Cap cost reduction lowers the negotiated price of a leased vehicle, reducing monthly payments by decreasing the overall lease balance. A down payment is an upfront amount paid at lease signing that lowers the amount financed but does not affect the vehicle's capitalized cost. Choosing a cap cost reduction strategically can provide more savings over the lease term compared to simply making a down payment.

Table of Comparison

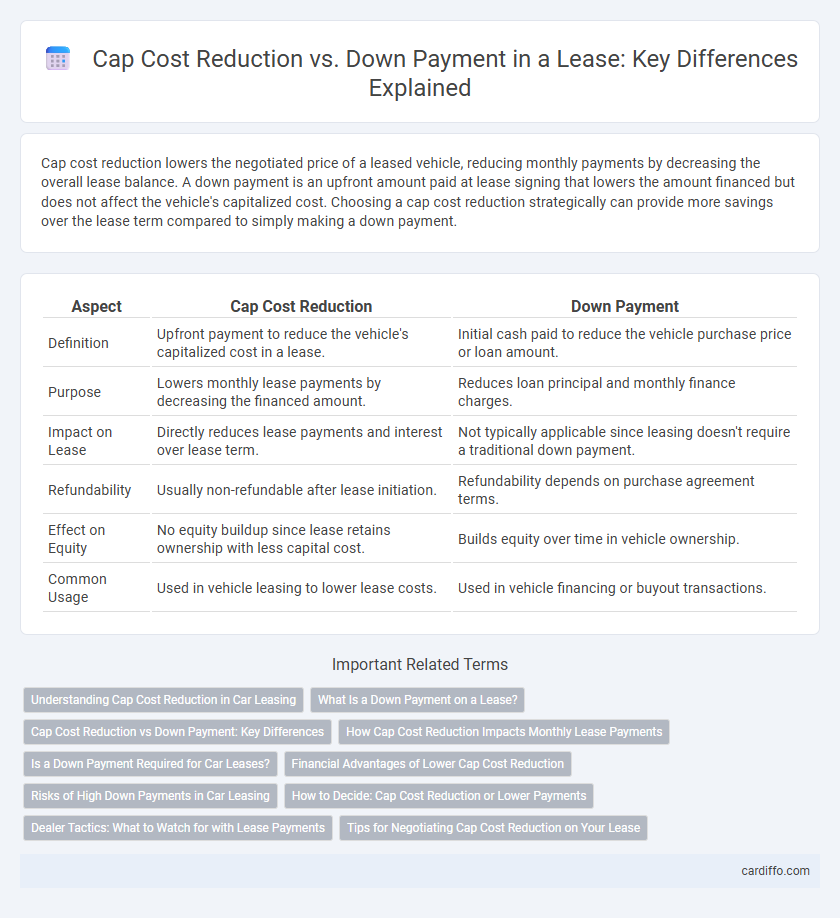

| Aspect | Cap Cost Reduction | Down Payment |

|---|---|---|

| Definition | Upfront payment to reduce the vehicle's capitalized cost in a lease. | Initial cash paid to reduce the vehicle purchase price or loan amount. |

| Purpose | Lowers monthly lease payments by decreasing the financed amount. | Reduces loan principal and monthly finance charges. |

| Impact on Lease | Directly reduces lease payments and interest over lease term. | Not typically applicable since leasing doesn't require a traditional down payment. |

| Refundability | Usually non-refundable after lease initiation. | Refundability depends on purchase agreement terms. |

| Effect on Equity | No equity buildup since lease retains ownership with less capital cost. | Builds equity over time in vehicle ownership. |

| Common Usage | Used in vehicle leasing to lower lease costs. | Used in vehicle financing or buyout transactions. |

Understanding Cap Cost Reduction in Car Leasing

Cap Cost Reduction in car leasing refers to the upfront amount paid to lower the vehicle's capitalized cost, which directly reduces monthly lease payments and overall lease expenses. Unlike a traditional down payment that may serve as a security deposit, the Cap Cost Reduction specifically decreases the lease's depreciation and interest charges, resulting in more affordable monthly installments. Understanding this distinction helps lessees optimize their lease agreements for better financial management and lower long-term costs.

What Is a Down Payment on a Lease?

A down payment on a lease, often called a capitalized cost reduction, is an upfront sum paid to lower the total amount financed in the lease agreement. This payment reduces monthly lease installments by decreasing the vehicle's capitalized cost, which is the negotiated price plus any additional fees. Understanding the difference between a down payment and other fees is crucial for optimizing lease terms and managing out-of-pocket costs effectively.

Cap Cost Reduction vs Down Payment: Key Differences

Cap Cost Reduction directly lowers the negotiated selling price of a leased vehicle, effectively decreasing monthly lease payments and the overall lease cost. In contrast, a down payment is an initial sum paid upfront to reduce the amount financed but does not necessarily affect the vehicle's capitalized cost. Understanding this distinction helps lessees optimize lease terms by strategically managing upfront costs and long-term payment obligations.

How Cap Cost Reduction Impacts Monthly Lease Payments

Cap cost reduction directly lowers the adjusted capitalized cost, which reduces the lease amount used to calculate monthly payments. A higher cap cost reduction results in smaller monthly lease fees by decreasing the overall financed amount and associated depreciation charges. Unlike a down payment that might serve as an upfront cash exchange, cap cost reduction specifically targets the vehicle's value to optimize monthly lease affordability.

Is a Down Payment Required for Car Leases?

A down payment, often referred to as a capitalized cost reduction (cap cost reduction), is not always required for car leases but can help lower monthly lease payments by reducing the vehicle's capitalized cost. Some manufacturers and dealerships offer lease programs with little to no down payment, making it easier for lessees to start a lease without a large upfront cost. However, putting money down upfront can reduce the total lease cost and the amount due at lease signing, affecting overall lease affordability.

Financial Advantages of Lower Cap Cost Reduction

Lower cap cost reduction in a lease preserves more upfront cash flow, allowing lessees to maintain liquidity for other investments or expenses. It results in higher monthly payments but minimizes the risk of loss if the vehicle is damaged or totaled, as less initial money is sunk into the lease. This strategy enhances financial flexibility and reduces the impact of depreciation on the lessee's immediate financial position.

Risks of High Down Payments in Car Leasing

High down payments in car leasing increase financial risk by tying up substantial capital that could be used elsewhere, reducing liquidity and flexibility. Cap cost reduction may lower monthly payments but offers less protection if the vehicle depreciates faster than expected or if the lessee defaults. Excessive upfront payments also limit the lessee's ability to adapt to changing financial situations or lease terms, potentially resulting in higher overall costs.

How to Decide: Cap Cost Reduction or Lower Payments

Cap cost reduction directly lowers the capitalized cost of the leased vehicle, resulting in lower monthly payments over the lease term without affecting upfront cash flow significantly. Down payment impacts the initial out-of-pocket expense by reducing the amount financed, which can also lower monthly payments but requires more cash upfront compared to applying a cap cost reduction. When deciding between cap cost reduction and down payment, evaluate your cash availability and payment preferences to balance initial expenses and ongoing monthly costs effectively.

Dealer Tactics: What to Watch for with Lease Payments

Cap cost reduction lowers the capitalized cost of a lease, reducing monthly payments but can obscure true lease expenses if dealers use it to mask additional fees. A down payment is an upfront cash contribution that directly lowers the amount financed but offers less flexibility and may not improve lease terms. Watch for dealer tactics that promote high cap cost reductions while adding hidden fees or inflating money factors, increasing overall lease costs despite lower monthly payments.

Tips for Negotiating Cap Cost Reduction on Your Lease

Maximizing your cap cost reduction in a lease negotiation can significantly lower monthly payments and reduce overall lease expenses. Research the vehicle's invoice price and current incentives to leverage a stronger bargaining position with dealerships. Emphasize obtaining all available rebates and consider offering a higher upfront cap cost reduction to improve your lease terms without inflating the down payment risk.

Cap Cost Reduction vs Down Payment Infographic

cardiffo.com

cardiffo.com