Gap insurance covers the difference between your vehicle's actual cash value and the remaining lease balance if your car is totaled or stolen, preventing significant out-of-pocket expenses. Without gap coverage, you may be responsible for paying the full lease balance even if your car is no longer drivable or recoverable. Choosing gap insurance protects your financial stability by minimizing potential loss after an accident or theft during the lease term.

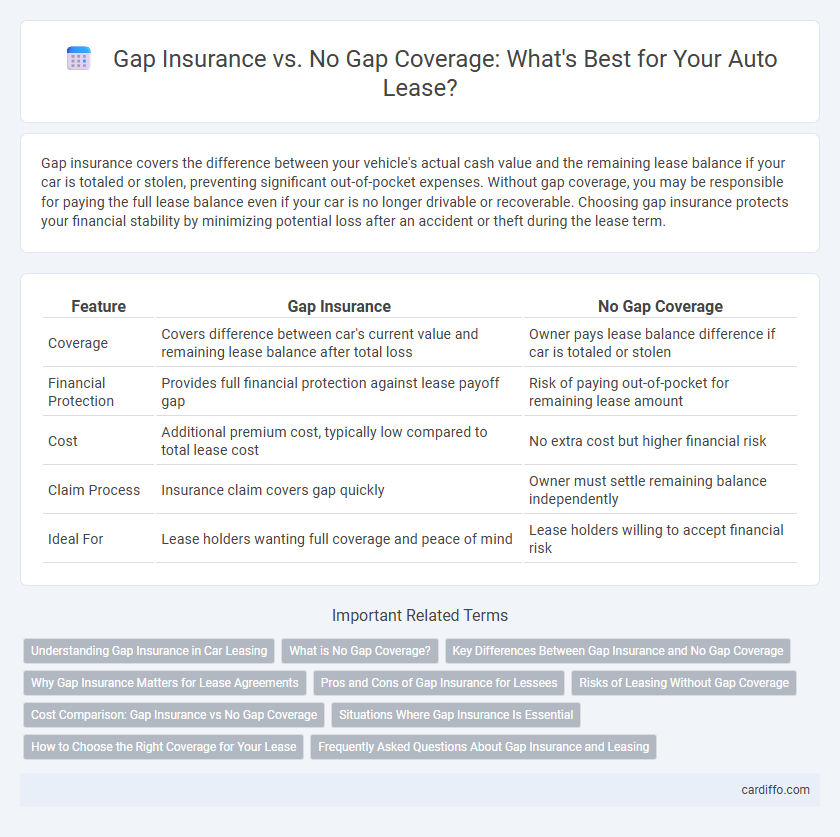

Table of Comparison

| Feature | Gap Insurance | No Gap Coverage |

|---|---|---|

| Coverage | Covers difference between car's current value and remaining lease balance after total loss | Owner pays lease balance difference if car is totaled or stolen |

| Financial Protection | Provides full financial protection against lease payoff gap | Risk of paying out-of-pocket for remaining lease amount |

| Cost | Additional premium cost, typically low compared to total lease cost | No extra cost but higher financial risk |

| Claim Process | Insurance claim covers gap quickly | Owner must settle remaining balance independently |

| Ideal For | Lease holders wanting full coverage and peace of mind | Lease holders willing to accept financial risk |

Understanding Gap Insurance in Car Leasing

Gap insurance in car leasing covers the difference between the vehicle's actual cash value and the remaining lease balance if the car is totaled or stolen. Without gap coverage, lessees may be responsible for paying the full lease payoff even if the insurance settlement is lower than the owed amount. Understanding gap insurance is crucial to avoid significant financial exposure during the lease term.

What is No Gap Coverage?

No Gap Coverage in a lease means the lessee is responsible for the difference between the vehicle's actual cash value and the outstanding lease balance if the car is totaled or stolen. Without Gap Insurance, this financial gap can result in unexpected expenses that exceed the vehicle's insurance payout. Understanding No Gap Coverage is crucial for protecting against potential lease-end liabilities and ensuring financial security.

Key Differences Between Gap Insurance and No Gap Coverage

Gap insurance covers the difference between a vehicle's actual cash value and the remaining lease balance if the car is totaled or stolen, offering financial protection against depreciation losses. Without gap coverage, lessees are responsible for paying the full remaining lease balance, even if the vehicle's value is significantly lower due to depreciation. Key differences include the financial risk exposure and potential out-of-pocket costs, with gap insurance providing a safety net that no gap coverage leaves unprotected.

Why Gap Insurance Matters for Lease Agreements

Gap insurance matters for lease agreements because it covers the difference between the vehicle's actual cash value and the remaining lease balance if the car is totaled or stolen. Without gap coverage, lessees may have to pay out-of-pocket for this difference, leading to significant financial loss. Lease contracts often require gap insurance to protect both the lessee and the leasing company from unexpected depreciation costs.

Pros and Cons of Gap Insurance for Lessees

Gap insurance protects lessees by covering the difference between the vehicle's actual cash value and the remaining lease balance in case of total loss or theft, reducing financial liability. However, it increases the overall lease cost and may be unnecessary if the vehicle retains high value or the lessee has strong financial resilience. Lessees facing rapid depreciation or longer lease terms benefit most from gap insurance, while those with short leases or additional savings might avoid extra expenses.

Risks of Leasing Without Gap Coverage

Leasing a vehicle without gap insurance exposes lessees to significant financial risks if the car is totaled or stolen, as they remain responsible for the outstanding lease balance even if the insurance payout is less than the car's depreciated value. Without gap coverage, lessees could face out-of-pocket expenses that exceed the vehicle's worth, including remaining payments, taxes, and fees. This risk makes gap insurance essential for protecting against depreciation gaps and minimizing financial liability during the lease term.

Cost Comparison: Gap Insurance vs No Gap Coverage

Gap insurance typically costs between $20 to $50 per month but can save thousands in out-of-pocket expenses if your leased vehicle is totaled or stolen. Without gap coverage, lessees risk paying the difference between their car's depreciated value and the remaining lease payoff, which can amount to several thousand dollars. The upfront cost of gap insurance often outweighs the financial risk and potential loss incurred without it.

Situations Where Gap Insurance Is Essential

Gap insurance is essential when leasing a vehicle that depreciates quickly or has high monthly payments, as it covers the difference between the car's actual cash value and the remaining lease balance in case of total loss. It is particularly important for lessees who make low down payments or have long-term leases, where the vehicle's value may drop faster than the lease payoff. Without gap coverage, drivers risk substantial out-of-pocket expenses after accidents, theft, or severe damage causing a total loss.

How to Choose the Right Coverage for Your Lease

Choosing the right coverage for your lease involves evaluating the potential financial gap between your vehicle's actual cash value and the amount owed on your lease. Gap insurance protects you from paying out-of-pocket if your leased car is totaled or stolen, covering the difference between the car's depreciated value and the remaining lease balance. Assess factors such as lease terms, vehicle depreciation rate, and your financial ability to cover this gap when deciding whether gap coverage is necessary.

Frequently Asked Questions About Gap Insurance and Leasing

Gap insurance covers the difference between the actual cash value of a leased vehicle and the outstanding lease balance if the car is totaled or stolen, providing essential financial protection for lessees. Without gap coverage, lessees may be responsible for paying the remaining lease balance out-of-pocket, which can lead to significant financial strain. Common questions include whether gap insurance is required in a lease, how to purchase it, and if it covers negative equity in case of a total loss.

Gap Insurance vs No Gap Coverage Infographic

cardiffo.com

cardiffo.com