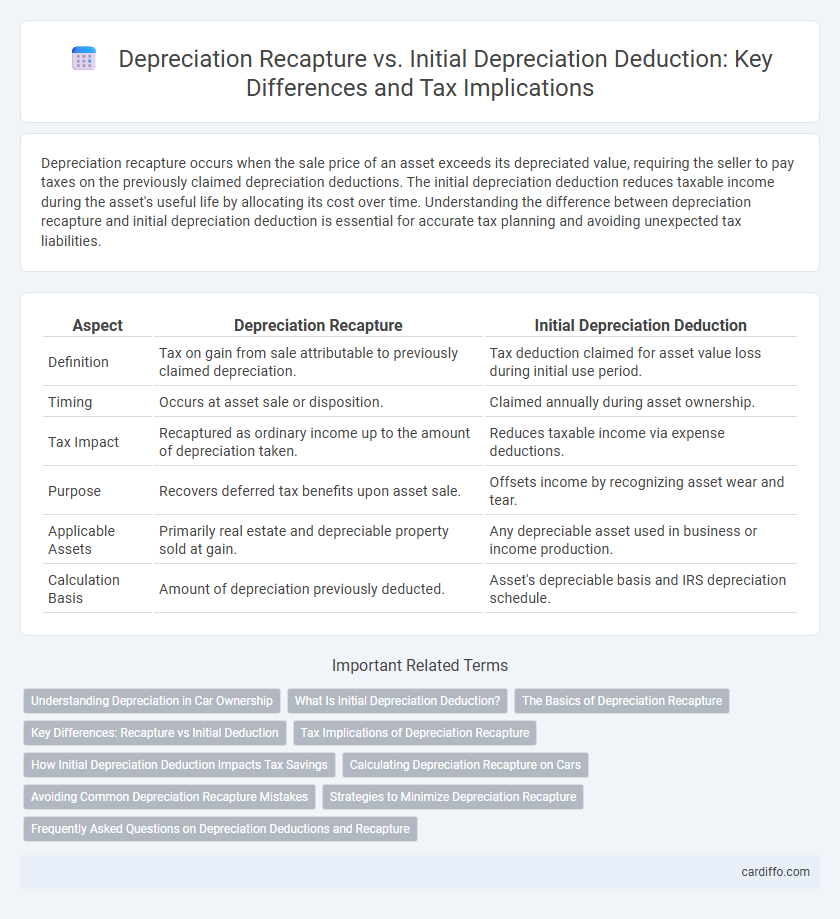

Depreciation recapture occurs when the sale price of an asset exceeds its depreciated value, requiring the seller to pay taxes on the previously claimed depreciation deductions. The initial depreciation deduction reduces taxable income during the asset's useful life by allocating its cost over time. Understanding the difference between depreciation recapture and initial depreciation deduction is essential for accurate tax planning and avoiding unexpected tax liabilities.

Table of Comparison

| Aspect | Depreciation Recapture | Initial Depreciation Deduction |

|---|---|---|

| Definition | Tax on gain from sale attributable to previously claimed depreciation. | Tax deduction claimed for asset value loss during initial use period. |

| Timing | Occurs at asset sale or disposition. | Claimed annually during asset ownership. |

| Tax Impact | Recaptured as ordinary income up to the amount of depreciation taken. | Reduces taxable income via expense deductions. |

| Purpose | Recovers deferred tax benefits upon asset sale. | Offsets income by recognizing asset wear and tear. |

| Applicable Assets | Primarily real estate and depreciable property sold at gain. | Any depreciable asset used in business or income production. |

| Calculation Basis | Amount of depreciation previously deducted. | Asset's depreciable basis and IRS depreciation schedule. |

Understanding Depreciation in Car Ownership

Depreciation recapture occurs when a vehicle sold for more than its depreciated value triggers taxation on the previously claimed depreciation deductions, impacting overall tax liability. Initial depreciation deduction allows car owners to reduce taxable income by accounting for vehicle wear and tear over the ownership period. Understanding these concepts is crucial for maximizing tax benefits and accurately assessing the financial impact of car ownership.

What Is Initial Depreciation Deduction?

Initial depreciation deduction refers to the amount of depreciation expense a taxpayer can deduct in the early years of an asset's useful life, typically using methods like the Modified Accelerated Cost Recovery System (MACRS) in the U.S. tax code. This deduction reduces taxable income by accounting for the asset's wear and tear or obsolescence, spreading the cost over a defined recovery period. It differs from depreciation recapture, which involves taxing the gain realized upon the sale of an asset due to previously claimed depreciation deductions.

The Basics of Depreciation Recapture

Depreciation recapture occurs when an asset sold for more than its depreciated value triggers a tax on the gain previously deducted through depreciation. This recapture converts what would be a capital gain into ordinary income up to the amount of the accumulated depreciation. Understanding the basics of depreciation recapture is crucial for accurately calculating tax liabilities after asset disposition.

Key Differences: Recapture vs Initial Deduction

Depreciation recapture involves taxing the gain realized when an asset is sold for more than its depreciated value, whereas the initial depreciation deduction reduces taxable income by accounting for asset wear and tear during ownership. The initial deduction provides immediate tax benefits by lowering taxable income each year, but recapture imposes a tax liability upon sale, effectively reversing some of those prior deductions. Depreciation recapture is taxed as ordinary income or at a specific recapture rate, contrasting with the initial deduction's role of deferring tax until asset disposition.

Tax Implications of Depreciation Recapture

Depreciation recapture triggers tax liabilities when selling an asset, requiring taxpayers to report previously claimed depreciation deductions as ordinary income, which can significantly increase the tax burden compared to the initial depreciation deduction. Initial depreciation deductions reduce taxable income during the asset's ownership, providing immediate tax relief, but recaptured depreciation is taxed at higher ordinary income rates upon sale. Understanding the tax implications of depreciation recapture ensures proper planning for capital gains and avoids unexpected tax consequences.

How Initial Depreciation Deduction Impacts Tax Savings

Initial depreciation deduction reduces taxable income by allowing property owners to deduct the loss in asset value annually, which directly lowers current tax liabilities. This upfront tax benefit enhances cash flow, but may trigger depreciation recapture upon sale, causing some deferred tax to be taxed as ordinary income. Understanding how initial depreciation deductions affect tax savings helps investors strategically plan for future tax impacts and maximize overall investment returns.

Calculating Depreciation Recapture on Cars

Calculating depreciation recapture on cars involves determining the difference between the sale price and the adjusted basis, which includes the initial depreciation deductions claimed. When a vehicle is sold for more than its adjusted basis, the excess amount is subject to recapture and taxed as ordinary income, reversing part or all of the prior depreciation benefits. Understanding the specific IRS rules for passenger vehicles, including luxury auto limits and alternative depreciation systems, is crucial for accurate recapture calculation.

Avoiding Common Depreciation Recapture Mistakes

Understanding the difference between depreciation recapture and the initial depreciation deduction is crucial to avoid costly tax mistakes during asset disposition. Depreciation recapture occurs when the sale price of an asset exceeds its adjusted basis, requiring taxpayers to pay tax on the accumulated depreciation as ordinary income. Properly tracking initial depreciation deductions and maintaining accurate records prevents underestimating taxable gains and ensures compliance with IRS regulations.

Strategies to Minimize Depreciation Recapture

Minimizing depreciation recapture involves strategic planning such as utilizing Section 1031 like-kind exchanges to defer gains and carefully managing the mix of accelerated depreciation methods with straight-line depreciation to reduce recapture exposure. Implementing cost segregation studies can maximize initial depreciation deductions while maintaining flexibility for future tax planning. Consulting a tax professional helps tailor strategies to specific asset types and holding periods, optimizing long-term tax outcomes.

Frequently Asked Questions on Depreciation Deductions and Recapture

Depreciation recapture occurs when a property is sold for more than its depreciated value, requiring a portion of the gain to be taxed as ordinary income, unlike the initial depreciation deduction which reduces taxable income during ownership. Taxpayers often ask how recapture impacts their overall tax liability and whether it applies to all types of depreciable assets. Understanding the differences between allowable initial deductions and potential recapture upon sale is essential for effective tax planning and compliance.

Depreciation Recapture vs Initial Depreciation Deduction Infographic

cardiffo.com

cardiffo.com