Residual value represents the estimated worth of a leased asset at the end of the lease term, influencing lease payments and depreciation costs. A purchase option allows the lessee to buy the leased asset at a predetermined price, often aligned with or below the residual value. Understanding the difference helps lessees evaluate costs, potential equity, and the flexibility of acquiring the asset outright after the lease period.

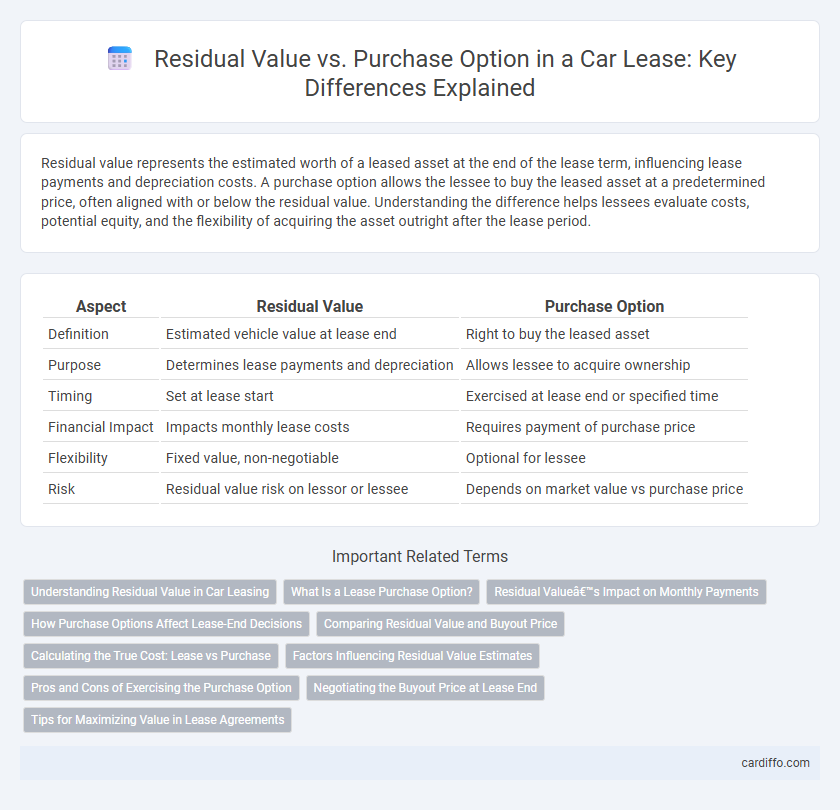

Table of Comparison

| Aspect | Residual Value | Purchase Option |

|---|---|---|

| Definition | Estimated vehicle value at lease end | Right to buy the leased asset |

| Purpose | Determines lease payments and depreciation | Allows lessee to acquire ownership |

| Timing | Set at lease start | Exercised at lease end or specified time |

| Financial Impact | Impacts monthly lease costs | Requires payment of purchase price |

| Flexibility | Fixed value, non-negotiable | Optional for lessee |

| Risk | Residual value risk on lessor or lessee | Depends on market value vs purchase price |

Understanding Residual Value in Car Leasing

Residual value in car leasing represents the estimated worth of the vehicle at the end of the lease term, influencing monthly payments and overall lease cost. A higher residual value typically results in lower monthly payments because the vehicle is expected to retain more of its value over time. Understanding residual value is crucial for lessees when considering purchase options, as it often determines the price to buy the car after the lease ends.

What Is a Lease Purchase Option?

A lease purchase option is a contractual agreement that allows the lessee to buy the leased asset at the end of the lease term for a predetermined price, often based on the residual value. The residual value represents the estimated market value of the asset at lease expiration, serving as the benchmark for the purchase option price. This option provides flexibility to the lessee to either return the asset or acquire it, depending on its condition and market conditions.

Residual Value’s Impact on Monthly Payments

Residual value significantly impacts monthly lease payments by determining the vehicle's estimated worth at lease end, reducing the amount financed and lowering monthly costs. A higher residual value results in smaller depreciation charges, making monthly payments more affordable compared to leases with lower residual values. Understanding residual value helps lessees anticipate total lease expenses and evaluate purchase option affordability at lease term completion.

How Purchase Options Affect Lease-End Decisions

Purchase options directly impact lease-end decisions by providing lessees the choice to buy the asset at a predetermined price, influencing their evaluation of the residual value versus market value. When the purchase option price is lower than the expected market value, lessees are more likely to exercise the option, reducing lease-end uncertainty and potential disposition costs. This dynamic shapes the financial strategy, as lessees weigh the residual value against the convenience and cost-effectiveness of acquiring the asset outright.

Comparing Residual Value and Buyout Price

Residual value represents the estimated worth of a leased asset at the end of the lease term, while the buyout price is the predetermined amount a lessee can pay to purchase the asset. Comparing residual value and buyout price helps lessees assess financial advantages, as a buyout price below the residual value typically indicates a favorable purchase option. Understanding this comparison is crucial for informed decisions in lease agreements and asset acquisition strategies.

Calculating the True Cost: Lease vs Purchase

Calculating the true cost of a lease versus purchase involves analyzing the residual value and the purchase option price to determine overall financial impact. The residual value represents the estimated vehicle worth at lease end, influencing monthly payments and total lease expense, while the purchase option reflects the buyout price if the lessee chooses ownership. Comparing total lease payments plus residual value against the outright purchase price and ownership costs reveals the most cost-effective choice.

Factors Influencing Residual Value Estimates

Residual value estimates in lease agreements depend on factors such as anticipated vehicle depreciation, market demand, and lease term length. Accurate predictions require analysis of historical resale values, economic conditions, and anticipated mileage, which directly impact the residual value's alignment with the purchase option price. Lease agreements with well-calculated residual values offer greater financial predictability for both lessors and lessees when considering end-of-lease purchase decisions.

Pros and Cons of Exercising the Purchase Option

Exercising the purchase option in a lease allows the lessee to acquire the asset at a predetermined residual value, which can be advantageous if the market value exceeds this amount, providing immediate equity. However, this may result in paying above-market value if the asset's condition has depreciated or demand has fallen, leading to a financial disadvantage. The decision hinges on comparing the residual value against current market prices, asset condition, and future utility to determine if exercise maximizes overall economic benefit.

Negotiating the Buyout Price at Lease End

Negotiating the buyout price at lease end involves understanding the residual value, which is the pre-determined estimated worth of the vehicle after the lease term. A purchase option allows lessees to buy the vehicle at or below this residual value, providing leverage during negotiations if the market value is lower. Considering current market trends and vehicle condition can strengthen bargaining power to secure a favorable buyout price.

Tips for Maximizing Value in Lease Agreements

Maximizing value in lease agreements involves carefully comparing the residual value and purchase option terms to avoid overpayment. Negotiate a residual value that accurately reflects the vehicle's market depreciation to minimize end-of-lease costs. Review purchase option prices to ensure they provide a competitive advantage if deciding to buy the leased asset at lease-end.

Residual Value vs Purchase Option Infographic

cardiffo.com

cardiffo.com