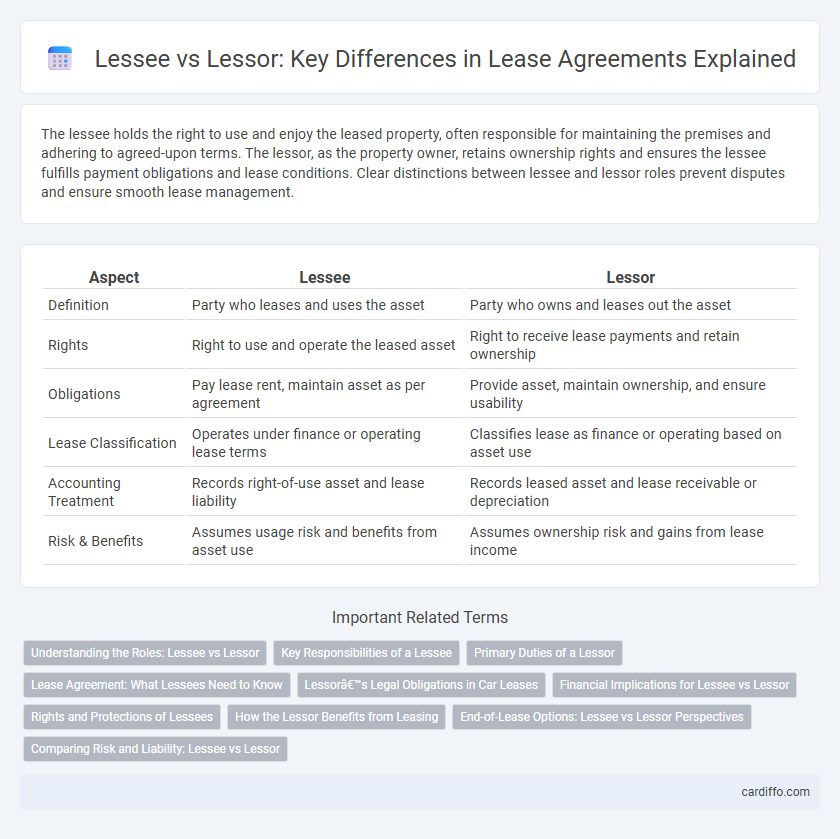

The lessee holds the right to use and enjoy the leased property, often responsible for maintaining the premises and adhering to agreed-upon terms. The lessor, as the property owner, retains ownership rights and ensures the lessee fulfills payment obligations and lease conditions. Clear distinctions between lessee and lessor roles prevent disputes and ensure smooth lease management.

Table of Comparison

| Aspect | Lessee | Lessor |

|---|---|---|

| Definition | Party who leases and uses the asset | Party who owns and leases out the asset |

| Rights | Right to use and operate the leased asset | Right to receive lease payments and retain ownership |

| Obligations | Pay lease rent, maintain asset as per agreement | Provide asset, maintain ownership, and ensure usability |

| Lease Classification | Operates under finance or operating lease terms | Classifies lease as finance or operating based on asset use |

| Accounting Treatment | Records right-of-use asset and lease liability | Records leased asset and lease receivable or depreciation |

| Risk & Benefits | Assumes usage risk and benefits from asset use | Assumes ownership risk and gains from lease income |

Understanding the Roles: Lessee vs Lessor

The lessee is the party that obtains the right to use an asset or property by paying rent under a lease agreement, while the lessor is the owner who grants this right. The lessee is responsible for maintaining the leased property according to the lease terms, and the lessor retains ownership and manages the property's overall condition. Understanding the distinct roles of lessee and lessor clarifies obligations, rights, and legal responsibilities in lease contracts.

Key Responsibilities of a Lessee

The lessee is responsible for timely payment of rent and maintenance of the leased property according to the lease agreement terms. They must use the property in a lawful manner and notify the lessor of any damages or required repairs. Compliance with all agreed-upon conditions, including utilities and property upkeep, ensures the lessee fulfills their contractual obligations.

Primary Duties of a Lessor

The primary duties of a lessor include ensuring the leased property is delivered in a usable condition, maintaining its habitability and safety throughout the lease term, and respecting the lessee's right to quiet enjoyment. The lessor must also perform necessary repairs and comply with relevant laws and lease agreement terms. Failure to fulfill these obligations can result in legal disputes or claims for damages by the lessee.

Lease Agreement: What Lessees Need to Know

A lease agreement legally binds the lessee and lessor, outlining the rights and responsibilities of both parties during the lease term. Lessees must understand key terms such as rent amount, duration, maintenance obligations, and penalties for breach or early termination. Clarity on these provisions ensures protection of the lessee's interests and prevents disputes with the lessor.

Lessor’s Legal Obligations in Car Leases

The lessor in car leases holds key legal obligations including ensuring the vehicle meets all safety and registration standards before delivery, maintaining clear title and ownership throughout the lease period, and providing timely disclosures about any defects or liens affecting the vehicle. Compliance with state and federal regulations such as the Truth in Leasing Act mandates transparency in lease terms, fees, and obligations to protect the lessee's rights. Failure to uphold these responsibilities can result in legal liability and potential lease termination rights for the lessee.

Financial Implications for Lessee vs Lessor

Lessee bears ongoing financial obligations including rent payments, maintenance costs, and potential penalties for lease violations, which impact cash flow and budgeting. Lessor benefits from steady rental income, tax advantages such as depreciation, and potential property appreciation, but assumes risks like property damage and vacancy periods. Understanding these financial implications is crucial for negotiating lease terms that balance risk and return for both parties.

Rights and Protections of Lessees

Lessees have the right to quiet enjoyment of the leased property, protecting them from unlawful eviction and ensuring uninterrupted use during the lease term. They are also entitled to timely notifications of any changes or termination of the lease, as mandated by tenant protection laws. Legal provisions often require lessors to maintain the property in habitable condition, safeguarding lessees against health and safety violations.

How the Lessor Benefits from Leasing

The lessor benefits from leasing by generating steady rental income while retaining ownership of the property or asset, which can appreciate in value over time. Leasing reduces the lessor's risk compared to outright sales, as lessees assume responsibility for maintenance and operational costs in many agreements. Furthermore, tax advantages, such as depreciation deductions and deferred capital gains, enhance the lessor's overall financial returns.

End-of-Lease Options: Lessee vs Lessor Perspectives

End-of-lease options differ significantly between lessees and lessors; lessees often prioritize flexibility, such as lease renewal, purchase, or return, while lessors focus on asset recovery and maximizing residual value. Lessees evaluate end-of-lease decisions based on financial impact and operational needs, whereas lessors assess market conditions to determine asset disposition or remarketing strategies. Balancing these perspectives is crucial for optimizing lease agreements and minimizing financial exposure for both parties.

Comparing Risk and Liability: Lessee vs Lessor

Lessee assumes risks related to property usage, including damage, maintenance, and compliance with lease terms, potentially facing liability for breaches or accidents occurring during the lease period. Lessor retains ownership risks such as structural integrity, property taxes, and legal responsibilities for ensuring the premises meet safety standards, often bearing liability for pre-existing conditions. Understanding the division of risk and liability in lease agreements is crucial to allocate responsibilities and protect both parties' interests effectively.

Lessee vs Lessor Infographic

cardiffo.com

cardiffo.com