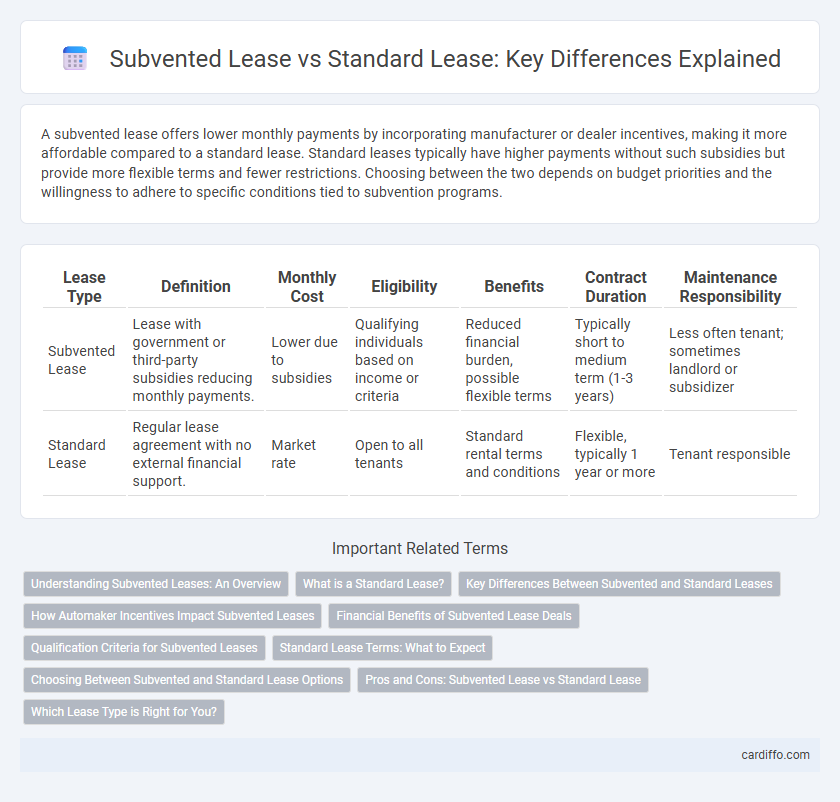

A subvented lease offers lower monthly payments by incorporating manufacturer or dealer incentives, making it more affordable compared to a standard lease. Standard leases typically have higher payments without such subsidies but provide more flexible terms and fewer restrictions. Choosing between the two depends on budget priorities and the willingness to adhere to specific conditions tied to subvention programs.

Table of Comparison

| Lease Type | Definition | Monthly Cost | Eligibility | Benefits | Contract Duration | Maintenance Responsibility |

|---|---|---|---|---|---|---|

| Subvented Lease | Lease with government or third-party subsidies reducing monthly payments. | Lower due to subsidies | Qualifying individuals based on income or criteria | Reduced financial burden, possible flexible terms | Typically short to medium term (1-3 years) | Less often tenant; sometimes landlord or subsidizer |

| Standard Lease | Regular lease agreement with no external financial support. | Market rate | Open to all tenants | Standard rental terms and conditions | Flexible, typically 1 year or more | Tenant responsible |

Understanding Subvented Leases: An Overview

Subvented leases involve financial incentives or subsidies provided by third parties, typically government agencies, to reduce the tenant's rental costs, enhancing affordability. These leases are commonly used in public housing, commercial development projects, and affordable housing initiatives to stimulate growth and accessibility. Standard leases, in contrast, do not include such subsidies, requiring tenants to pay full market rent without external financial support.

What is a Standard Lease?

A standard lease is a legally binding contract between a landlord and tenant that outlines terms such as rent amount, lease duration, and tenant responsibilities without government financial support. Unlike a subvented lease, which includes subsidies or rent assistance to reduce tenant costs, a standard lease requires tenants to pay the full market rent. This type of lease is commonly used in private rental agreements where market conditions dictate rent levels and lease conditions.

Key Differences Between Subvented and Standard Leases

Subvented leases offer lower monthly payments and reduced upfront costs as they involve financial incentives from manufacturers or government programs, while standard leases typically require higher payments without subsidies. Subvented leases are often tied to specific vehicle models or energy-efficient options, making them ideal for buyers seeking cost-effective or eco-friendly choices. Standard leases provide more flexibility in vehicle selection and terms but lack the financial benefits found in subvented agreements.

How Automaker Incentives Impact Subvented Leases

Automaker incentives significantly reduce monthly payments in subvented leases by directly lowering the capitalized cost used to calculate lease charges. These incentives, often offered as cash rebates or special financing rates, make subvented leases more affordable compared to standard leases without such benefits. As a result, subvented leases deliver substantial savings by decreasing the residual and depreciation components included in the lease pricing structure.

Financial Benefits of Subvented Lease Deals

Subvented lease agreements offer significant financial benefits by reducing monthly payments through manufacturer or dealer subsidies, lowering overall lease costs compared to standard leases. These deals often include incentives like reduced down payments and competitive interest rates, enhancing affordability for lessees. The reduced financial burden makes subvented leases an attractive option for consumers seeking cost-effective vehicle financing.

Qualification Criteria for Subvented Leases

Subvented leases require tenants to meet specific financial criteria, including income thresholds and credit score minimums, to qualify for reduced rental rates subsidized by government or institutional programs. Eligibility typically depends on demonstrating financial need, verified through documentation such as tax returns, employment verification, and credit history. These stringent qualification criteria distinguish subvented leases from standard leases, which generally lack income-based restrictions and subsidies.

Standard Lease Terms: What to Expect

Standard lease terms typically require tenants to pay a fixed monthly rent for a predetermined period, often ranging from one to three years, with responsibilities such as utilities, maintenance, and insurance resting largely on the tenant. Security deposits, late payment fees, and penalties for early termination are common clauses that protect landlords' interests in standard leases. Unlike subvented leases, which offer government subsidies or rent control benefits, standard leases provide fewer financial incentives but offer more flexible rental property options.

Choosing Between Subvented and Standard Lease Options

Choosing between subvented and standard lease options depends on budget constraints and financial goals; subvented leases offer lower monthly payments through manufacturer subsidies, making them ideal for cost-conscious lessees. Standard leases typically feature higher payments without subsidies but provide greater flexibility in terms and conditions, appealing to those prioritizing lease customization. Evaluating total lease cost, residual values, and eligibility for incentives ensures optimal lease selection aligned with individual financial strategies.

Pros and Cons: Subvented Lease vs Standard Lease

Subvented leases offer lower monthly payments due to manufacturer or government subsidies, making them cost-effective for budget-conscious lessees. Standard leases provide greater flexibility in terms, mileage limits, and vehicle choice, appealing to those seeking personalized leasing options. However, subvented leases often come with stricter eligibility criteria and limited vehicle selection, while standard leases may result in higher overall costs without financial incentives.

Which Lease Type is Right for You?

Subvented lease offers lower monthly payments through manufacturer incentives, making it ideal for budget-conscious consumers seeking new vehicles with reduced upfront costs. Standard lease provides more flexible terms and fewer restrictions, better suited for drivers who prefer customization and mileage freedom. Evaluating your driving habits, budget, and long-term vehicle use helps determine which lease type aligns best with your financial goals and lifestyle.

Subvented Lease vs Standard Lease Infographic

cardiffo.com

cardiffo.com