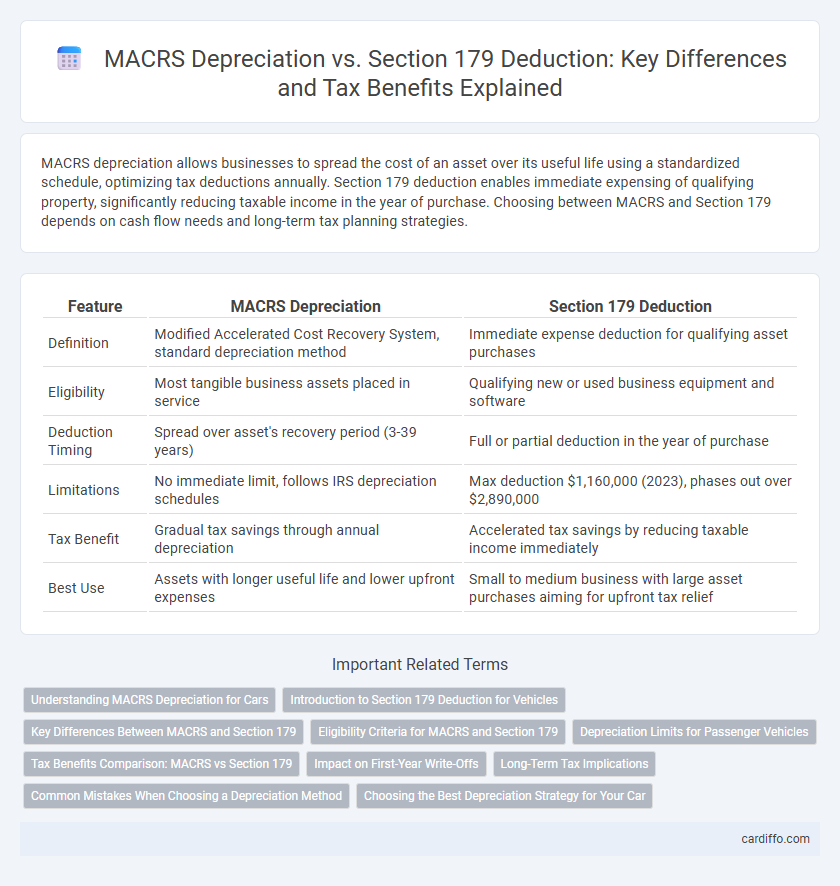

MACRS depreciation allows businesses to spread the cost of an asset over its useful life using a standardized schedule, optimizing tax deductions annually. Section 179 deduction enables immediate expensing of qualifying property, significantly reducing taxable income in the year of purchase. Choosing between MACRS and Section 179 depends on cash flow needs and long-term tax planning strategies.

Table of Comparison

| Feature | MACRS Depreciation | Section 179 Deduction |

|---|---|---|

| Definition | Modified Accelerated Cost Recovery System, standard depreciation method | Immediate expense deduction for qualifying asset purchases |

| Eligibility | Most tangible business assets placed in service | Qualifying new or used business equipment and software |

| Deduction Timing | Spread over asset's recovery period (3-39 years) | Full or partial deduction in the year of purchase |

| Limitations | No immediate limit, follows IRS depreciation schedules | Max deduction $1,160,000 (2023), phases out over $2,890,000 |

| Tax Benefit | Gradual tax savings through annual depreciation | Accelerated tax savings by reducing taxable income immediately |

| Best Use | Assets with longer useful life and lower upfront expenses | Small to medium business with large asset purchases aiming for upfront tax relief |

Understanding MACRS Depreciation for Cars

MACRS Depreciation for cars allows businesses to recover the cost of vehicles over a specified recovery period, typically five years, using the double declining balance method before switching to straight-line depreciation. This method accelerates expense recognition compared to Section 179, which permits immediate expensing of the entire vehicle cost up to a limit, but MACRS spreads deductions over time. Understanding MACRS is essential for tax planning, especially when managing cash flow and maximizing long-term tax benefits for business vehicle investments.

Introduction to Section 179 Deduction for Vehicles

The Section 179 deduction allows businesses to immediately expense the cost of qualifying vehicles up to a certain limit, providing significant tax benefits in the year of purchase. Unlike MACRS depreciation, which spreads the vehicle's cost over several years, Section 179 enables faster cost recovery, improving cash flow for business owners. This deduction is subject to specific vehicle weight and usage criteria, making it essential for businesses to understand eligibility requirements and maximize tax savings.

Key Differences Between MACRS and Section 179

MACRS depreciation allows businesses to recover asset costs over a predetermined schedule based on asset class lives, while Section 179 enables immediate expensing of qualifying property up to a specified limit. MACRS spreads deductions over several years, optimizing long-term tax benefits, whereas Section 179 offers accelerated deductions that reduce taxable income in the acquisition year, subject to annual deduction caps and income limitations. The choice between MACRS and Section 179 depends on cash flow needs, taxable income, and the value of assets purchased within tax year limits.

Eligibility Criteria for MACRS and Section 179

MACRS depreciation eligibility requires property to be placed in service and used in a trade or business with a defined recovery period outlined by IRS property classes, typically including tangible assets such as machinery and equipment. Section 179 deduction eligibility mandates that the property be purchased for business use, acquired for use in the active conduct of a trade or business, and is limited by annual investment caps and taxable income thresholds. Unlike MACRS, Section 179 applies only to specific property types and imposes stricter limits on deduction amounts to encourage immediate expensing within qualifying parameters.

Depreciation Limits for Passenger Vehicles

MACRS Depreciation for passenger vehicles sets annual limits on depreciation deductions, often capping the allowable write-off amount each year to prevent excessive tax benefits. Section 179 Deduction permits immediate expensing of eligible passenger vehicles but imposes strict dollar limits, which vary based on the vehicle's classification and weight, typically limiting deductions to lower amounts for cars and SUVs under 6,000 pounds. Understanding these depreciation limits is crucial for maximizing tax advantages while ensuring compliance with IRS regulations on business vehicle expenses.

Tax Benefits Comparison: MACRS vs Section 179

MACRS depreciation allows businesses to recover the cost of tangible property over a predetermined life span using accelerated depreciation methods, leading to lower taxable income over several years. Section 179 deduction enables immediate expensing of qualified asset purchases up to a specified limit, providing larger upfront tax savings and improved cash flow in the acquisition year. When comparing tax benefits, MACRS offers gradual tax relief, while Section 179 delivers more significant immediate deductions, making it ideal for businesses seeking faster tax write-offs.

Impact on First-Year Write-Offs

MACRS depreciation allows businesses to recover asset costs over a defined recovery period using accelerated methods, resulting in moderate first-year write-offs compared to straight-line depreciation. Section 179 deduction enables immediate expensing of the entire cost of eligible assets up to a specified limit, significantly maximizing first-year tax savings. The choice between MACRS and Section 179 directly impacts cash flow and tax strategy by influencing the timing and amount of depreciation expense recognized in the initial year.

Long-Term Tax Implications

MACRS depreciation spreads asset costs over a fixed recovery period, providing gradual tax deductions that reduce taxable income annually, which can lead to higher cumulative tax benefits over time for long-lived assets. Section 179 deduction allows immediate expensing of qualifying assets up to a certain limit, offering substantial upfront tax relief but potentially lower total deductions in future years. Long-term tax planning must consider potential income fluctuations, asset replacement cycles, and changes in tax law to optimize the balance between accelerated expensing and extended depreciation benefits.

Common Mistakes When Choosing a Depreciation Method

Common mistakes when choosing between MACRS depreciation and the Section 179 deduction include misunderstanding eligibility requirements and the impact on taxable income. Many taxpayers incorrectly assume all property qualifies for Section 179, leading to disallowed deductions. Failing to consider depreciation recapture rules under MACRS can result in unexpected tax liabilities during asset disposition.

Choosing the Best Depreciation Strategy for Your Car

MACRS depreciation allows businesses to recover the cost of their vehicle over a specified recovery period through annual deductions, best suited for those preferring gradual expense recognition. Section 179 deduction enables immediate expensing of the entire car purchase cost up to annual limits, ideal for businesses seeking to maximize upfront tax benefits. Evaluating factors such as vehicle cost, business usage percentage, and yearly taxable income helps determine whether MACRS or Section 179 provides the most effective tax strategy.

MACRS Depreciation vs Section 179 Deduction Infographic

cardiffo.com

cardiffo.com