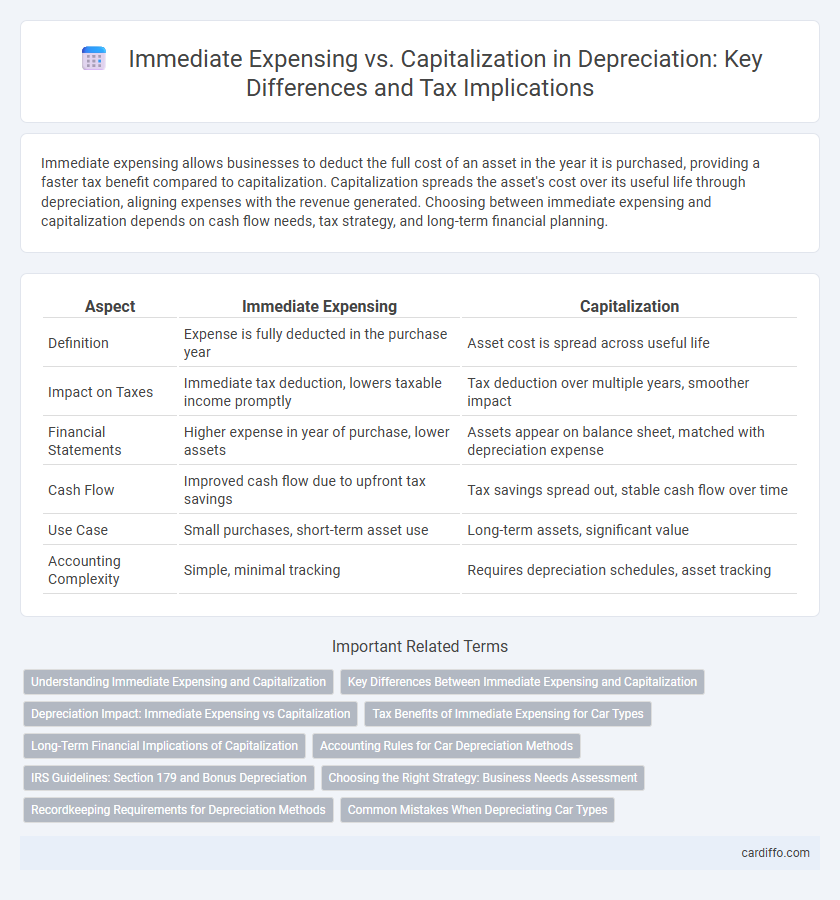

Immediate expensing allows businesses to deduct the full cost of an asset in the year it is purchased, providing a faster tax benefit compared to capitalization. Capitalization spreads the asset's cost over its useful life through depreciation, aligning expenses with the revenue generated. Choosing between immediate expensing and capitalization depends on cash flow needs, tax strategy, and long-term financial planning.

Table of Comparison

| Aspect | Immediate Expensing | Capitalization |

|---|---|---|

| Definition | Expense is fully deducted in the purchase year | Asset cost is spread across useful life |

| Impact on Taxes | Immediate tax deduction, lowers taxable income promptly | Tax deduction over multiple years, smoother impact |

| Financial Statements | Higher expense in year of purchase, lower assets | Assets appear on balance sheet, matched with depreciation expense |

| Cash Flow | Improved cash flow due to upfront tax savings | Tax savings spread out, stable cash flow over time |

| Use Case | Small purchases, short-term asset use | Long-term assets, significant value |

| Accounting Complexity | Simple, minimal tracking | Requires depreciation schedules, asset tracking |

Understanding Immediate Expensing and Capitalization

Immediate expensing allows businesses to deduct the full cost of eligible assets in the year of purchase, accelerating tax benefits and improving cash flow. Capitalization requires spreading the asset's cost over its useful life through depreciation, matching expense recognition with the asset's economic benefits. Understanding when to apply immediate expensing versus capitalization depends on tax regulations, asset type, and financial strategy to optimize tax efficiency and financial reporting.

Key Differences Between Immediate Expensing and Capitalization

Immediate expensing allows businesses to deduct the full cost of an asset in the year of purchase, improving cash flow and reducing taxable income immediately. Capitalization requires spreading the asset's cost over its useful life through depreciation or amortization, matching expenses with revenue generation over time. Key differences include the timing of expense recognition, impact on financial statements, and tax implications, with immediate expensing often favored for smaller purchases and capitalization mandated for significant, long-term assets.

Depreciation Impact: Immediate Expensing vs Capitalization

Immediate expensing accelerates cost recognition by deducting the full asset cost in the purchase year, resulting in higher initial tax savings but no future depreciation expense. Capitalization spreads the asset cost over its useful life through depreciation, offering a consistent annual expense and matched revenue recognition. This approach impacts financial statements and cash flow timing differently, influencing investment decisions and tax planning strategies.

Tax Benefits of Immediate Expensing for Car Types

Immediate expensing allows businesses to deduct the full purchase price of qualifying vehicles in the year of acquisition, providing significant tax benefits compared to capitalization and gradual depreciation. This method reduces taxable income swiftly, enhancing cash flow for investments in cars usually classified under passenger vehicles, trucks, or SUVs. The tax code often sets specific limits and eligibility criteria for different car types, maximizing short-term tax savings and simplifying accounting processes.

Long-Term Financial Implications of Capitalization

Capitalization spreads the cost of an asset over its useful life, aligning expenses with the asset's revenue-generating period and enhancing long-term financial accuracy. This approach improves balance sheet strength by adding assets rather than expenses, positively impacting key financial ratios such as return on assets and debt-to-equity. Over time, capitalization supports more predictable net income, facilitating better financial planning and investment decisions.

Accounting Rules for Car Depreciation Methods

Accounting rules for car depreciation methods require firms to choose between immediate expensing and capitalization based on the vehicle's cost and useful life. Immediate expensing allows businesses to deduct the entire purchase price of a qualifying car in the year of acquisition, adhering to Section 179 of the IRS tax code, while capitalization mandates spreading the vehicle's cost over its estimated useful life using methods such as straight-line or MACRS depreciation. The IRS enforces strict guidelines and limits on immediate expensing for passenger vehicles, often referred to as luxury auto limits, influencing the choice of depreciation strategy to optimize tax benefits.

IRS Guidelines: Section 179 and Bonus Depreciation

Section 179 of the IRS code allows businesses to immediately expense the entire cost of qualifying property up to a specified limit, fostering cash flow advantages by reducing taxable income in the acquisition year. Bonus depreciation enables businesses to deduct a significant percentage of the purchase price of eligible assets in the first year, applicable to new and used property, supplementing Section 179 benefits. Combining these provisions strategically optimizes tax savings while complying with IRS depreciation rules for tangible business property.

Choosing the Right Strategy: Business Needs Assessment

Selecting between immediate expensing and capitalization depends on the business's cash flow requirements, tax strategy, and long-term asset management goals. Immediate expensing accelerates deductions, improving short-term cash flow but reducing future depreciation benefits, while capitalization spreads expense recognition over the asset's useful life, aligning with long-term profitability analysis. Evaluating the impact on financial statements and tax obligations ensures the chosen approach supports sustainable business growth and regulatory compliance.

Recordkeeping Requirements for Depreciation Methods

Immediate expensing simplifies recordkeeping by allowing businesses to deduct the full cost of an asset in the year of purchase, eliminating the need to track depreciation schedules over multiple periods. Capitalization requires detailed records of asset cost, useful life, salvage value, and accumulated depreciation to accurately apply systematic depreciation methods like MACRS or straight-line. Maintaining precise documentation ensures compliance with IRS regulations and supports accurate financial reporting.

Common Mistakes When Depreciating Car Types

Common mistakes when depreciating car types include incorrectly classifying vehicles between passenger cars and SUVs, leading to improper application of depreciation limits. Immediate expensing is often overlooked for low-cost vehicles under the Section 179 deduction, while capitalization mistakes arise from failing to separate improvements from routine maintenance. Accurate asset classification and understanding IRS depreciation guidelines prevent errors that affect tax reporting and financial statements.

Immediate Expensing vs Capitalization Infographic

cardiffo.com

cardiffo.com