A subvention lease offers financial incentives or subsidies that reduce monthly payments, making it more affordable than a standard lease. Standard leases typically have fixed monthly payments without any financial support from manufacturers or dealers. Choosing between the two depends on budget flexibility and the availability of promotional offers.

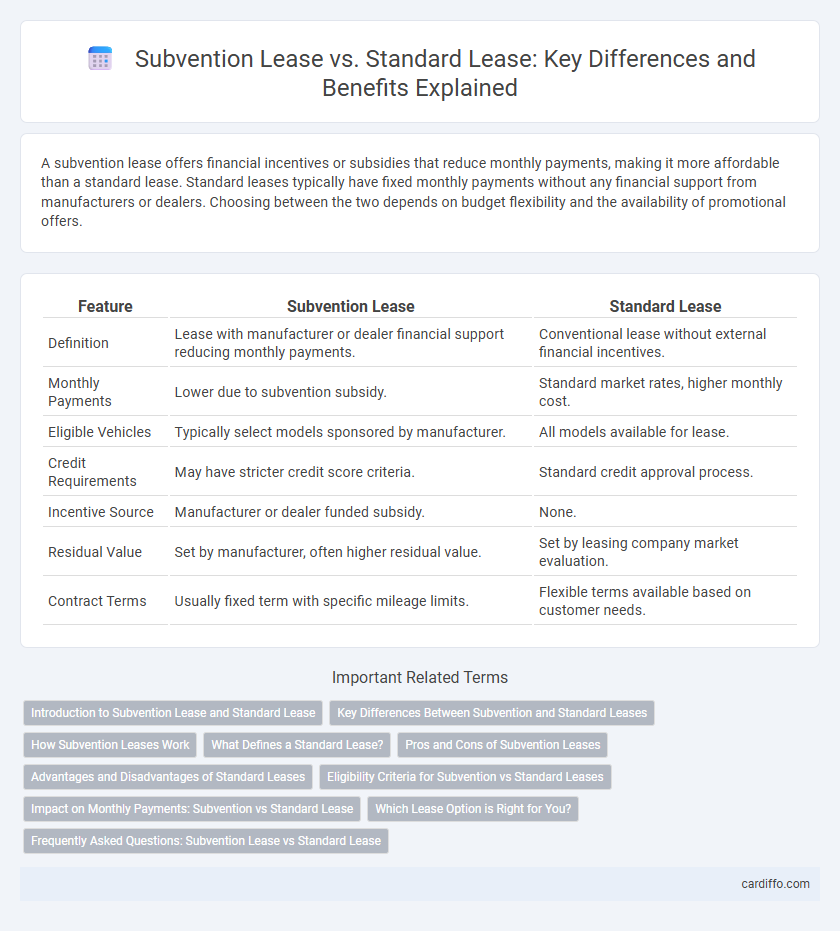

Table of Comparison

| Feature | Subvention Lease | Standard Lease |

|---|---|---|

| Definition | Lease with manufacturer or dealer financial support reducing monthly payments. | Conventional lease without external financial incentives. |

| Monthly Payments | Lower due to subvention subsidy. | Standard market rates, higher monthly cost. |

| Eligible Vehicles | Typically select models sponsored by manufacturer. | All models available for lease. |

| Credit Requirements | May have stricter credit score criteria. | Standard credit approval process. |

| Incentive Source | Manufacturer or dealer funded subsidy. | None. |

| Residual Value | Set by manufacturer, often higher residual value. | Set by leasing company market evaluation. |

| Contract Terms | Usually fixed term with specific mileage limits. | Flexible terms available based on customer needs. |

Introduction to Subvention Lease and Standard Lease

Subvention lease involves a third party, often the manufacturer or dealer, subsidizing the lease payments to reduce the lessee's monthly costs, enhancing affordability compared to standard leases. Standard leases require the lessee to cover the full monthly payments based on depreciation, interest, and fees without external financial support. Understanding the key difference in payment structure helps businesses and consumers choose leases that best fit their financial strategies and asset management goals.

Key Differences Between Subvention and Standard Leases

Subvention leases typically involve a manufacturer or dealer providing financial incentives or subsidies to reduce monthly payments, making them more affordable compared to standard leases. Standard leases require the lessee to bear the full cost of depreciation and interest, resulting in higher monthly payments without external financial support. The key difference lies in the funding source: subvention leases use third-party subsidies to lower costs, whereas standard leases rely solely on market terms and lessee payments.

How Subvention Leases Work

Subvention leases work by offering reduced monthly payments or interest rates subsidized by the manufacturer or dealer, making high-cost vehicles more affordable for lessees. These leases often include incentives such as cash rebates or deferred payments, which are reflected in lower lease charges compared to standard leases. The subsidy helps bridge the gap between the vehicle's market value and the lease terms, providing enhanced affordability and flexible payment options.

What Defines a Standard Lease?

A standard lease is defined by fixed monthly payments over a predetermined term without extra financial incentives or subsidies from the lessor. The lessee assumes responsibility for maintaining the leased asset and adhering to mileage or usage limits specified in the contract. Standard leases typically do not include subventions, meaning they lack dealer or manufacturer financial support that reduces lease costs.

Pros and Cons of Subvention Leases

Subvention leases reduce upfront costs by subsidizing monthly payments, making high-value assets more affordable for businesses. They often include maintenance and service packages, which can lower operational risks but may result in higher overall cost compared to standard leases. However, subvention leases might restrict flexibility with stricter terms and potential penalties for early termination, unlike standard leases which offer more straightforward, transparent agreements.

Advantages and Disadvantages of Standard Leases

Standard leases offer predictable monthly payments and straightforward contract terms, which provide financial stability and ease of budgeting for lessees. They typically require lower initial costs compared to subvention leases but lack the flexible incentives or subsidies that subvention leases provide. A disadvantage of standard leases includes limited negotiation options on interest rates and fewer promotional benefits, potentially leading to higher overall lease expenses.

Eligibility Criteria for Subvention vs Standard Leases

Subvention leases require specific eligibility criteria such as income limits, credit score thresholds, or association with certain organizations or government programs to qualify for reduced interest rates or financial incentives. Standard leases generally have more flexible criteria, mainly focusing on creditworthiness, stable income, and employment verification without additional program-based restrictions. Applicants for subvention leases must meet both financial and program-specific requirements, while standard lease eligibility centers on basic tenant screening standards.

Impact on Monthly Payments: Subvention vs Standard Lease

Subvention leases typically offer lower monthly payments compared to standard leases by incorporating manufacturer incentives or subsidies that reduce the capitalized cost. Standard leases base monthly payments solely on the vehicle's depreciation, interest rate, and residual value, resulting in higher payment amounts without external financial support. Choosing a subvention lease can significantly decrease the monthly financial burden for lessees by leveraging these hidden discounts.

Which Lease Option is Right for You?

Choosing between a subvention lease and a standard lease depends on your financial goals and credit profile; subvention leases often feature lower monthly payments subsidized by manufacturers, making them attractive for those seeking affordability. Standard leases typically have straightforward terms without subsidies, providing more predictable costs but potentially higher payments. Evaluating total lease costs, eligibility for incentives, and personal budget constraints will help determine the most suitable lease option.

Frequently Asked Questions: Subvention Lease vs Standard Lease

Subvention leases typically offer lower monthly payments by subsidizing the interest rate or total lease cost, making them attractive for budget-conscious lessees. Standard leases involve fixed terms and payments without external financial incentives, often resulting in higher monthly costs but greater transparency and predictability. Common questions focus on comparing total lease costs, eligibility for subvention programs, and the impact on residual values at lease-end.

Subvention Lease vs Standard Lease Infographic

cardiffo.com

cardiffo.com