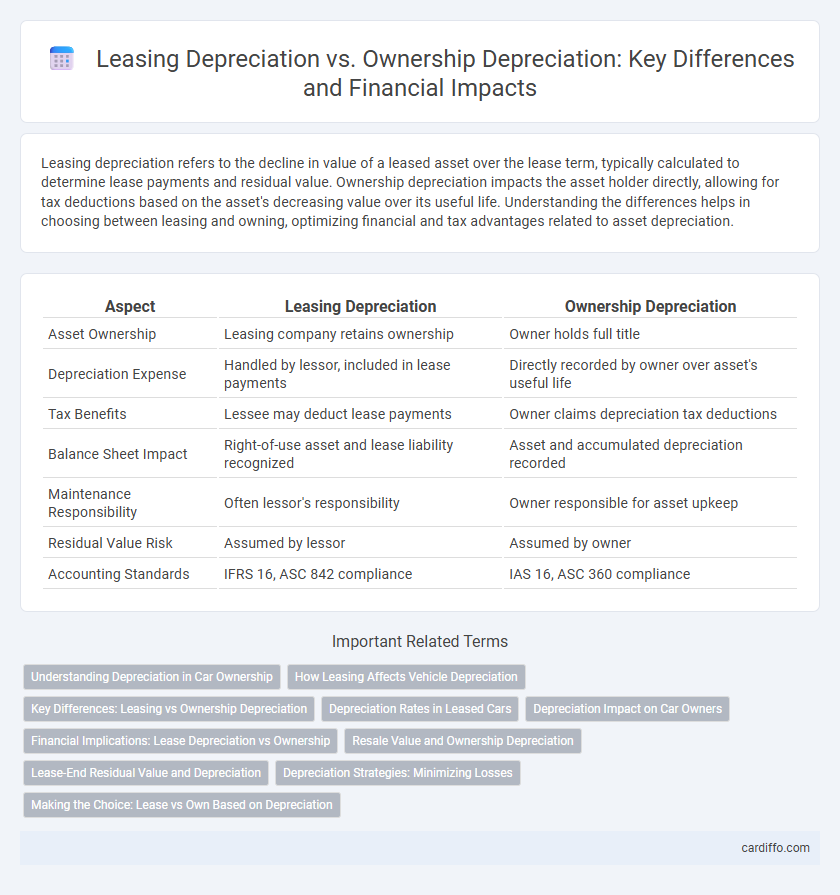

Leasing depreciation refers to the decline in value of a leased asset over the lease term, typically calculated to determine lease payments and residual value. Ownership depreciation impacts the asset holder directly, allowing for tax deductions based on the asset's decreasing value over its useful life. Understanding the differences helps in choosing between leasing and owning, optimizing financial and tax advantages related to asset depreciation.

Table of Comparison

| Aspect | Leasing Depreciation | Ownership Depreciation |

|---|---|---|

| Asset Ownership | Leasing company retains ownership | Owner holds full title |

| Depreciation Expense | Handled by lessor, included in lease payments | Directly recorded by owner over asset's useful life |

| Tax Benefits | Lessee may deduct lease payments | Owner claims depreciation tax deductions |

| Balance Sheet Impact | Right-of-use asset and lease liability recognized | Asset and accumulated depreciation recorded |

| Maintenance Responsibility | Often lessor's responsibility | Owner responsible for asset upkeep |

| Residual Value Risk | Assumed by lessor | Assumed by owner |

| Accounting Standards | IFRS 16, ASC 842 compliance | IAS 16, ASC 360 compliance |

Understanding Depreciation in Car Ownership

Understanding depreciation in car ownership requires comparing leasing depreciation and ownership depreciation, where leased vehicles often show higher annual depreciation costs due to residual value adjustments. Ownership depreciation reflects a gradual loss in vehicle value over time, influenced by mileage and wear, impacting resale price directly. Accurate knowledge of these depreciation patterns helps car owners make informed financial decisions regarding purchasing or leasing options.

How Leasing Affects Vehicle Depreciation

Leasing significantly influences vehicle depreciation by transferring the financial impact of value loss to the leasing company rather than the lessee, resulting in lower monthly payments compared to outright ownership. Lessees avoid the risk of steep depreciation since they only pay for the vehicle's estimated depreciation during the lease term, not the full decrease in market value. Ownership depreciation directly affects the owner's equity as the vehicle loses value over time, impacting resale value and total cost of ownership.

Key Differences: Leasing vs Ownership Depreciation

Leasing depreciation focuses on the asset's residual value and lease term, resulting in lower monthly expenses compared to ownership depreciation, which accounts for the total asset cost spread over its useful life. Ownership depreciation allows for tax deductions on asset value decline, offering potential capital expense benefits, whereas leasing depreciation typically simplifies accounting by including depreciation within lease payments. The financial impact varies as ownership incurs upfront costs and maintenance responsibilities, while leasing shifts asset risk and depreciation management to the lessor.

Depreciation Rates in Leased Cars

Depreciation rates in leased cars often appear higher because lease agreements typically account for the vehicle's expected loss in value over the lease term, reflecting accelerated depreciation compared to ownership. Ownership depreciation allows cost recovery over a longer period, spreading the vehicle's value decline more gradually and often benefiting from tax deductions related to depreciation schedules. Lease depreciation focuses on residual value estimates, influencing monthly payments by predicting how much the car will depreciate over the lease period.

Depreciation Impact on Car Owners

Leasing depreciation typically results in lower monthly payments for car owners since the lease is based on the vehicle's expected depreciation during the lease term, rather than its full purchase price. Ownership depreciation directly impacts the car owner's equity, as the vehicle's value decreases over time and affects potential resale value. Understanding depreciation rates and how they differ between leasing and ownership is crucial for car owners to optimize financial decisions related to vehicle costs.

Financial Implications: Lease Depreciation vs Ownership

Lease depreciation impacts financial statements by reducing lease liability and right-of-use assets, often resulting in lower upfront expenses and improved cash flow compared to ownership. Ownership depreciation allows for asset value reduction reflected as an expense, directly affecting net income and providing potential tax benefits through accelerated depreciation methods. The choice between lease and ownership depreciation influences key financial metrics, investment decisions, and tax planning strategies within a company.

Resale Value and Ownership Depreciation

Leasing depreciation typically reflects the vehicle's estimated loss in value during the lease term, often resulting in lower monthly payments due to the lessor assuming residual risk. Ownership depreciation directly impacts the owner's equity, as the vehicle's resale value after the ownership period determines the actual financial loss when selling. High resale value reduces ownership depreciation costs, making vehicles with strong market demand more cost-effective to own long-term.

Lease-End Residual Value and Depreciation

Lease-end residual value significantly influences leasing depreciation, as it determines the expected asset worth at lease termination, directly impacting monthly lease payments and overall cost. Ownership depreciation depends on the asset's purchase price, useful life, and method chosen, such as straight-line or declining balance, reflecting the actual loss in value over time. Comparing both, leasing depreciation often results in lower upfront costs and fixed monthly expenses tied to the residual value, whereas ownership depreciation offers tax benefits and asset control but entails higher upfront investment and residual value risk.

Depreciation Strategies: Minimizing Losses

Leasing depreciation strategies focus on minimizing losses by aligning the asset's residual value with lease terms, reducing risk exposure and preserving cash flow. Ownership depreciation involves accelerated methods such as double declining balance to maximize early tax benefits, offsetting purchase costs and lowering taxable income. Effective depreciation management requires balancing asset usage, market value fluctuations, and tax regulations to optimize financial outcomes.

Making the Choice: Lease vs Own Based on Depreciation

Leasing depreciation reflects the vehicle's loss in value over the lease term, typically based on residual value set by the lessor, resulting in predictable monthly expenses. Ownership depreciation is the actual decrease in the asset's value over time, influenced by factors such as market demand, mileage, and condition, impacting resale value. Choosing between lease and ownership depends on the financial strategy: leasing offers controlled depreciation costs without ownership risk, while owning allows potential equity retention despite exposure to full depreciation.

Leasing Depreciation vs Ownership Depreciation Infographic

cardiffo.com

cardiffo.com