Choosing between an early termination penalty and an early buyout option in a lease agreement significantly impacts financial outcomes. An early termination penalty typically involves paying a fixed fee or remaining lease payments, which can be costly and less flexible. The early buyout option allows lessees to purchase the leased asset before the lease ends, often providing a clearer path to ownership and potentially lower overall costs.

Table of Comparison

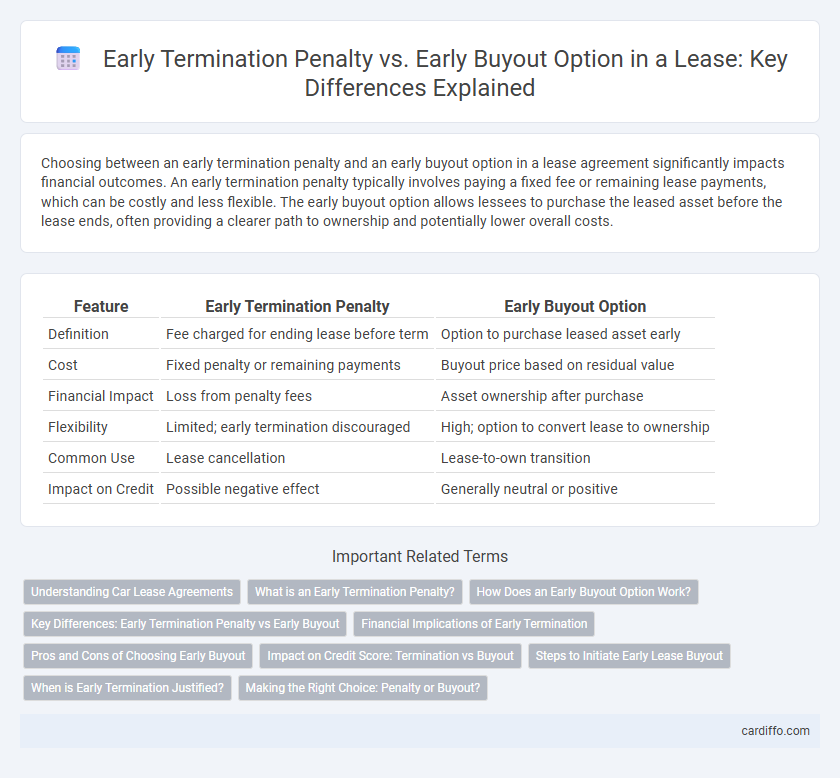

| Feature | Early Termination Penalty | Early Buyout Option |

|---|---|---|

| Definition | Fee charged for ending lease before term | Option to purchase leased asset early |

| Cost | Fixed penalty or remaining payments | Buyout price based on residual value |

| Financial Impact | Loss from penalty fees | Asset ownership after purchase |

| Flexibility | Limited; early termination discouraged | High; option to convert lease to ownership |

| Common Use | Lease cancellation | Lease-to-own transition |

| Impact on Credit | Possible negative effect | Generally neutral or positive |

Understanding Car Lease Agreements

Early termination penalties in car lease agreements often involve substantial fees and remaining lease payments that increase the overall cost of ending the contract prematurely. In contrast, the early buyout option allows lessees to purchase the vehicle before the lease term ends, typically by paying the remaining lease balance plus a predefined residual value. Understanding the specific terms, including residual value, buyout price, and penalty fees, is crucial for lessees to navigate costs effectively and avoid financial surprises.

What is an Early Termination Penalty?

An Early Termination Penalty is a fee charged to lessees who end their lease agreement before the scheduled expiration date, often calculated as a percentage of the remaining lease payments or a fixed sum detailed in the lease contract. This penalty aims to compensate the lessor for potential financial losses and administrative costs associated with the premature lease termination. Understanding the specific terms of the early termination clause in the lease agreement is crucial for lessees to avoid unexpected charges and evaluate alternatives like early buyout options.

How Does an Early Buyout Option Work?

An early buyout option allows lessees to purchase the leased asset before the lease term ends by paying a predetermined buyout price, often specified in the lease agreement. This option provides flexibility and can reduce total costs compared to continuing payments or incurring early termination penalties. Understanding the exact buyout amount and timing is crucial for maximizing financial benefits in a lease contract.

Key Differences: Early Termination Penalty vs Early Buyout

Early termination penalties impose a fixed fee or residual payment if a lease ends before its agreed term, often calculated based on remaining months or depreciation. Early buyout options allow lessees to purchase the leased asset outright by paying the remaining balance or a predetermined price, providing ownership instead of simply ending the lease. The key difference lies in penalties being a charge for ending the lease prematurely, whereas buyouts convert the lease into ownership through a structured payment.

Financial Implications of Early Termination

Early termination penalties often result in substantial financial costs, including fees calculated as a percentage of the remaining lease payments, which can significantly impact a lessee's budget. In contrast, an early buyout option allows the lessee to pay off the remainder of the lease balance, potentially reducing the total financial burden by avoiding ongoing monthly payments and additional penalty fees. Understanding these financial implications is crucial for lessees to make informed decisions that minimize overall expenses when exiting a lease agreement prematurely.

Pros and Cons of Choosing Early Buyout

Choosing an early buyout option in a lease agreement can offer the advantage of ownership transfer, eliminating future lease payments and potential penalties. However, it may require a significant upfront payment and could involve fees exceeding the remaining lease value compared to the early termination penalty. Evaluating the total financial impact, including residual value and market conditions, is essential to determine if an early buyout provides a more cost-effective solution than incurring early termination penalties.

Impact on Credit Score: Termination vs Buyout

Early termination penalties on a lease often result in negative reports to credit bureaus, potentially lowering your credit score as missed or late payments accumulate. In contrast, early buyout options usually involve paying off the remaining lease balance without adverse credit reporting, preserving or even improving credit standing if payments are made on time. Understanding these impacts helps lessees make informed decisions to protect or enhance their credit profiles during lease conclusion.

Steps to Initiate Early Lease Buyout

Initiating an early lease buyout requires reviewing the lease agreement for specific buyout clauses and contacting the leasing company to request the payoff amount, which typically includes the remaining balance plus any applicable fees. After obtaining the buyout quote, arrange financing or payment method and submit a formal buyout request to the lessor, ensuring all documentation is accurate to avoid delays. Completing the buyout transaction allows for immediate ownership transfer, contrasting with early termination penalties that often involve lease-end fees and potential credit impacts.

When is Early Termination Justified?

Early termination of a lease is justified when unforeseen circumstances such as job relocation, financial hardship, or significant changes in personal situations make continuing the lease impractical. The early termination penalty typically involves a fee or forfeiture of the security deposit, whereas the early buyout option allows the lessee to pay a predetermined amount to end the lease without further obligations. Evaluating the cost-effectiveness of the early termination penalty versus the early buyout option depends on the specific lease agreement terms and the lessee's financial situation.

Making the Right Choice: Penalty or Buyout?

Evaluating early termination penalties versus early buyout options requires analyzing total costs, including remaining lease payments and fees. Lease agreements often specify a fixed penalty for early termination, while buyout options involve paying the residual value of the asset, which may lead to ownership benefits. Selecting the optimal choice depends on factors like financial flexibility, asset depreciation, and long-term usage plans.

Early Termination Penalty vs Early Buyout Option Infographic

cardiffo.com

cardiffo.com