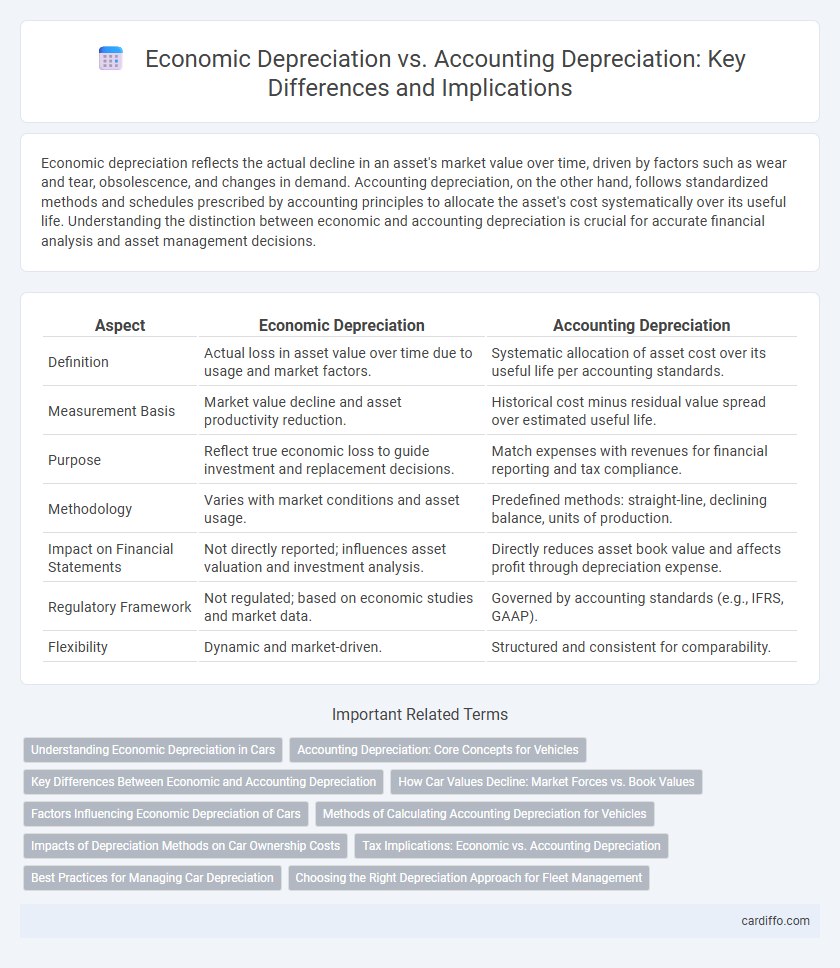

Economic depreciation reflects the actual decline in an asset's market value over time, driven by factors such as wear and tear, obsolescence, and changes in demand. Accounting depreciation, on the other hand, follows standardized methods and schedules prescribed by accounting principles to allocate the asset's cost systematically over its useful life. Understanding the distinction between economic and accounting depreciation is crucial for accurate financial analysis and asset management decisions.

Table of Comparison

| Aspect | Economic Depreciation | Accounting Depreciation |

|---|---|---|

| Definition | Actual loss in asset value over time due to usage and market factors. | Systematic allocation of asset cost over its useful life per accounting standards. |

| Measurement Basis | Market value decline and asset productivity reduction. | Historical cost minus residual value spread over estimated useful life. |

| Purpose | Reflect true economic loss to guide investment and replacement decisions. | Match expenses with revenues for financial reporting and tax compliance. |

| Methodology | Varies with market conditions and asset usage. | Predefined methods: straight-line, declining balance, units of production. |

| Impact on Financial Statements | Not directly reported; influences asset valuation and investment analysis. | Directly reduces asset book value and affects profit through depreciation expense. |

| Regulatory Framework | Not regulated; based on economic studies and market data. | Governed by accounting standards (e.g., IFRS, GAAP). |

| Flexibility | Dynamic and market-driven. | Structured and consistent for comparability. |

Understanding Economic Depreciation in Cars

Economic depreciation in cars reflects the actual loss in market value over time due to factors such as usage, wear and tear, and technological obsolescence, presenting a more realistic financial impact than accounting depreciation. Unlike accounting depreciation, which often follows standardized methods like straight-line or declining balance for tax and record-keeping purposes, economic depreciation captures fluctuations in car value driven by supply-demand dynamics and market conditions. Understanding economic depreciation helps car owners and buyers make informed decisions about resale value, insurance, and investment in vehicle maintenance.

Accounting Depreciation: Core Concepts for Vehicles

Accounting depreciation for vehicles allocates the cost of a vehicle systematically over its useful life using methods such as straight-line or declining balance. This approach matches vehicle expense to periods benefiting from its use, reflecting wear and tear, obsolescence, and usage patterns. Unlike economic depreciation, accounting depreciation follows standardized rules aimed at financial reporting and tax compliance rather than real-time market value changes.

Key Differences Between Economic and Accounting Depreciation

Economic depreciation measures the actual decline in an asset's market value over time, reflecting its real economic loss, while accounting depreciation allocates the asset's cost systematically over its useful life based on accounting standards. Economic depreciation varies with market conditions and asset usage, whereas accounting depreciation follows predefined methods such as straight-line or declining balance for financial reporting and tax purposes. The key difference lies in economic depreciation representing true value loss, and accounting depreciation focusing on expense recognition and compliance.

How Car Values Decline: Market Forces vs. Book Values

Economic depreciation reflects the actual decline in a car's market value driven by factors such as mileage, condition, and demand fluctuations, while accounting depreciation allocates the car's cost systematically over its useful life based on predefined schedules. Market forces cause the vehicle's resale price to drop as supply, consumer preferences, and technological advancements evolve, leading to economic depreciation that may differ significantly from accounting records. Book values, calculated using methods like straight-line or declining-balance, often lag behind or underestimate the real-time market value changes impacting a car's true economic worth.

Factors Influencing Economic Depreciation of Cars

Economic depreciation of cars depends on factors such as market demand fluctuations, technological advancements, and changing consumer preferences. Engine efficiency improvements and emission regulations accelerate value loss by making older models less desirable. Geographic location and vehicle usage intensity also significantly affect the rate at which a car's economic value declines over time.

Methods of Calculating Accounting Depreciation for Vehicles

Accounting depreciation for vehicles commonly employs methods such as straight-line, declining balance, and units of production to allocate the asset's cost over its useful life. The straight-line method spreads the cost evenly, while the declining balance accelerates expense recognition in earlier years. Units of production ties depreciation directly to vehicle usage, providing a flexible approach aligned with actual wear and tear.

Impacts of Depreciation Methods on Car Ownership Costs

Economic depreciation reflects the actual decline in a car's market value over time, whereas accounting depreciation follows standardized methods like straight-line or declining balance for financial reporting. Choosing economic depreciation provides a more accurate assessment of car ownership costs by capturing real-world value loss, affecting resale price predictions and tax considerations. Accounting depreciation impacts financial statements and tax deductions but may understate or overstate true economic costs, influencing budgeting and investment decisions for car owners.

Tax Implications: Economic vs. Accounting Depreciation

Economic depreciation reflects the actual loss in an asset's market value over time, influencing economic decisions and investment strategies. Accounting depreciation follows standardized methods for allocating an asset's cost over its useful life, directly affecting reported financial statements and taxable income. Tax implications arise because tax authorities often rely on accounting depreciation for deductions, which can differ significantly from the economic depreciation, impacting taxable profits and tax liabilities.

Best Practices for Managing Car Depreciation

Economic depreciation reflects the actual decline in a vehicle's market value over time, while accounting depreciation follows standardized methods like straight-line or declining balance for financial reporting. Best practices for managing car depreciation involve regularly assessing the vehicle's market value to align insurance and resale expectations, maintaining detailed maintenance records to preserve asset condition, and choosing accounting methods that mirror the car's usage pattern for accurate expense tracking. Implementing a strategy that incorporates both economic and accounting perspectives ensures optimized tax benefits and financial transparency.

Choosing the Right Depreciation Approach for Fleet Management

Economic depreciation reflects the actual loss in value of fleet assets due to wear and market conditions, providing a realistic measure for decision-making in fleet management. Accounting depreciation follows standardized methods such as straight-line or declining balance to allocate asset costs over their useful life, ensuring compliance with financial reporting standards. Selecting the appropriate depreciation approach depends on balancing accurate asset valuation with regulatory requirements to optimize maintenance, replacement, and budgeting strategies for fleet operations.

Economic Depreciation vs Accounting Depreciation Infographic

cardiffo.com

cardiffo.com