Manufacturer leases typically offer competitive rates and incentives directly from the vehicle maker, often including maintenance packages and warranty coverage tailored to their models. Third-party leases provide a broader selection of vehicle makes and flexible terms but may lack the specialized benefits and manufacturer-backed support. Choosing between them depends on preferences for brand-specific perks versus variety and leasing conditions.

Table of Comparison

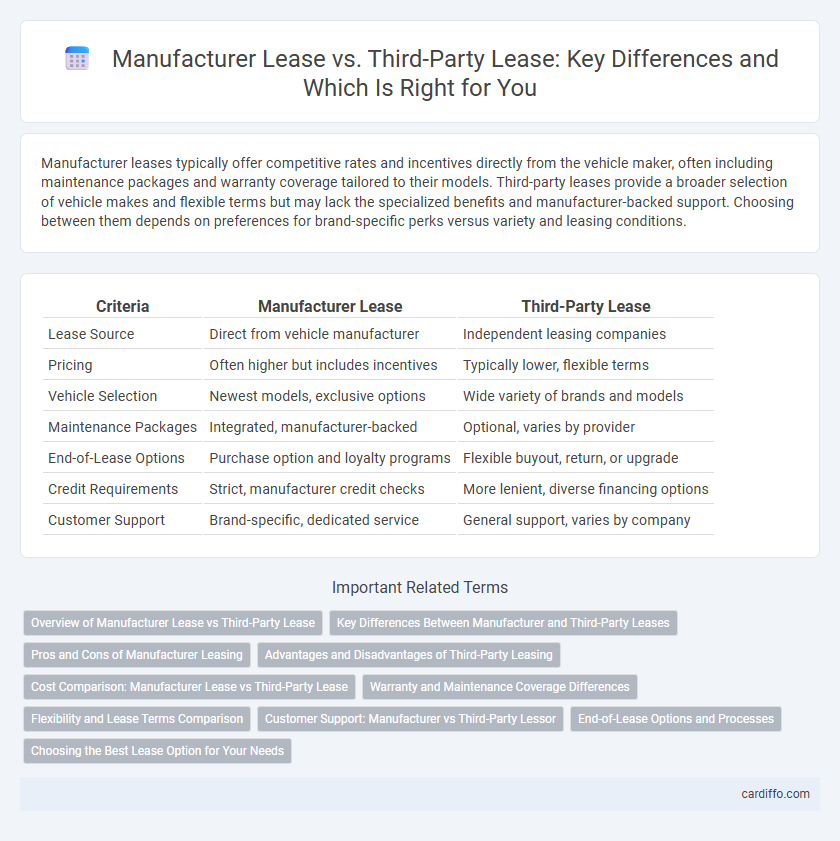

| Criteria | Manufacturer Lease | Third-Party Lease |

|---|---|---|

| Lease Source | Direct from vehicle manufacturer | Independent leasing companies |

| Pricing | Often higher but includes incentives | Typically lower, flexible terms |

| Vehicle Selection | Newest models, exclusive options | Wide variety of brands and models |

| Maintenance Packages | Integrated, manufacturer-backed | Optional, varies by provider |

| End-of-Lease Options | Purchase option and loyalty programs | Flexible buyout, return, or upgrade |

| Credit Requirements | Strict, manufacturer credit checks | More lenient, diverse financing options |

| Customer Support | Brand-specific, dedicated service | General support, varies by company |

Overview of Manufacturer Lease vs Third-Party Lease

Manufacturer lease agreements typically involve direct contracts between the lessee and the vehicle manufacturer or its finance arm, often providing incentives like lower interest rates and loyalty bonuses. Third-party leases are offered by independent companies that may provide more flexible terms, a wider selection of vehicle brands, and potentially competitive pricing without manufacturer restrictions. Choosing between manufacturer lease and third-party lease depends on preferences for brand-specific benefits versus broader options and negotiating power.

Key Differences Between Manufacturer and Third-Party Leases

Manufacturer leases typically offer lower monthly payments and incentives directly from the vehicle maker, while third-party leases might provide more flexible terms and a broader range of vehicle options from independent leasing companies. Manufacturer leases often include maintenance packages and warranties that align closely with the vehicle's original coverage, whereas third-party leases may require separate agreements for such services. The ownership remains with the leasing company in both cases, but manufacturer leases are generally tied to specific brands, affecting residual values and lease-end options.

Pros and Cons of Manufacturer Leasing

Manufacturer leasing offers direct access to the latest vehicle models with brand-specific incentives such as extended warranties and maintenance packages, providing enhanced reliability and lower total cost of ownership. However, these leases often come with higher monthly payments and stricter mileage limits compared to third-party leases, potentially reducing flexibility. Brand loyalty programs and exclusive promotions can offset upfront costs but may limit the lessee's ability to negotiate terms or choose from a broader vehicle selection.

Advantages and Disadvantages of Third-Party Leasing

Third-party leasing offers flexibility in choosing equipment from various manufacturers and often provides more competitive pricing compared to manufacturer leases. However, third-party leases may lack dedicated manufacturer support and can involve complex contract terms, potentially leading to higher maintenance costs or limited upgrade options. Businesses should weigh the cost savings against possible service challenges when considering third-party leasing.

Cost Comparison: Manufacturer Lease vs Third-Party Lease

Manufacturer leases typically offer lower initial down payments and more attractive interest rates due to direct financing from the automaker, reducing overall leasing costs. Third-party leases may have higher interest rates and additional fees, increasing the total cost of leasing despite sometimes lower monthly payments. Evaluating the total expense, including upfront costs, monthly payments, and potential penalties, is essential for an accurate manufacturer lease versus third-party lease cost comparison.

Warranty and Maintenance Coverage Differences

Manufacturer leases typically include comprehensive warranty and maintenance coverage, ensuring that all repairs and routine services are handled directly through the original equipment manufacturer, often at no extra cost to the lessee. Third-party leases may offer limited or no warranty and maintenance coverage, requiring lessees to manage these aspects independently or purchase additional service packages. The distinction impacts overall lease cost, risk management, and the lessee's convenience in maintaining the leased asset.

Flexibility and Lease Terms Comparison

Manufacturer leases typically offer less flexibility with fixed terms and mileage limits tailored to specific vehicle models, often including incentives like maintenance packages. Third-party leases provide greater customization in lease duration, mileage allowances, and vehicle selection, accommodating more personalized needs. Comparing lease terms reveals manufacturer leases prioritize brand-specific benefits, while third-party leases emphasize adaptability and broader vehicle options.

Customer Support: Manufacturer vs Third-Party Lessor

Manufacturer lease agreements often provide superior customer support due to direct access to brand-specific expertise, streamlined communication, and faster resolution of technical issues. Third-party lessors may offer more flexible lease terms but can lack in-depth product knowledge and prompt service response, potentially leading to slower problem resolution. Evaluating the quality of customer support in both lease types is crucial for ensuring efficient maintenance and minimizing downtime during the lease period.

End-of-Lease Options and Processes

Manufacturer leases typically offer structured end-of-lease options such as buyout, vehicle return, or lease extension with predefined terms set by the original manufacturer, ensuring streamlined processes and potential loyalty incentives. Third-party leases provide more flexible end-of-lease choices, often including third-party buyout options and diverse vehicle return locations, which may result in varied processes and fees. Understanding differences in residual value assessments and disposition fees is crucial for lessees to optimize financial outcomes at lease termination.

Choosing the Best Lease Option for Your Needs

Evaluating Manufacturer Lease versus Third-Party Lease requires assessing factors such as cost, flexibility, and maintenance coverage. Manufacturer leases typically offer manufacturer-backed warranties and incentives, while third-party leases often provide more customizable terms and competitive pricing. Selecting the best lease option depends on your financial goals, vehicle preferences, and desired leasing structure.

Manufacturer Lease vs Third-Party Lease Infographic

cardiffo.com

cardiffo.com