Actual Cash Value (ACV) reflects the depreciated worth of an item considering age, wear, and tear, often resulting in a lower payout after damage or loss. Replacement Value (RV) covers the cost to purchase a new, identical item without subtracting depreciation, ensuring full cost recovery for repairs or replacements. Understanding the distinction between ACV and RV helps pet owners make informed decisions about insurance coverage options.

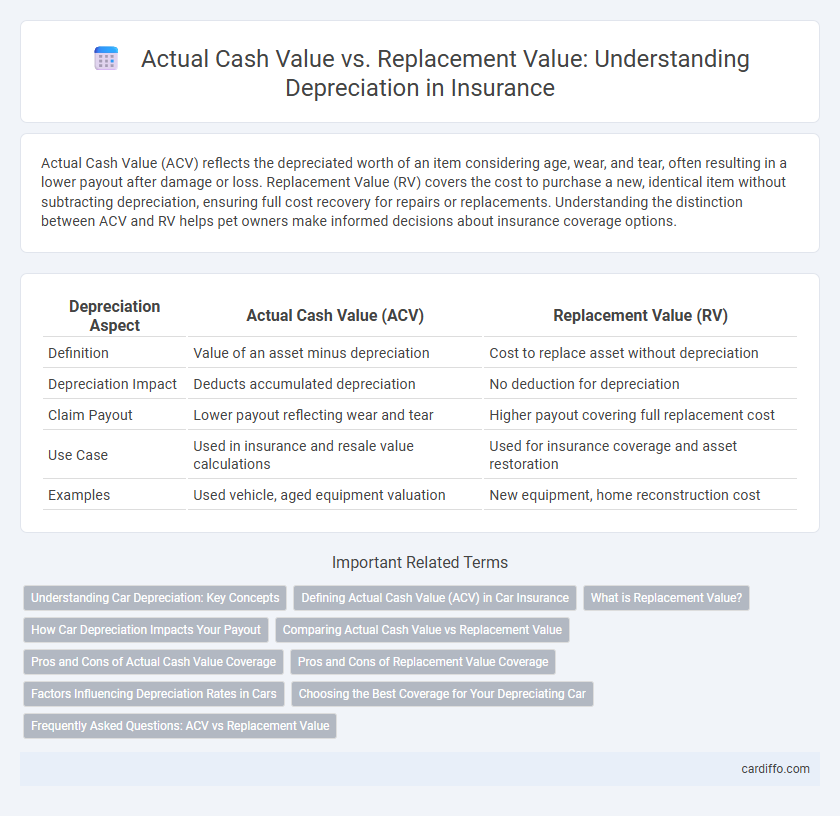

Table of Comparison

| Depreciation Aspect | Actual Cash Value (ACV) | Replacement Value (RV) |

|---|---|---|

| Definition | Value of an asset minus depreciation | Cost to replace asset without depreciation |

| Depreciation Impact | Deducts accumulated depreciation | No deduction for depreciation |

| Claim Payout | Lower payout reflecting wear and tear | Higher payout covering full replacement cost |

| Use Case | Used in insurance and resale value calculations | Used for insurance coverage and asset restoration |

| Examples | Used vehicle, aged equipment valuation | New equipment, home reconstruction cost |

Understanding Car Depreciation: Key Concepts

Understanding car depreciation involves recognizing the difference between Actual Cash Value (ACV) and Replacement Value in auto insurance claims. ACV reflects the vehicle's market value after deducting depreciation based on age, mileage, and condition, while Replacement Value covers the cost of purchasing a new car of similar make and model without factoring in depreciation. This distinction impacts the compensation amount during claims, influencing decisions on repairs or replacement.

Defining Actual Cash Value (ACV) in Car Insurance

Actual Cash Value (ACV) in car insurance refers to the vehicle's replacement cost minus depreciation for age, wear, and tear at the time of loss. Insurers calculate ACV to determine the payout amount, reflecting the car's fair market value rather than the purchase price or replacement cost. This valuation method helps ensure equitable compensation based on the car's current condition and market value.

What is Replacement Value?

Replacement Value refers to the cost required to replace damaged or lost property with a new item of similar kind and quality, without deducting for depreciation. This valuation method ensures that the insured receives sufficient funds to purchase a brand-new equivalent, reflecting current market prices. Replacement Value is favored in insurance policies that aim to restore property to its original condition rather than its depreciated worth.

How Car Depreciation Impacts Your Payout

Car depreciation directly affects your payout by reducing the actual cash value (ACV) of your vehicle, which insurance companies use to determine compensation after a claim. ACV accounts for the car's age, wear and tear, and market demand, resulting in a lower payout compared to replacement value, which covers the cost of buying a new, similar vehicle. Understanding this distinction helps policyholders anticipate lower claim settlements due to the natural decrease in their car's worth over time.

Comparing Actual Cash Value vs Replacement Value

Actual Cash Value (ACV) calculates depreciation by subtracting an asset's age and wear from its original price, reflecting its current market value. Replacement Value covers the cost to purchase a new asset with similar features and functionality, excluding depreciation factors. Understanding the distinction between ACV and Replacement Value is crucial for accurate insurance claims and financial reporting.

Pros and Cons of Actual Cash Value Coverage

Actual Cash Value (ACV) coverage reimburses policyholders for the depreciated value of damaged property, factoring in wear and age at the time of loss. The primary advantage of ACV coverage is its lower premium cost compared to Replacement Value coverage, making it more affordable for many consumers. However, the key drawback is the reduced payout that may not fully cover the cost of repairing or replacing the item with a new equivalent.

Pros and Cons of Replacement Value Coverage

Replacement Value coverage ensures full reimbursement for repairing or replacing damaged property without deducting depreciation, offering stronger financial protection after a loss. It tends to result in higher premiums compared to Actual Cash Value but minimizes out-of-pocket expenses during claims. This coverage is ideal for properties with high depreciation rates or when maintaining the original quality and specifications of the item is essential.

Factors Influencing Depreciation Rates in Cars

Depreciation rates in cars are influenced by factors such as make and model, vehicle age, mileage, and overall condition, which directly impact the difference between actual cash value and replacement value. Market demand and technological advancements also play a significant role in determining how quickly a vehicle loses value over time. Understanding these factors enables accurate calculation of depreciation, essential for insurance claims and resale pricing.

Choosing the Best Coverage for Your Depreciating Car

When selecting coverage for your depreciating car, understanding the difference between Actual Cash Value (ACV) and Replacement Value is crucial. ACV covers the current market value minus depreciation, often resulting in lower payout, while Replacement Value pays for a new equivalent without factoring in depreciation. Opting for Replacement Value coverage ensures better financial protection against depreciation losses in the event of a total loss.

Frequently Asked Questions: ACV vs Replacement Value

Actual Cash Value (ACV) represents the item's replacement cost minus depreciation for age, wear, and tear, while Replacement Value covers the full cost to replace the item without deduction. ACV is commonly used in insurance claims to reflect the current market value, whereas Replacement Value ensures you receive enough to purchase a new equivalent. Understanding the difference helps policyholders determine the true coverage and potential out-of-pocket expenses during claims.

Actual Cash Value vs Replacement Value Infographic

cardiffo.com

cardiffo.com