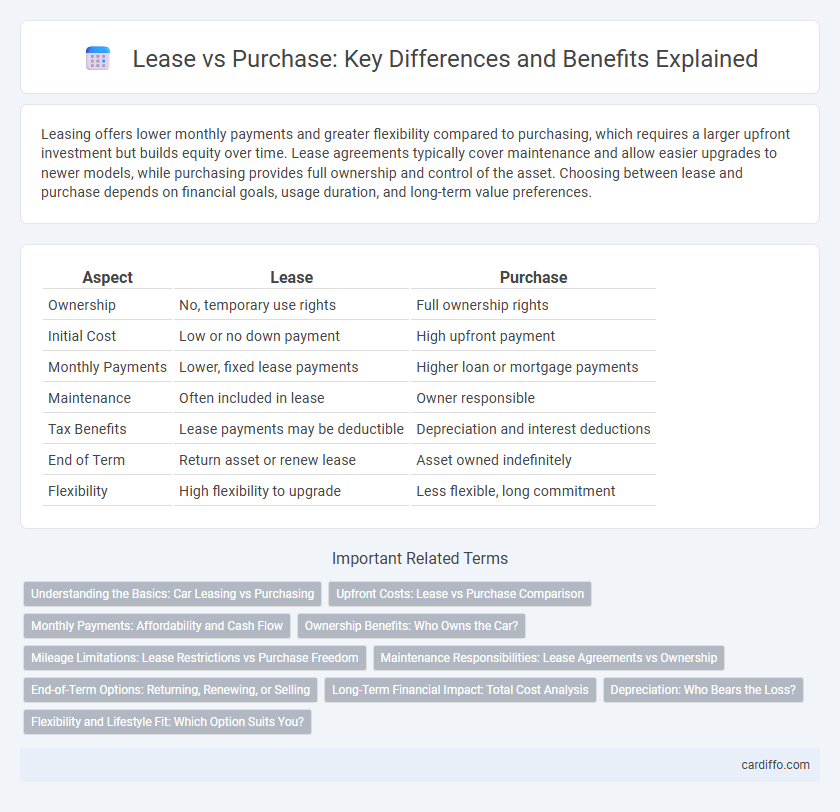

Leasing offers lower monthly payments and greater flexibility compared to purchasing, which requires a larger upfront investment but builds equity over time. Lease agreements typically cover maintenance and allow easier upgrades to newer models, while purchasing provides full ownership and control of the asset. Choosing between lease and purchase depends on financial goals, usage duration, and long-term value preferences.

Table of Comparison

| Aspect | Lease | Purchase |

|---|---|---|

| Ownership | No, temporary use rights | Full ownership rights |

| Initial Cost | Low or no down payment | High upfront payment |

| Monthly Payments | Lower, fixed lease payments | Higher loan or mortgage payments |

| Maintenance | Often included in lease | Owner responsible |

| Tax Benefits | Lease payments may be deductible | Depreciation and interest deductions |

| End of Term | Return asset or renew lease | Asset owned indefinitely |

| Flexibility | High flexibility to upgrade | Less flexible, long commitment |

Understanding the Basics: Car Leasing vs Purchasing

Car leasing offers lower monthly payments and the ability to drive a new vehicle every few years, appealing to those who prefer flexibility and lower upfront costs. Purchasing a car builds ownership equity over time and allows unlimited mileage, making it ideal for long-term use and eventual resale value. Understanding factors like total cost of ownership, maintenance responsibilities, and end-of-term options is essential when choosing between leasing and buying a vehicle.

Upfront Costs: Lease vs Purchase Comparison

Leasing a vehicle typically requires lower upfront costs, including a smaller initial payment and lower or no down payment compared to purchasing. In contrast, buying a car often involves a substantial down payment, taxes, registration fees, and higher upfront financial commitment. Evaluating these upfront cost differences is crucial for budgeting and financial planning when deciding between lease versus purchase options.

Monthly Payments: Affordability and Cash Flow

Lease agreements typically offer lower monthly payments compared to purchasing, enhancing affordability and preserving cash flow for other expenses. Monthly lease payments usually cover depreciation and usage, making them more predictable and budget-friendly than loan repayments that include principal and interest. This financial structure allows businesses and individuals to manage liquidity more effectively while accessing updated assets.

Ownership Benefits: Who Owns the Car?

Leasing a car offers lower monthly payments but the vehicle remains the property of the leasing company, meaning no ownership benefits or equity accumulation for the lessee. Purchasing a car grants full ownership, allowing the buyer to build equity, customize the vehicle, and sell it whenever desired. Ownership also provides long-term financial advantages, including potential asset value after the loan is paid off.

Mileage Limitations: Lease Restrictions vs Purchase Freedom

Lease agreements typically impose strict mileage limitations, often ranging from 10,000 to 15,000 miles annually, with costly penalties for exceeding these limits. In contrast, purchasing a vehicle allows unlimited mileage, providing greater freedom for high-mileage drivers without additional fees. Consumers should evaluate their driving habits carefully to determine whether leasing or buying aligns best with their mileage needs and financial goals.

Maintenance Responsibilities: Lease Agreements vs Ownership

Lease agreements often place maintenance responsibilities on the lessor, minimizing repair costs and upkeep duties for the lessee throughout the lease term. In contrast, ownership entails full responsibility for all maintenance tasks, repairs, and associated expenses, impacting long-term vehicle costs and resale value. Understanding these differences helps individuals and businesses make informed financial decisions based on usage, budget, and asset control preferences.

End-of-Term Options: Returning, Renewing, or Selling

End-of-term options for leases typically include returning the asset to the lessor, renewing the lease agreement for an extended period, or purchasing the asset outright at a predetermined residual value. Returning the leased item avoids ownership responsibilities but may involve fees for excess wear or mileage. Opting to renew allows continued use without upfront purchase costs, while buying provides long-term asset control and potential equity benefits.

Long-Term Financial Impact: Total Cost Analysis

Lease agreements often result in lower upfront costs but may lead to higher overall expenses over the lease term compared to purchasing. Purchasing a property or asset typically involves significant initial capital outlay but can yield long-term equity and value appreciation, reducing cost per use. Comprehensive total cost analysis includes maintenance, taxes, depreciation, and residual value to determine the most financially advantageous option over time.

Depreciation: Who Bears the Loss?

In a lease agreement, depreciation risk primarily falls on the lessor, as they retain ownership of the asset and absorb its declining value over time. When purchasing, the lessee bears full depreciation costs, directly impacting the asset's resale value and overall investment. Understanding depreciation allocation is crucial for businesses evaluating lease versus purchase decisions to manage financial exposure effectively.

Flexibility and Lifestyle Fit: Which Option Suits You?

Leasing offers greater flexibility with shorter commitment periods, allowing for easy upgrades to newer models and adapting to changing lifestyle needs. Purchasing provides long-term stability and ownership benefits, ideal for those seeking to build equity and avoid recurring payments. Evaluating personal budget, usage patterns, and future plans helps determine whether leasing or buying better aligns with an individual's lifestyle and financial goals.

Lease vs Purchase Infographic

cardiffo.com

cardiffo.com