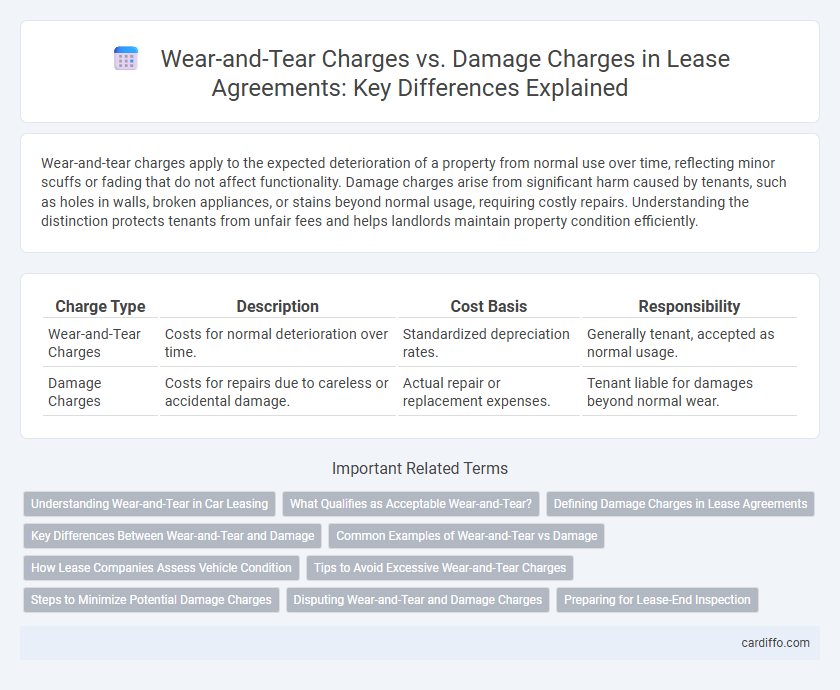

Wear-and-tear charges apply to the expected deterioration of a property from normal use over time, reflecting minor scuffs or fading that do not affect functionality. Damage charges arise from significant harm caused by tenants, such as holes in walls, broken appliances, or stains beyond normal usage, requiring costly repairs. Understanding the distinction protects tenants from unfair fees and helps landlords maintain property condition efficiently.

Table of Comparison

| Charge Type | Description | Cost Basis | Responsibility |

|---|---|---|---|

| Wear-and-Tear Charges | Costs for normal deterioration over time. | Standardized depreciation rates. | Generally tenant, accepted as normal usage. |

| Damage Charges | Costs for repairs due to careless or accidental damage. | Actual repair or replacement expenses. | Tenant liable for damages beyond normal wear. |

Understanding Wear-and-Tear in Car Leasing

Wear-and-tear charges in car leasing refer to the expected depreciation and minor deterioration that occurs from normal vehicle use over the lease term, such as small scratches, light tire wear, and interior fabric fading. These charges differ from damage charges, which apply to significant damages beyond normal usage, including dents, broken parts, or deep stains that require costly repairs. Understanding the distinction helps lessees avoid unexpected fees by maintaining the vehicle within acceptable wear standards defined in the lease agreement.

What Qualifies as Acceptable Wear-and-Tear?

Acceptable wear-and-tear in a lease refers to the natural deterioration of a property due to normal use, such as minor scuffs on walls, worn carpets, and faded paint. These conditions are expected over the course of a lease term and typically do not result in charges from landlords. Damage charges apply only when there is excessive or intentional harm beyond ordinary use, like large holes in walls or broken fixtures.

Defining Damage Charges in Lease Agreements

Damage charges in lease agreements refer to fees imposed on tenants for repairs required beyond normal wear-and-tear, involving intentional, negligent, or accidental harm to the property. These charges cover costs for fixing broken windows, holes in walls, or significant stains that compromise the property's condition and value. Precise definitions and documentation of damage charges help prevent disputes and ensure clear tenant responsibilities under the lease terms.

Key Differences Between Wear-and-Tear and Damage

Wear-and-tear charges apply to normal deterioration of property caused by everyday use, such as minor scuffs or fading paint, reflecting expected aging over time. Damage charges arise from tenant negligence or abuse, including holes in walls, broken windows, or stained carpets that exceed normal usage. Understanding these distinctions is essential for accurate lease agreements, as wear-and-tear expenses are typically covered by the landlord, while damage costs are charged to the tenant.

Common Examples of Wear-and-Tear vs Damage

Common examples of wear-and-tear charges in lease agreements include minor carpet stains, small nail holes from picture hangers, and faded paint due to sunlight exposure. Damage charges typically arise from broken windows, large holes in walls, or significant carpet burns that exceed normal use expectations. Understanding these distinctions helps tenants anticipate potential costs and maintain their lease compliance effectively.

How Lease Companies Assess Vehicle Condition

Lease companies assess vehicle condition by conducting detailed inspections that differentiate normal wear-and-tear from damage, using industry standards such as the Fair Wear and Tear Guide. Wear-and-tear charges are applied for minor, expected deterioration like small scratches or tire tread wear, whereas damage charges target significant issues such as dents, broken parts, or interior stains exceeding normal use. This assessment influences end-of-lease fees and return obligations, ensuring lessees are only charged for vehicle condition beyond typical use.

Tips to Avoid Excessive Wear-and-Tear Charges

Regularly document the property's condition through photos and videos to establish a clear baseline for wear-and-tear versus damage. Maintain routine cleaning and minor repairs to prevent small issues from escalating into costly damage charges. Communicate promptly with your landlord about any necessary maintenance to avoid misunderstandings during lease termination inspections.

Steps to Minimize Potential Damage Charges

To minimize potential damage charges on a lease, conduct a thorough walk-through with the landlord before moving in and document any existing issues with photos and written notes. Maintain regular cleaning and avoid neglecting minor repairs to prevent wear from escalating into chargeable damage. At lease end, schedule a pre-move-out inspection to address concerns proactively and ensure compliance with the lease's maintenance requirements.

Disputing Wear-and-Tear and Damage Charges

Disputing wear-and-tear charges requires understanding the distinction between normal depreciation, which tenants are not liable for, and damage charges resulting from tenant negligence or abuse. Documentation such as move-in and move-out inspection reports, along with dated photos, provide critical evidence to challenge unfair charges. Tenants should reference state-specific tenant laws to ensure landlords comply with regulations governing wear-and-tear versus damage assessments.

Preparing for Lease-End Inspection

Preparing for a lease-end inspection requires carefully distinguishing between normal wear-and-tear charges and damage charges to avoid unexpected fees. Normal wear-and-tear includes minor scuffs or fading, while damage charges cover significant dents, holes, or stains beyond reasonable use. Documenting the vehicle or property condition with photos and addressing minor repairs beforehand can help minimize disputable charges.

Wear-and-Tear Charges vs Damage Charges Infographic

cardiffo.com

cardiffo.com