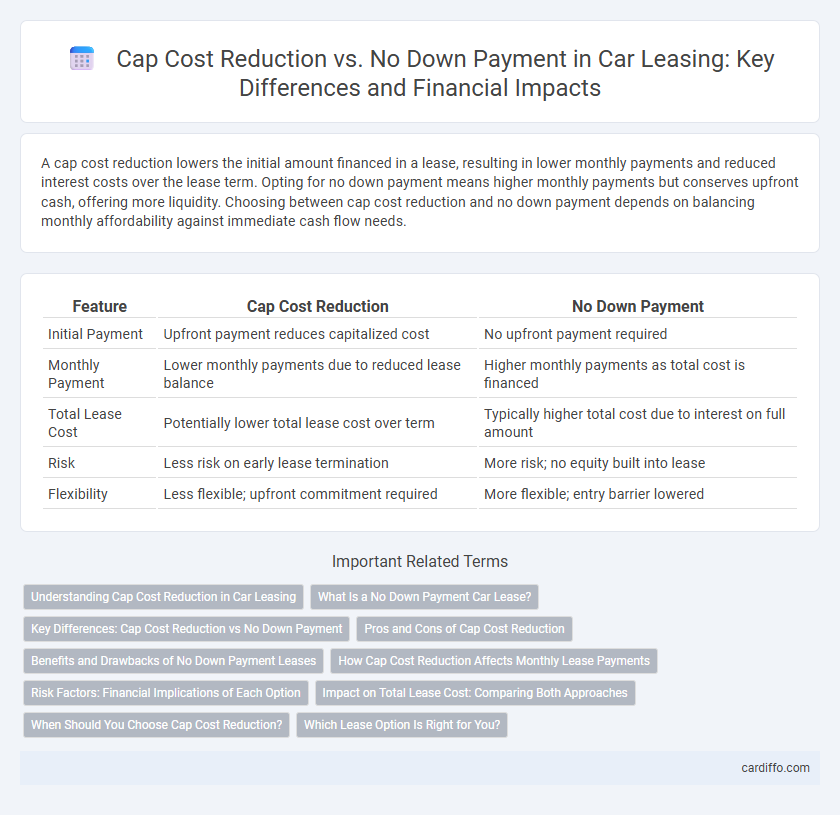

A cap cost reduction lowers the initial amount financed in a lease, resulting in lower monthly payments and reduced interest costs over the lease term. Opting for no down payment means higher monthly payments but conserves upfront cash, offering more liquidity. Choosing between cap cost reduction and no down payment depends on balancing monthly affordability against immediate cash flow needs.

Table of Comparison

| Feature | Cap Cost Reduction | No Down Payment |

|---|---|---|

| Initial Payment | Upfront payment reduces capitalized cost | No upfront payment required |

| Monthly Payment | Lower monthly payments due to reduced lease balance | Higher monthly payments as total cost is financed |

| Total Lease Cost | Potentially lower total lease cost over term | Typically higher total cost due to interest on full amount |

| Risk | Less risk on early lease termination | More risk; no equity built into lease |

| Flexibility | Less flexible; upfront commitment required | More flexible; entry barrier lowered |

Understanding Cap Cost Reduction in Car Leasing

Cap Cost Reduction in car leasing lowers the vehicle's capitalized cost, effectively reducing monthly lease payments by decreasing the amount financed. This upfront payment can include cash, trade-in value, or rebates applied to lower the lease base price. Choosing Cap Cost Reduction versus no down payment impacts total lease costs, as no down payment leases typically result in higher monthly payments and may increase interest over the lease term.

What Is a No Down Payment Car Lease?

A no down payment car lease eliminates the initial upfront cost typically associated with leasing, allowing you to drive off without paying anything at signing. This type of lease increases the monthly payments since the total cost is spread entirely over the lease term. Unlike Cap Cost Reduction, which lowers monthly payments by reducing the vehicle's capitalized cost through an upfront payment, no down payment leases require higher monthly installments but preserve your immediate cash flow.

Key Differences: Cap Cost Reduction vs No Down Payment

Cap cost reduction involves an upfront payment that lowers the vehicle's capitalized cost, reducing monthly lease payments and interest charges. No down payment leases require no initial cash outlay, resulting in higher monthly payments since the entire cost is financed over the lease term. The key difference lies in the immediate financial commitment and impact on monthly payment amounts throughout the lease.

Pros and Cons of Cap Cost Reduction

Cap cost reduction lowers monthly lease payments by reducing the vehicle's initial capitalized cost, providing immediate financial relief and potentially improving lease affordability. However, it limits flexibility since the upfront cash is tied to the lease, which could be lost if the vehicle is totaled or stolen early in the term. Opting for no down payment maximizes liquidity and reduces financial risk, but results in higher monthly payments and increased total lease cost over the term.

Benefits and Drawbacks of No Down Payment Leases

No down payment leases offer the benefit of lower upfront costs, making it easier for individuals with limited cash flow to acquire a vehicle. However, skipping the cap cost reduction often results in higher monthly payments and potentially paying more interest over the lease term. This option may also increase the risk of negative equity if the vehicle's value depreciates faster than expected.

How Cap Cost Reduction Affects Monthly Lease Payments

Cap cost reduction directly lowers the capitalized cost of a lease, resulting in reduced monthly lease payments by decreasing the amount financed. Unlike no down payment leases, which maintain higher capitalized costs and thus higher payments, cap cost reduction spreads the initial payment benefit over the lease term. This financing approach improves cash flow management by minimizing monthly obligations without altering residual value or money factor.

Risk Factors: Financial Implications of Each Option

Cap Cost Reduction lowers monthly lease payments by reducing the vehicle's capitalized cost upfront, but ties up cash and risks loss if the car is totaled early in the lease. No Down Payment leases preserve cash flow by requiring no upfront payment, yet increase monthly payments and total interest costs, potentially leading to higher overall expenses. Financial risk increases with Cap Cost Reduction if the vehicle depreciates faster than expected, whereas No Down Payment shifts risk toward higher lease payments and potential negative equity.

Impact on Total Lease Cost: Comparing Both Approaches

Cap Cost Reduction lowers the total lease cost by reducing the vehicle's capitalized cost, which directly decreases monthly payments and the amount of interest paid over the lease term. Opting for no down payment results in higher monthly payments and increased overall lease expense, as the entire vehicle cost is financed throughout the lease duration. Evaluating total lease cost highlights that upfront Cap Cost Reduction typically offers more savings compared to the no down payment option.

When Should You Choose Cap Cost Reduction?

Choosing cap cost reduction in a lease is beneficial when aiming to lower monthly payments and reduce overall interest costs over the lease term. It makes sense if you have available funds upfront and want to improve cash flow by minimizing your monthly obligations. Avoid cap cost reduction when preserving liquidity is a priority or if you anticipate early lease termination, as upfront payments may not be fully recouped.

Which Lease Option Is Right for You?

Choosing between a cap cost reduction and no down payment in a lease depends on your financial goals and monthly budget. A cap cost reduction lowers your monthly payments by paying more upfront, reducing the financed amount and interest charges over the lease term. Opting for no down payment means higher monthly costs but preserves cash flow, making it suitable for those prioritizing liquidity and short-term savings.

Cap Cost Reduction vs No Down Payment Infographic

cardiffo.com

cardiffo.com