose | Spread the cost of asset over its useful life for tax purposes. | Reduce taxable income by direct expense recognition. |

| Application | Applied on property, equipment, and capital assets. | Applied on operational or business expenses. |

| Timing | Deductions spread over multiple tax years. | Deductions taken in the year expense is incurred. |

| Tax Impact | Reduces taxable income gradually through depreciation. | Reduces taxable income immediately. |

| Examples | Vehicles, machinery, buildings. | Office supplies, utilities, rent. |

| Limits | Subject to prescribed depreciation rates and classes. | Subject to expense eligibility and caps. |

Understanding Car Depreciation: Key Concepts

Capital Cost Allowance (CCA) is a tax deduction in Canada that allows businesses to deduct the depreciable amount of a vehicle over its useful life, directly reducing taxable income. Cash Allowance refers to the actual decrease in a car's market value over time, impacting resale price but not directly affecting tax calculations. Understanding car depreciation requires distinguishing between CCA as an accounting method for tax purposes and cash allowance as the real-world loss in vehicle value.

What is Capital Cost Allowance (CCA)?

Capital Cost Allowance (CCA) is a tax deduction in Canada that allows businesses to recover the cost of depreciable property through annual expense claims. Unlike cash allowance, which represents actual cash payments, CCA reduces taxable income based on the asset's depreciation over time. This mechanism helps businesses align tax relief with asset usage and investment in capital assets.

Explaining Cash Allowance in Car Depreciation

Cash Allowance in car depreciation refers to a reduction in the purchase price offered by the dealer or manufacturer, effectively lowering the initial investment cost. Unlike Capital Cost Allowance, which is a tax deduction representing the depreciation of the vehicle over time, Cash Allowance provides immediate financial relief upfront. This allowance directly affects the vehicle's taxable basis and can influence the overall tax benefits obtained through depreciation claims.

CCA vs Cash Allowance: Core Differences

Capital Cost Allowance (CCA) is a tax deduction that allows businesses to depreciate the cost of tangible assets over time, reducing taxable income, while Cash Allowance represents an actual cash payment or subsidy given to businesses. CCA is non-cash and affects accounting profits by spreading asset costs over multiple years, whereas Cash Allowance directly impacts cash flow with immediate financial benefit. The core difference lies in CCA's function as a tax deferral mechanism and Cash Allowance's role as an immediate financial incentive.

Tax Implications of CCA and Cash Allowances

Capital Cost Allowance (CCA) allows businesses to deduct the depreciation of tangible assets over time, reducing taxable income and deferring tax liability. Cash allowances provide immediate expense recognition but may not offer the same tax deferral benefits as CCA. Understanding the tax implications of CCA versus cash allowances is critical for optimizing cash flow and minimizing overall tax burden.

Calculating Depreciation for Car Types

Calculating depreciation for car types involves distinguishing between Capital Cost Allowance (CCA) and cash allowances, where CCA applies to the gradual expense deduction of a vehicle's capital cost in tax calculations. The CCA method uses prescribed rates based on the class of the vehicle, such as Class 10 for most passenger vehicles with a 30% declining balance rate, ensuring tax deferral over the asset's useful life. In contrast, cash allowances provide a fixed reimbursement or deduction that does not directly reflect the vehicle's depreciating value and are treated separately from CCA for tax purposes.

How CCA Impacts Business Vehicle Expenses

Capital Cost Allowance (CCA) allows businesses to deduct a portion of the vehicle's depreciable cost annually, reducing taxable income and improving cash flow. Unlike cash allowances, CCA spreads the expense over several years based on the vehicle's class, aligning tax benefits with the asset's useful life. Tracking CCA ensures accurate tax reporting and maximizes vehicle-related tax savings for the business.

Optimizing Cash Allowance for Maximum Savings

Capital Cost Allowance (CCA) allows businesses to deduct the depreciation of tangible assets over time, reducing taxable income, while cash allowance provides immediate expense recognition. Optimizing cash allowance involves strategically categorizing and timing expenses to maximize current tax savings without depleting cash flow. Leveraging both CCA scheduling and cash allowances enhances overall tax efficiency and preserves liquidity for reinvestment.

Pros and Cons: Capital Cost Allowance vs Cash Allowance

Capital Cost Allowance (CCA) allows businesses to deduct the depreciation of assets over time, reducing taxable income and spreading tax benefits across multiple years, which enhances long-term tax planning. Cash Allowance provides immediate tax relief by allowing full deduction of expenses in the year incurred, improving short-term cash flow but potentially increasing taxable income in future years. While CCA benefits companies with stable profits seeking gradual tax reductions, Cash Allowance suits businesses needing quick tax savings or facing fluctuating revenues.

Choosing the Right Depreciation Method for Your Fleet

Choosing the right depreciation method for your fleet involves understanding the differences between Capital Cost Allowance (CCA) and Cash Allowance. CCA allows businesses to deduct a percentage of the asset's depreciable value annually, optimizing tax benefits over time, while Cash Allowance offers an immediate deduction but may reduce long-term tax advantages. Evaluating your fleet's usage patterns, asset lifespan, and tax strategy ensures the most efficient depreciation approach for maximizing financial outcomes.

Capital Cost Allowance vs Cash Allowance Infographic

cardiffo.com

cardiffo.com